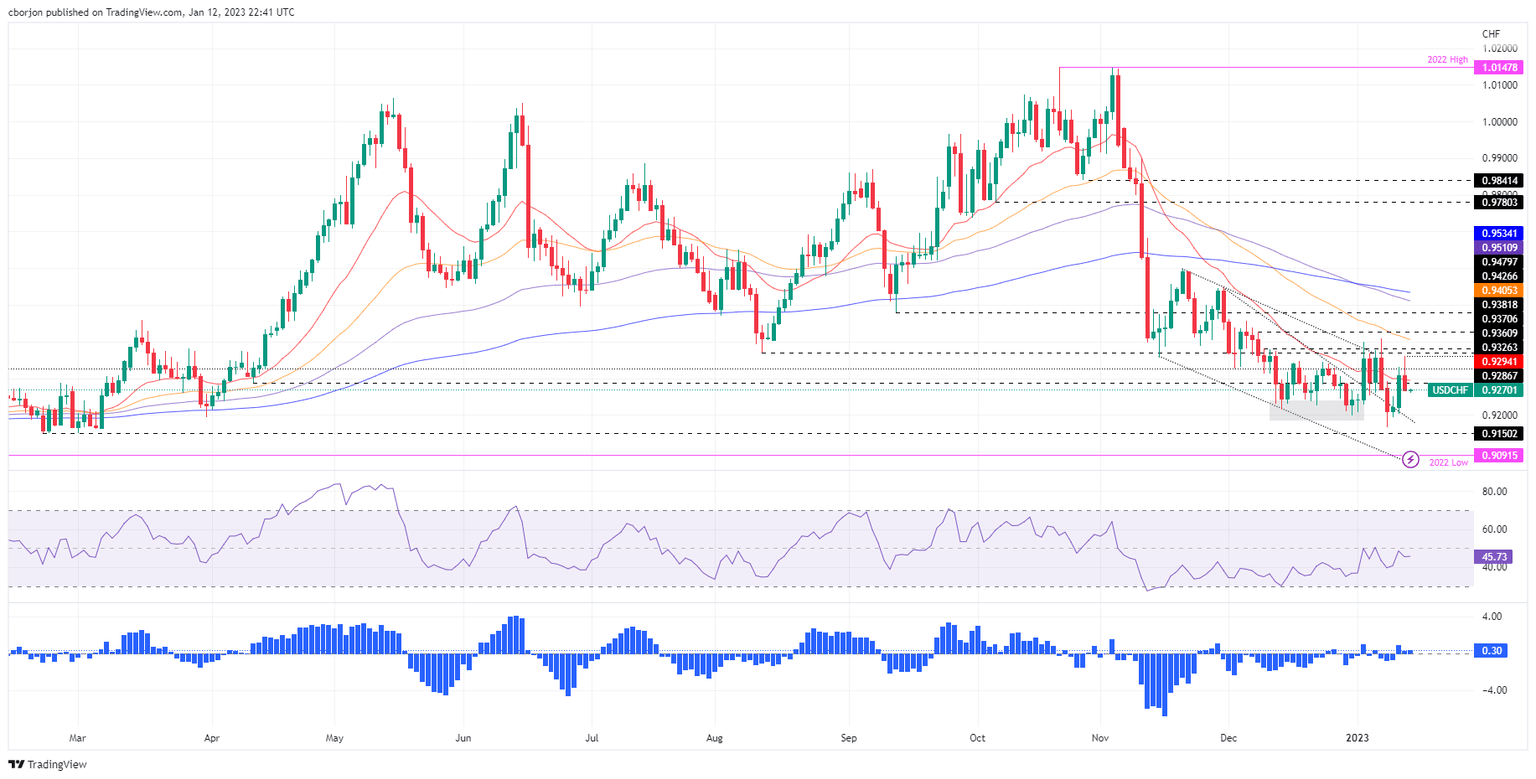

USD/CHF Price Analysis: Drops below 0.9300, extends its losses beneath the 20-DMA

- USD/CHF seesawed in a 100-pip range but finished Thursday’s session with losses of 0.44%.

- The USD/CHF remains downward biased, but it needs to drop below 0.9200 to challenge the 0.9167 YTD low.

- It would turn bullish above the 20-day EMA nearby 0.9300.

After attempting to clear 0.9300, the USD/CHF resumed its downtrend due to the release of a softer inflation report in the United States (US), which spurred a repricing for a less aggressive Federal Reserve (Fed); consequently, the US Dollar weakened. Therefore, the USD/CHF erased its earlier gains and dived beneath 0.9280 as the Asian session began. At the time of writing, the USD/CHF is almost unchanged, around 0.9270.

USD/CHF Price Analysis: Technical outlook

Following the release of the US CPI, the USD/CHF seesawed in the 0.9265/0.9360 range before stabilizing around 0.9270, 30 pips below the 20-day Exponential Moving Average (EMA) at 0.9294. Oscillators like the Relative Strength Index (RSI) pointing downwards and the Rate of Change (RoC) almost flat suggests sellers are gathering momentum. However, to further extend its downtrend, USD/CHF bears need to decisively break below 0.9265 to aim towards the 0.9200 mark and wall of support.

On the other hand, if USD/CHF buyers reclaim the 20-day EMA, that will immediately expose 0.9300, followed by the current week’s high of 0.9360, on its way north to 0.9400.

USD/CHF Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.