USD/CHF closed with gains amid cautious market sentiment

- US Dollar strengthened against the Swiss Franc on Tuesday’s session at the 0.9075 area.

- Focus shifts to the next US CPI reading, the Fed’s interest decision next week.

- US bond yields limited the greenback’s gains.

The USD/CHF closed Tuesday’s session at the 0.9075 area, recording a 0.16% gain. The US dollar benefited from a cautious market mood despite US bond yields retreating ahead of next week's CPI and interest decision from the Fed. In addition, fears of a global economic downturn amid a fresh cycle of rate hikes by the main central banks may continue to cushion the US Dollar.

Markets anticipate a pause by the Fed on June 13-14

According to the CME FedWatch Tool, investors are currently predicting a 73.6% chance that the Federal Reserve (Fed) will not raise interest rates at their upcoming meeting in June, instead keeping the target rate at 5.25%. However, this decision will largely depend on the forthcoming May Consumer Price Index (CPI) data. It is anticipated that the headline inflation will slow down to 4.2% (year-on-year) from the previous 4.9%, while the Core rate is expected to increase to 5.6% (year-on-year) from the previous reading of 5.5%. Consequently, the market's expectations regarding the Fed's decision could potentially impact the strength of the US Dollar.

Regarding the market sentiment, in Wednesday’s session, China will release key economic data which may have an impact on the prospects of a global economic downturn and hence, a weak reading may further support the greenback.

Levels to watch

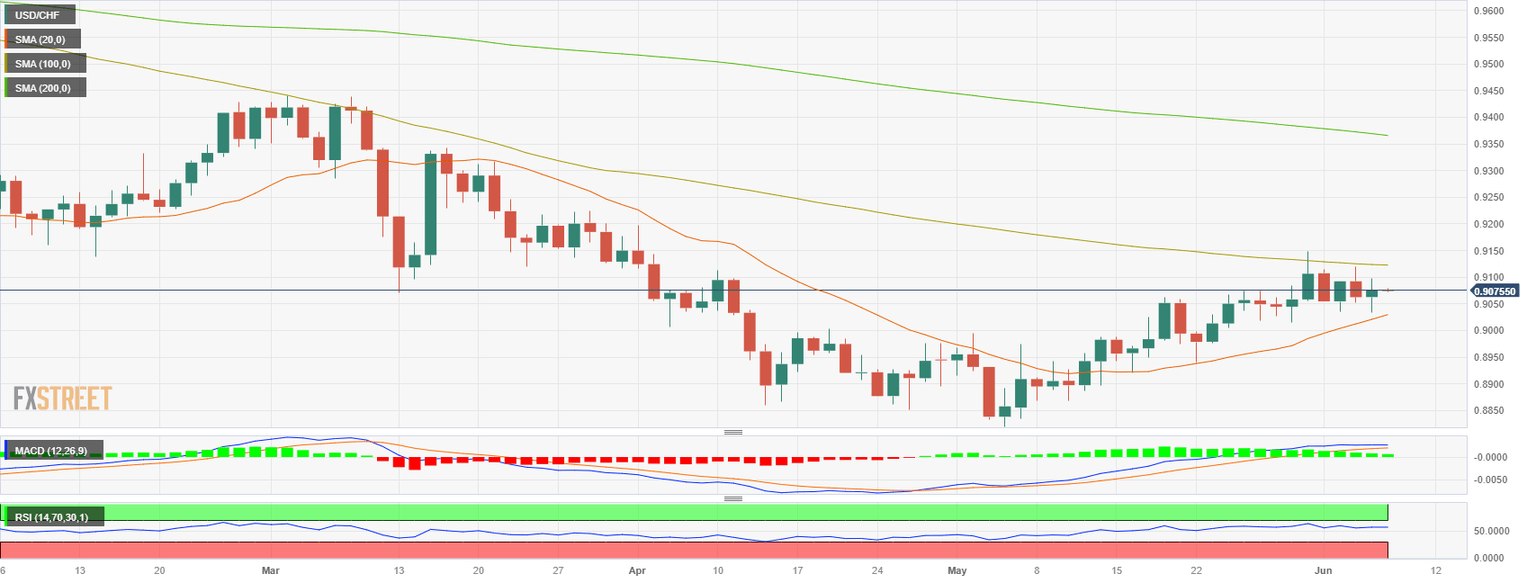

According to the daily chart, the technical outlook slightly favours the USD but indicators turned somewhat flat in positive territory. Meanwhile, the 20- and 100-day Simple Moving Averages (SMA) seem to be converging towards the 0.9100 area, hinting at a possible bullish cross by the 20-day SMA to confirm the shorter-term positive outlook.

On the upside, the mentioned level of the SMAs convergence stands as the first resistance for the bulls. Then, the following levels to watch stand at 0.9150 and 0.9180. On the downside, the 20-day SMA at 0.9030 stands as immediate support followed by the 0.9000 psychological mark and the 0.8980 area.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.