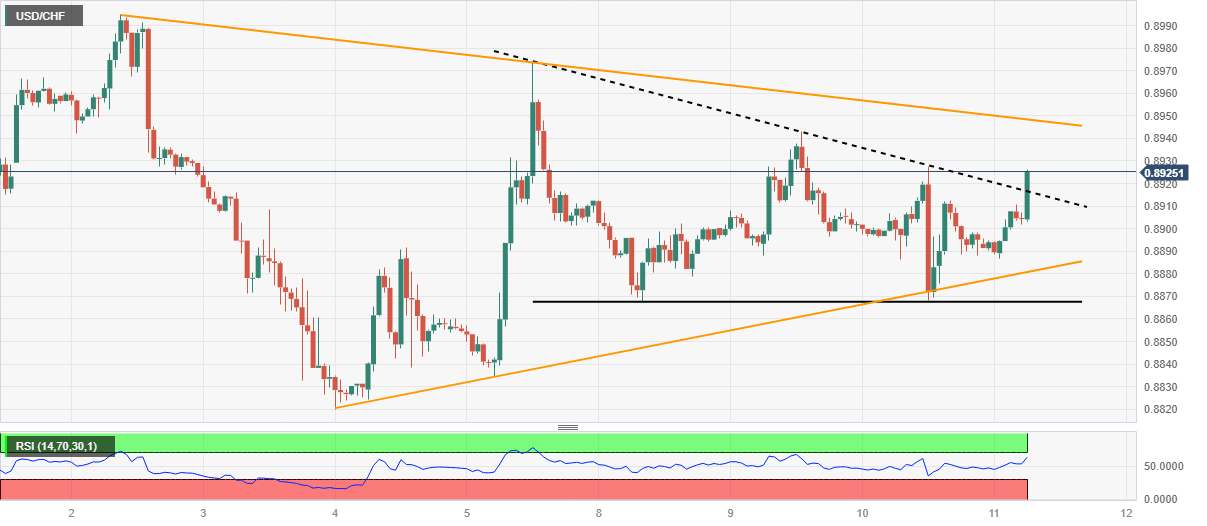

USD/CHF Price Analysis: Bullish triangle confirmation signals further upside past 0.8900

- USD/CHF picks up bids to prod the top line of a bullish chart formation.

- Upbeat RSI, clear bounce off 0.8870 double-bottom keeps USD/CHF buyers hopeful.

- Sellers need validation from 0.8880, buyers may aim for 0.8950 on confirming bullish triangle breakout.

USD/CHF remains on the front foot around 0.8920, reversing the previous day’s losses heading into Thursday’s European session.

In doing so, the Swiss Franc (CHF) pair pierces the top line of the one-week-old descending triangle bullish chart formation.

Adding strength to the USD/CHF upside bias is the quote’s clear rebound from the stated triangle’s lower line, by forming double bottom near 0.8865, as well as the firmer but not overbought RSI (14) line.

With this, the USD/CHF pair appears well set to approach a downward-sloping resistance line from May 05, around 0.8950 by the press time.

However, the pair’s upside beyond 0.8950 may find it difficult amid the likely overbought RSI (14) line around then. Additionally challenging the USD/CHF bulls above 0.8950 is the monthly high of near 0.8995, quickly followed by the 0.9000 psychological magnet.

On the contrary, a one-week-old ascending trend line, close to 0.8880 at the latest, can act as short-term support in a case where the USD/CHF defies the latest triangle breakout by slipping back under 0.8915 level.

Even so, the stated triangle’s lower line of around 0.8865 can challenge the pair bears before directing them to the monthly low of 0.8820 and the 0.8800 round figure.

USD/CHF: Hourly chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.