USD/CHF Price Analysis: Climbs sharply towards six-week highs around 0.9760s

- The USD/CHF reclaims the 0.9700 figure, advancing towards the 0.9800 mark, up by 0.70%.

- USD/CHF Price Analysis: A daily close above 0.9740 opens the way towards 0.9900; otherwise, a fall to 0,9600 is on the cards.

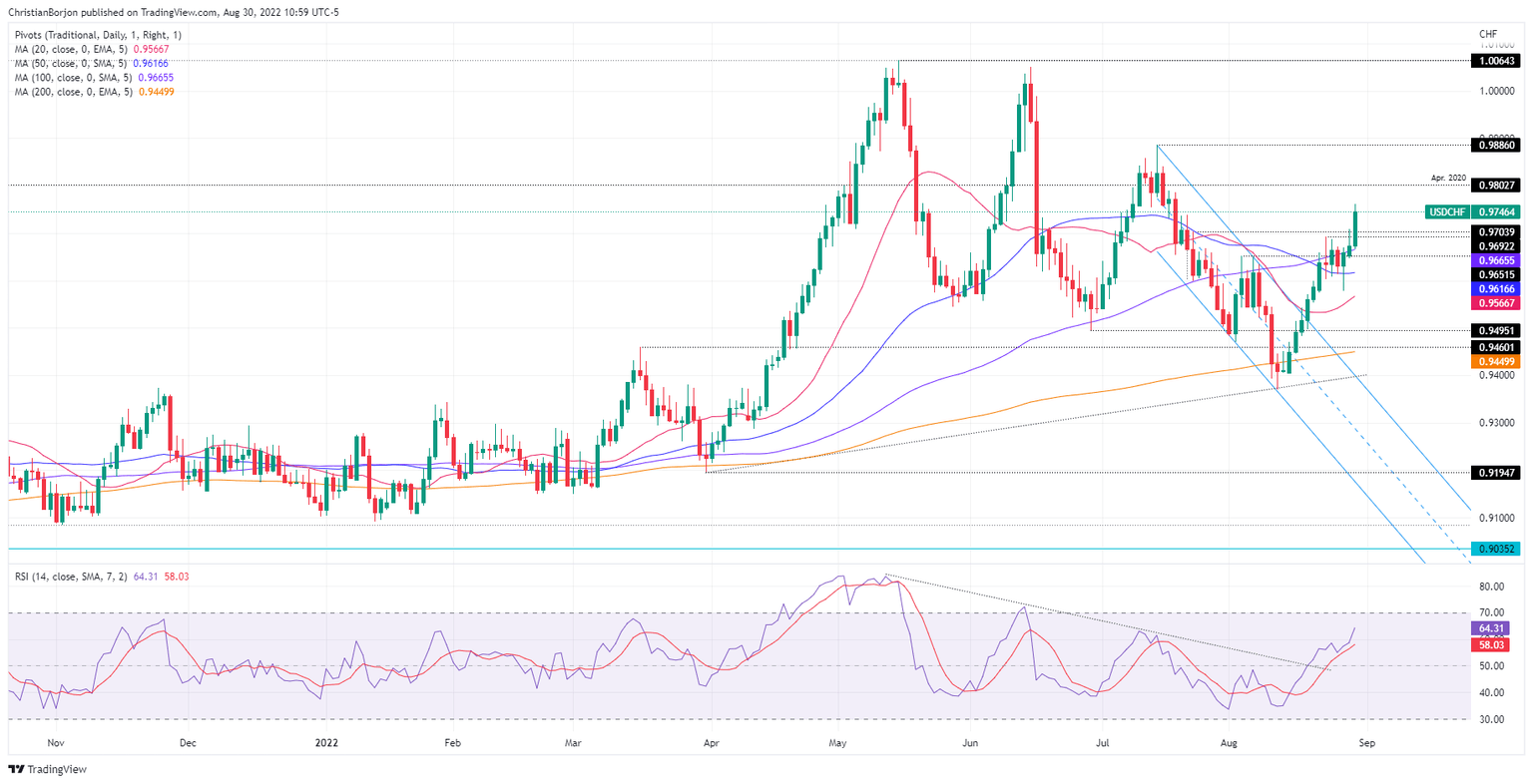

The USD/CHF climbs during the North American session, hitting a six-week high at around 0.9762, leaving below the 20-day EMA, widening the gap from the long-term daily moving averages (DMAs). At the time of writing, the USD/CHF exchanges hands at 0.9746, up 0.70%.

USD/CHF Price Analysis: Technical outlook

The USD/CHF weekly chart illustrates the pair extended its gains above the 20-EMA, lying at 0.9676, following Monday’s unsuccessful break. Additionally, the Relative Strength Index (RSI) crossed above the 7-week RSI’s SMA, aiming higher, showing buyers are gathering momentum. Therefore, the USD/CHF is resuming its upward bias in the near term.

The USD/CHF daily chart illustrates the major bouncing off the 100-day EMA, after Monday’s failure to do, and extended its gains to hit a daily high at 0-9762 before retreating toward current price levels, just above the July 21 high at 0.9739. If the USD/CHF achieves a daily close below tie latter, a retracement towards the 0.9600 figure is on the cards. Otherwise, the USD/CHF could continue its way north, towards the 0.9886 mark, ahead of the 0.9900 psychological level.

Hence, the USD/CHF first resistance would be the 0.9800 figure, followed by the July 14 daily high at 0.9886, ahead of the psychologically 0.9900 mark. On the other hand, the USD/CHF first support would be the 0.9700 figure. Once cleared, the next demand area would be the 100-day EMA at 0.9665, followed by the 50-day EMA at 0.9616, and then the August 26 daily low at 0.9577.

USD/CHF Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.