USD/CHF Price Analysis: Bulls looking for signs of a correction

- The Swiss Franc is on the march but a correction is eyed for.

- USD/CHF bulls are lurking in what could be a support area for the coming sessions.

The Swiss Franc rallied in tandem with the Euro on Thursday which made a fresh four-week high against the US Dollar after the European Central Bank lifted interest rates to a two-decade high of 3.5% and guided towards more hikes ahead. This has seen USD/CHF subsequently plummet on the day towards a critical support area as the following technical analysis will illustrate:

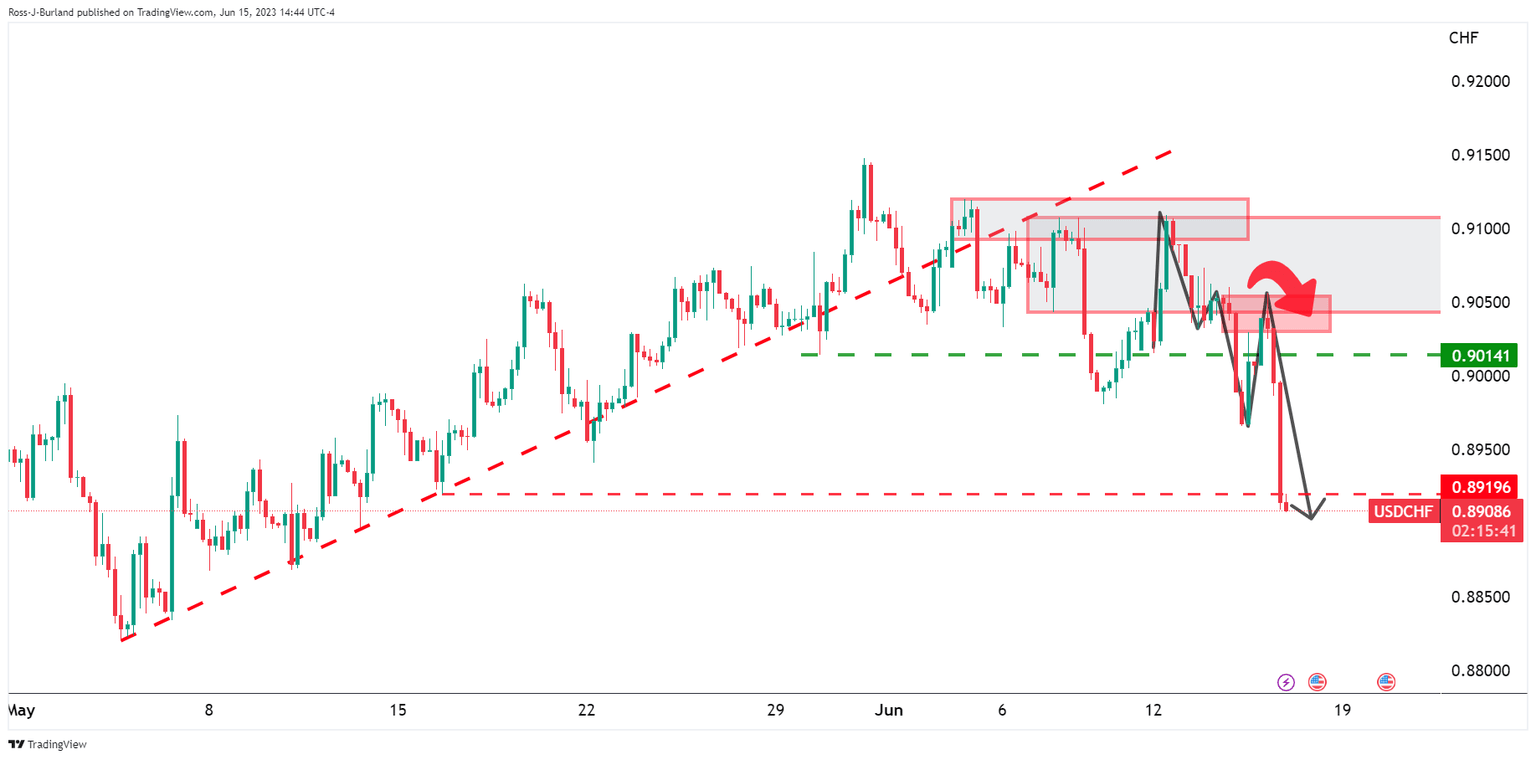

USD/CHF H4 chart

We have seen a breakdown in the market structure which has left behind the M-formation, a reversion pattern that leaves scope for a correction back towards prior support structures.

USD/CHF H1 charts

Zooming down to the hourly charts, we see the structure on the left where the price could be headed before a deceleration might come into play leading to a phase of accumulation.

Zooming into the present, bulls will be monitoring for that deceleration and a bullish structure within the accumulation schematic to lean against and targetting the imbalance to the upside.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.