- USD/CHF attracted some dip-buying on Wednesday near the very important 200-day SMA.

- Slightly overbought RSI on the daily chart warrants caution before placing fresh bullish bets.

- Any meaningful slide towards the 0.9140-30 region could be seen as a buying opportunity.

The USD/CHF pair caught some fresh bids on Wednesday and has now moved back closer to near four-month tops touched in the previous session.

A fresh leg up in the US Treasury bond yields helped revived the US dollar demand. Apart from this, the prevalent risk-on mood undermined demand for the safe-haven Swiss franc and provided a goodish lift to the USD/CHF pair.

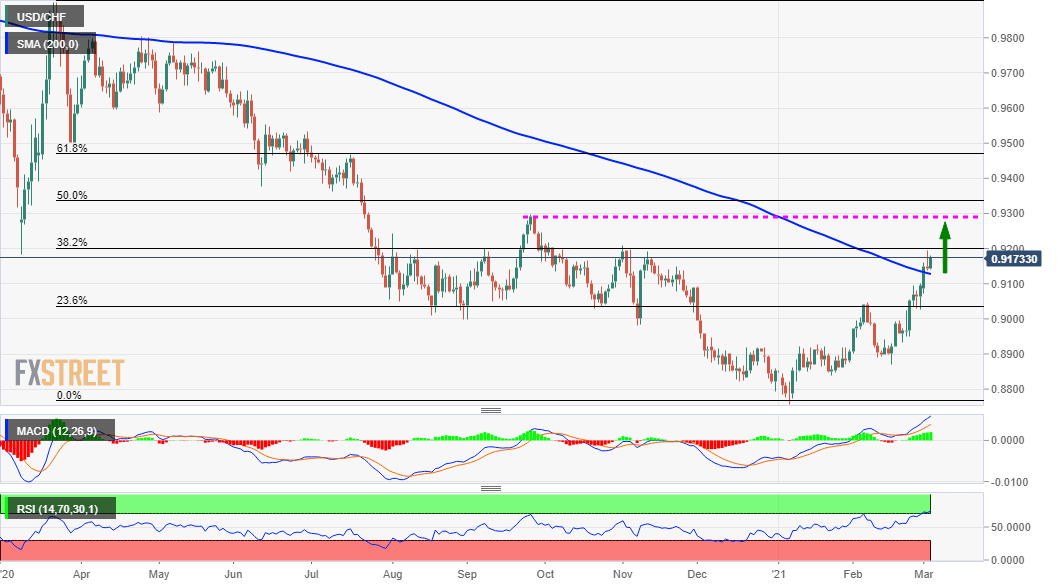

From a technical perspective, the overnight pullback from the vicinity of the 0.9200 mark, or a resistance marked by the 38.2% Fibonacci level of the 0.9902-0.8758 downfall, stalled near the very important 200-day SMA.

The emergence of some dip-buying and acceptance above a technically significant moving average supports prospects for additional gains. That said, slightly overbought RSI on the daily chart warrants some caution for bullish traders.

This makes it prudent to wait for some near-term consolidation before positioning for an extension of a near two-month-old uptrend. Alternatively, bulls might wait for a sustained move beyond the 0.9200 mark before placing fresh bets.

On the flip side, the 0.9140-30 region (200-DMA) might continue to protect the immediate downside. Any subsequent fall might still be seen as a buying opportunity and remain limited near the 0.9100-0.9090 horizontal support.

This is followed by the 23.6% Fibo. level, around the 0.9040-35 region, which if broken will negate any near-term bullish bias. The USD/CHF pair might then slide below the key 0.9000 psychological mark and test 0.8965-60 support zone.

USD/CHF daily chart

Technical levels to watch

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains near 1.0300 after US PMI data

EUR/USD trades in positive territory at around 1.0300 on Friday. The pair breathes a sigh of relief as the US Dollar rally stalls, even as markets stay cautious amid geopolitical risks and Trump's tariff plans. US ISM PMI improved to 49.3 in December, beating expectations.

GBP/USD holds around 1.2400 as the mood improves

GBP/USD preserves its recovery momentum and trades around 1.2400 in the American session on Friday. A broad pullback in the US Dollar allows the pair to find some respite after losing over 1% on Thursday. A better mood limits US Dollar gains.

Gold retreats below $2,650 in quiet end to the week

Gold shed some ground on Friday after rising more than 1% on Thursday. The benchmark 10-year US Treasury bond yield trimmed pre-opening losses and stands at around 4.57%, undermining demand for the bright metal. Market players await next week's first-tier data.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

Week ahead – US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.