USD/CHF declined as the Greenback remains weak, defends the 20-day SMA

- USD/CHF took a dip in Tuesday’s session and fell to 0.9110.

- Despite the Consumer Confidence index in the US and Housing prices exceeding expectations, the USD remains weak.

- The Federal Reserve maintains a cautious stance, asking the market for patience, which keeps the odds for rate cuts in June or July low.

The USD/CHF pair is trading lower, despite optimistic signals from the US economy, specifically in the Housing market, and Consumer Confidence data. On the Swiss front, its economic calendar remained empty at the start of the week.

The US Consumer Confidence index was reported to have risen to 102, outperforming forecasts while the the S&P/Case-Shiller Home Price Indices also beat expectations and rose by 7.4% YoY in March.

In the meantime, investors remain focused on key economic data, specifically, the forthcoming figures from the Personal Consumption Expenditures (PCE) and Q1 GDP revisions, to be released on Thursday and Friday to provide further market direction. The Federal Reserve (Fed) Beige Book report on Wednesday might also be considered by investors to place bets on the timing of the easing cycle.

USD/CHF technical analysis

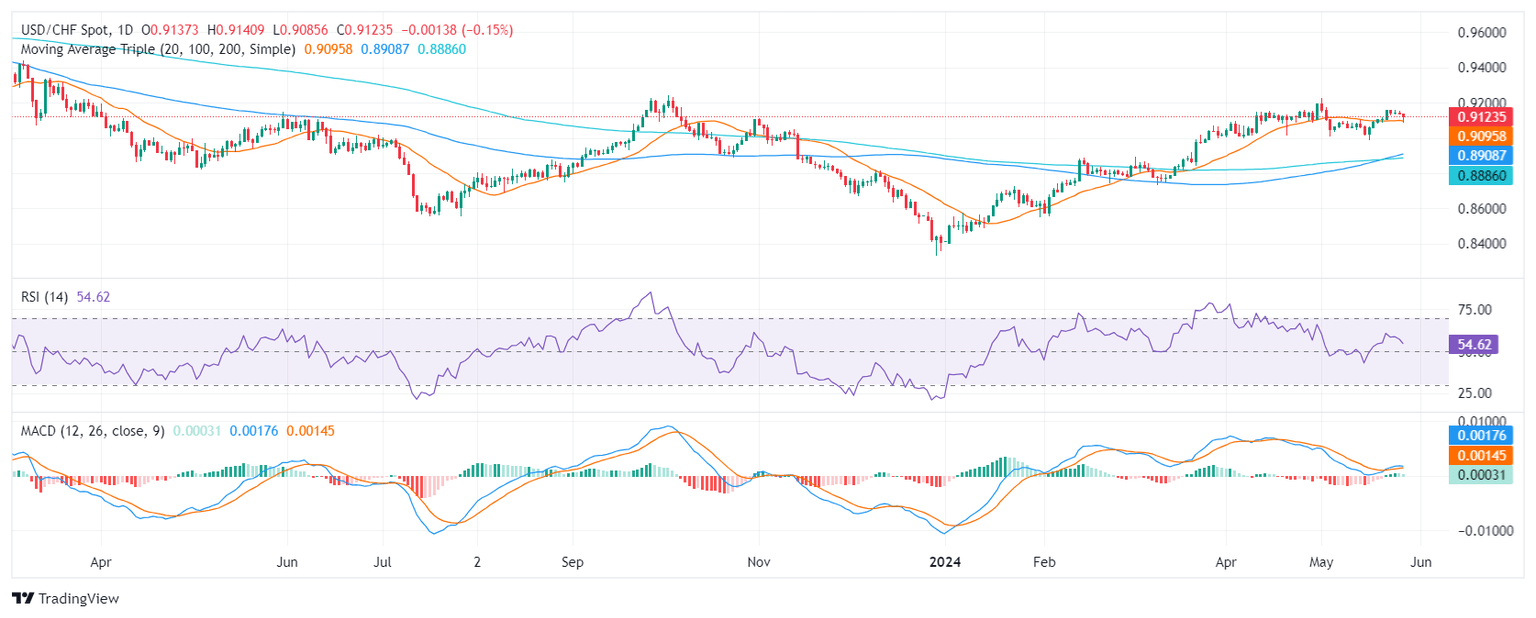

In the daily analysis, the Relative Strength Index (RSI) stands in positive territory but exhibits a minor decline in the latest session, indicating a minor momentum shift that could favor sellers in the near term. Concurrently, the Moving Average Convergence Divergence (MACD) shows decreasing green bars, indicating a weakening bullish momentum.

USD/CHF daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.