USD/CHF holds losses after soft US labor market data

- Pair bottomed at a low of 0.8375 and then recovered above 0.8400 but holds daily losses.

- US August NFPs came in lower than expected, following this weak labor market data trend.

- Investors might bet on a bigger cut in September from the Fed.

On Friday, the USD/CHF fell to a daily low of 0.8375 and then recovered back above 0.8400. The upside, however, is limited as the US reported weak labor market figures.

The US Dollar’s appeal diminished after the release of a lower-than-expected NFP report for August, which showed the creation of 142,000 new jobs, falling short of the 160,000 forecast but surpassing July’s revised figure of 89,000. The Unemployment Rate decreased as anticipated, moving from 4.3% to 4.2%. Additionally, Average Hourly Earnings increased by 3.8% year-over-year, exceeding expectations.

Following the data, based on the CME FedWatch tool, the likelihood of a 0.50% rate cut by the Federal Reserve (Fed) at its September 18 meeting remained steady at around 40%, but what it a done deal is that the easing cycle will start in that month, with a 25 bps cut. Incoming data will justify or not a bigger cut.

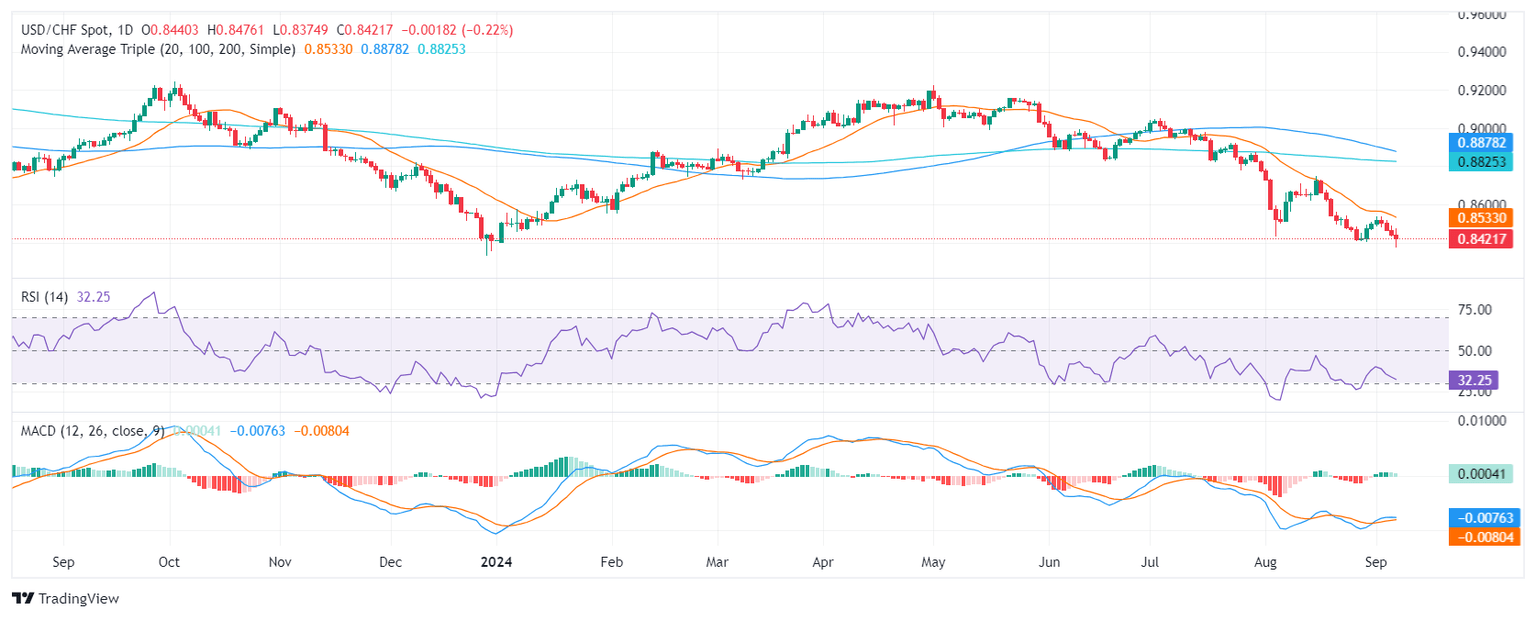

USD/CHF Technical Outlook

The outlook for USD/CHF is neutral to bearish as the Relative Strength Index (RSI) hovers deep in negative terrain but with a flat slope, while the Moving Average Convergence Divergence (MACD) is showing flat green bars, further supporting the neutral outlook for the pair. Overall, the bias is still tilted to the downside as the pair hovers below its 20,100 and 200-day Simple Moving Averages (SMAs).

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.