USD/CHF Price Analysis: Bounces at 18-month lows, reclaims the 0.9100 figure

- After hitting 18-month-lows, the USD/CHF is back above the 0.9100 threshold.

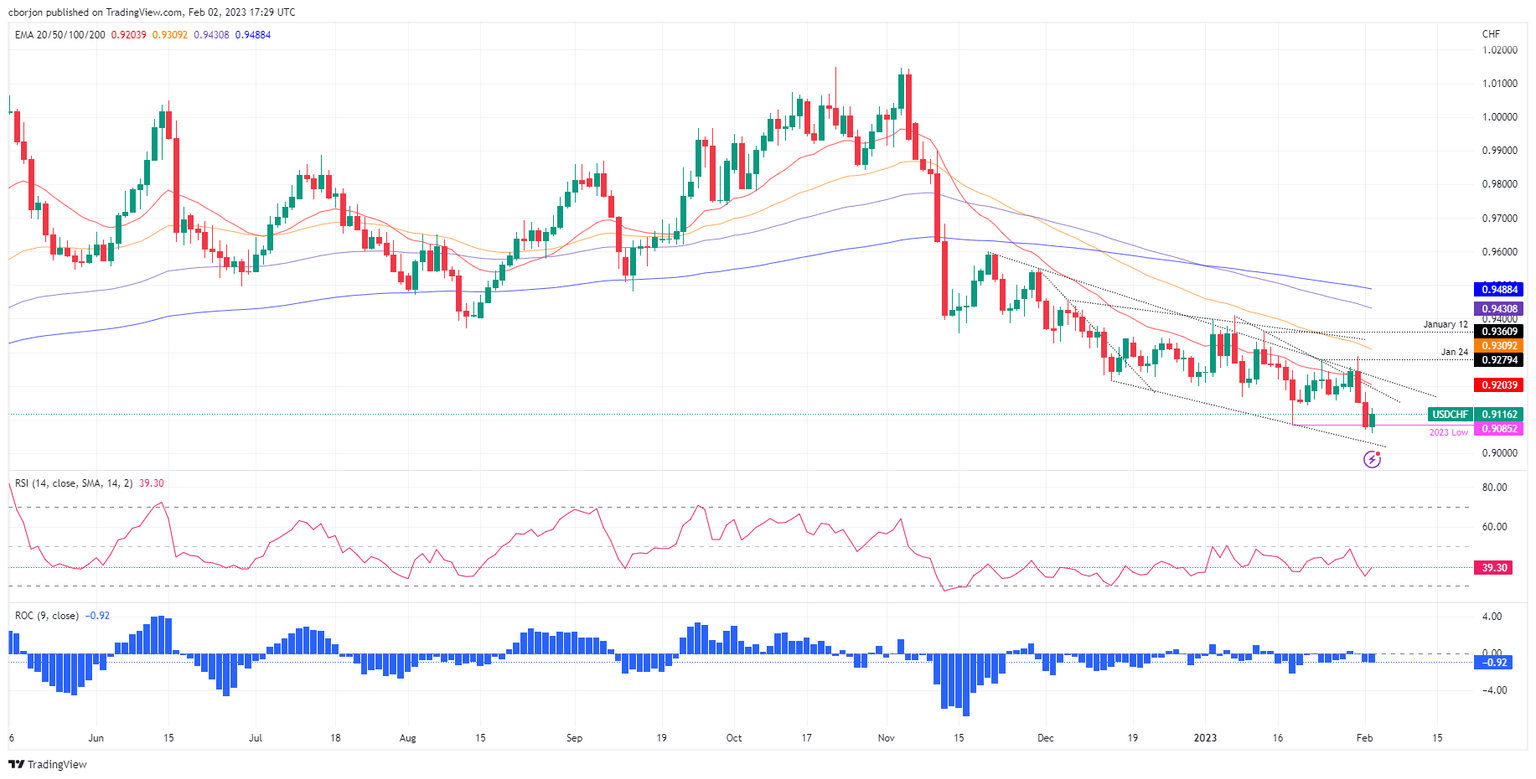

- USD/CHF Price Analysis: Remains downward biased below 0.9180, but once reclaimed, buyers would target 0.9280.

The USD/CHF climbs sharply after diving to fresh 18-month lows at 0.9059. However, it’s staging a comeback as the greenback gets bolstered following Wednesday’s US Federal Reserve’s decision to lift rates, which initially was perceived as dovish in the FX space. Nevertheless, the US Dollar (USD) had erased most of Wednesday’s losses, a tailwind for the USD/CHF. Therefore, the USD/CHF exchanges hand at 0.9221, above its opening price by 0.50%.

USD/CHF Price Analysis: Technical outlook

After the Fed’s decision, the USD/CHF fall continued on Wednesday, reaching new YTD lows, which were broken on Thursday. As the North American session progressed, USD/CHF bulls stepped in at 0.9050s and lifted the spot back above 0.91000.

Although the USD/CHF pair holds to gains in the day, it remains downward biased and is expected to extend its losses as long as it stays below 0.9180. A breach of 0.9059, the YTD low, would set the stage to challenge the 0.9000 psychological barrier.

On the other side, if the USD/CHF reclaims the February 1 high of 0.9182, that would exacerbate a test of the 0.9200 figure. Once cleared, the 20-day Exponential Moving Average (EMA) is next, followed by the January 31 high at 0.9288, ahead of 0.9300.

USD/CHF Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.