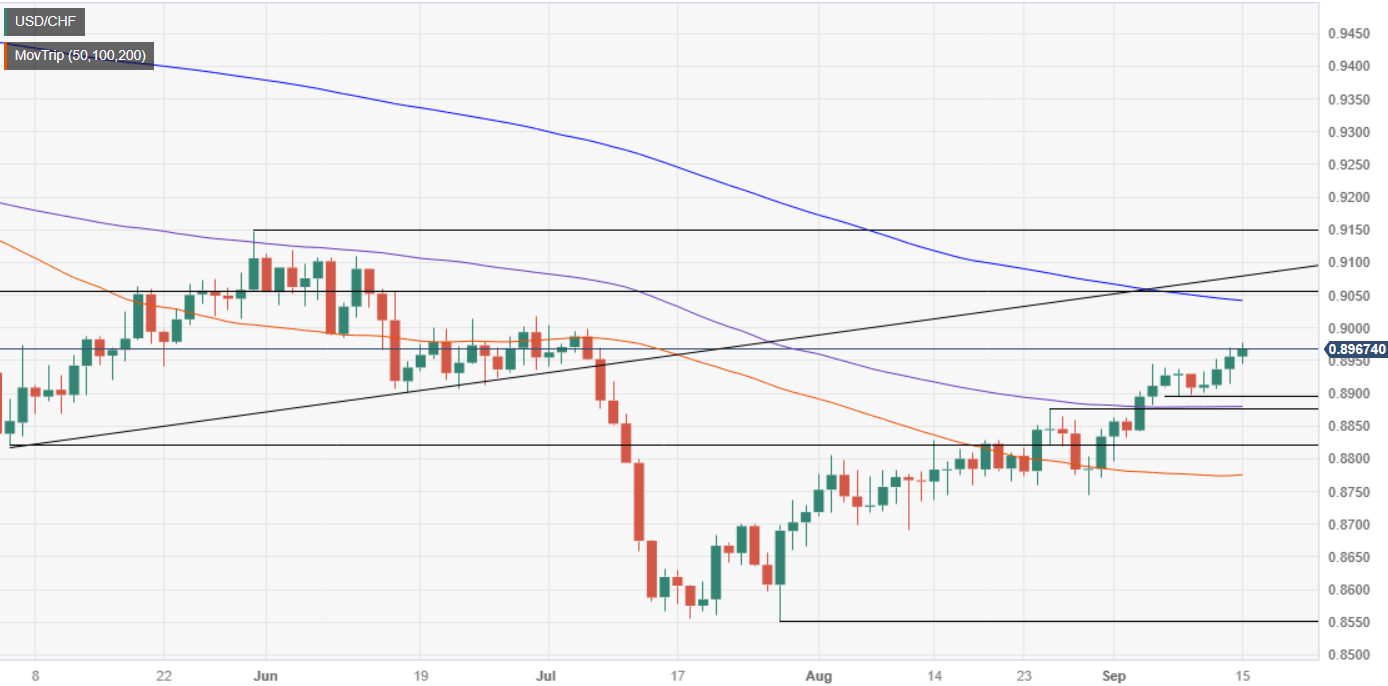

USD/CHF hovers below 0.9000: Is a breakout imminent?

- USD/CHF trades at 0.8963, just shy of the key 0.9000 level, after gaining 4.50% from its year-to-date low.

- Buyers aim to reclaim the 0.9000 psychological mark and the 200-day Moving Average at 0.9039 for further upside.

- Downside risks emerge if the pair falls below the September 14 daily low of 0.8914, targeting the 0.8900 mark and the 50-DMA at 0.8774.

The USD/CHF extended its gains in the week to five consecutive days and printed a new two-month high at 0.8977, yet it remains shy of reclaiming the 0.9000 figure. Nevertheless, the pair is set to continue its uptrend and challenge the 200-day Moving Average (DMA() at 0.9039 once buyers reclaim 0.9000. At the time of writing, the major is trading at 0.8963 after hitting a daily low of 0.8944.

The daily chart portrays the pair’s recovery after printing a new year-to-date (YTD) low of 0.8552. Since then, the USD/CHF has achieved gains of 4.50% as buyers stepped in and lifted the exchange rate to current levels. Even though buyers reclaimed the 50-DMA at 0.8774, they remain shy of remaining in charge unless they reclaim the psychological 0.9000 figure, followed by the 200-DMA at 0.9039. Once those areas are cleared, the next test would be the May 31 high at 0.9147.

Conversely, if the USD/CHF drops below the September 14 daily low of 0.8914, that would exacerbate a challenge of the 0.8900 mark. A breach of the latter, and the pair could aim toward the current week’s low of 0.8893, followed by the 50-DMA at 0.8774.

USD/CHF Price Action – Daily chart

USD/CHF Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.