USD/CHF maintains a downward trajectory despite strong US GDP data

- USD/CHF falls further to 0.8800, marking a decline of 0.48%.

- US GDP continues to surpass market expectations, growing at 2.8% YoY.

- Markets increasingly expect rate cuts from the Fed and SNB in September.

In Thursday's trading session, the USD/CHF continued to extend its decline, closing down by 0.48% at around 0.8800 despite the robust GDP figures released by the United States. This resulted in a total loss of over 2% for the pair during the last two sessions.

The US Gross Domestic Product (GDP) showed promising results as it expanded at an annual rate of 2.8% during the second quarter, according to the initial estimate given by the US Bureau of Economic Analysis. The figures outperformed the market expectations which were set at 2%, and the GDP posed a strong progress from the 1.4% rise seen in the first quarter.

Another less significant yet positive data came from the US when it reported Initial Jobless Claims for the week that ended on July 19 at 235K, which showed improvements. In contrast, Durable Goods Orders in June witnessed a dramatic fall of 6.6%.

The upcoming blackout period suggests that there won’t be any further comments from the Fed. Currently, the CME Fedwatch Tool strongly predicts a heightened prospect of a rate cut in September. The market also bet on a third rate cut in September by the Swiss National Bank (SNB).

USD/CHF technical analysis

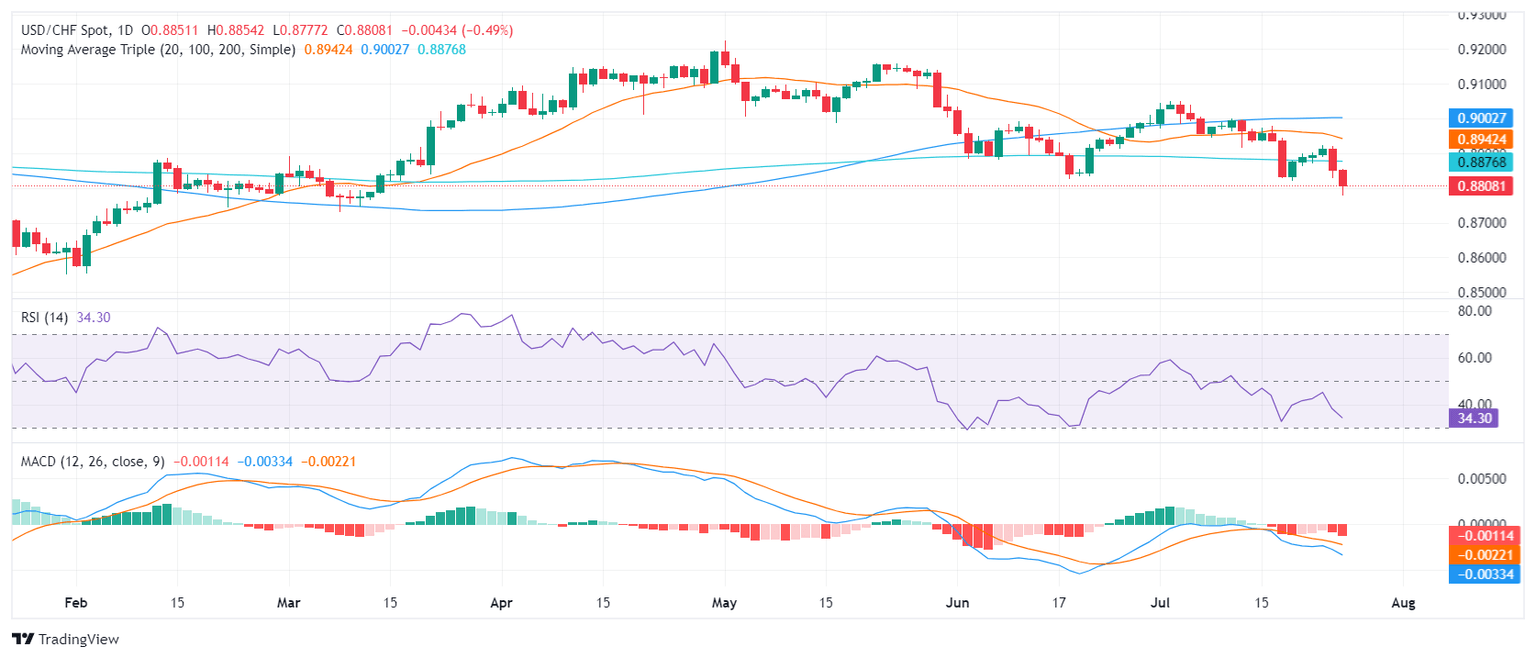

The technical outlook for USD/CHF remains neutral-bearish as the pair consistently trades below the 20, 100, and 200-day Simple Moving Average (SMA). As seen on Thursday, technical indicators continually stay in the negative range.

The new support levels have been revised to 0.8750 and 0.8730, while resistance levels have now been adjusted to 0.8800, 0.8830, and 0.8850.

USD/CHF daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.