USD/CHF Price Analysis: Clings to 0.9300 after a hawkish Fed

- On Thursday, the Swiss franc collapsed almost 1%, as Fed policymakers eye the first rate hike in the March meeting.

- The US Dollar Index marches firmly above 97.00 for the first time since 2020.

- USD/CHF is upward biased, though a retracement before resuming the uptrend is on the cards.

During the North American session, the USD/CHF advances close to 1%, trading above 0.9300 for the first time since November 2021 highs. At the time of writing, the USD/CHF exchanges hands at 0.9312.

A risk-on market mood dented the prospects of the Swiss franc, which usually rallies on risk aversion. In the meantime, the US Dollar marches firmly throughout the session, with the US Dollar Index (DXY) advancing 1.23%, sitting at 97.131.

USD/CHF Price Forecast: Technical outlook

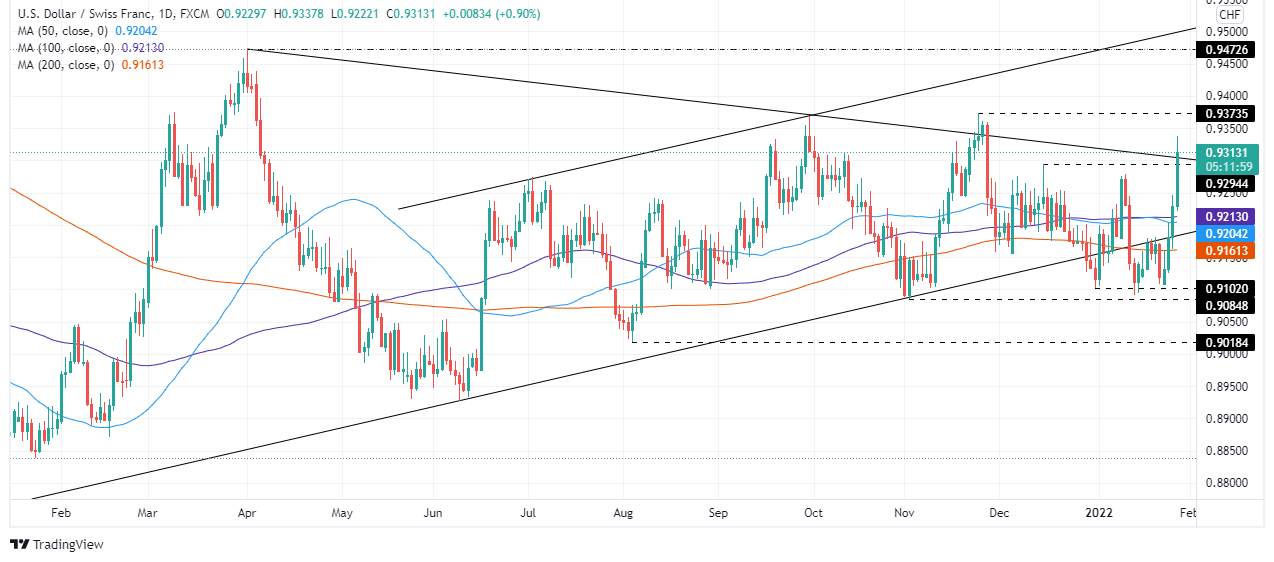

The USD/CHF is upward biased. On Wednesday, the pair broke resistance levels on its way towards 0.9300, like the 50 and 100-day moving averages (DMAs), lying at 0.9204 and 0.9212. Furthermore, it broke a downslope resistance trendline drawn from April – September 2021 cycle highs that pass around the 0.9300-05 area. However, due to the nature of the movement, a pullback towards the figure, or December 15, 2021, a daily high at 0.9294, is on the cards.

That said, the USD/CHF first support is 0.9300. A break of that level immediately suggests a test of December 15, 2021, high at 0.9294, followed by a January 26 daily high at 0.9246.

Contrarily, to the upside, the first resistance is November 2021 cycle high at 0.9373. A breach of the latter would expose the 0.9400 figure, followed by April 2021, swing highs at 0.9472.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.