USD/CHF clears daily gains and falls below the 20-day SMA

- The USD/CHF initially rose to 0.9123 and then settled near 0.9070 below the 20-day SMA.

- The US Dollar measured by the DXY also cleared gains and retreated to 106.12.

- Falling US yields after Lorie Logan’s words from the Fed explain the USD’s weakness.

- Eyes on Thursday’s inflation data from the US from September while investors still asses Friday’s NFPs from the US.

In Monday’s session, the USD/CHF reversed its course after peaking at a high of 0.9123 and settling around 0.9055 below the 20-day Simple Moving Average. On the US Dollar’s side, it lost steam, driven by a significant decline of the US yields after Lorie Logan from the Federal Reserve (Fed) commented that there may be “less need” to hike rates. In addition, US traders will remain on the sideline on Monday, celebrating the Columbum’s holiday and no relevant data is expected during the rest session.

Following Logan’s words, investors seem to be betting on a less aggressive Fed as the 2,5 and 10-year Treasury Bond yields declined to 4.95%,4.60% and 4.67%, adding downward pressure on the pair.

On the data front, Nonfarm payrolls (NFP) from the US from September showed a similar tendency as August results. Job creation ticked up as the number of employed people in the US in all non-agricultural businesses in the US came in at 336,000, much higher than the 170,000 expected and the previous 270,000. Wage inflation measured by the Average Hourly Earning came in at 0.2% MoM vs the 0.3% expected, while the Unemployment rate rose to 3.8% YoY.

On Thursday, the US will release inflation readings from September, and the headline and core measures are expected to have declined to 3.6% and 4.1% YoY. In line with that, a soft inflation reading could pave the way for more downside for the US Dollar via lower bond yields and dovish bets on the Federal Reserve.

In addition, the geopolitical conflict between the Hamas terrorist group and Israel could make investors refrain from making significant moves and instead seek refuge in the green currency, limiting the downside for the pair.

USD/CHF Levels to watch

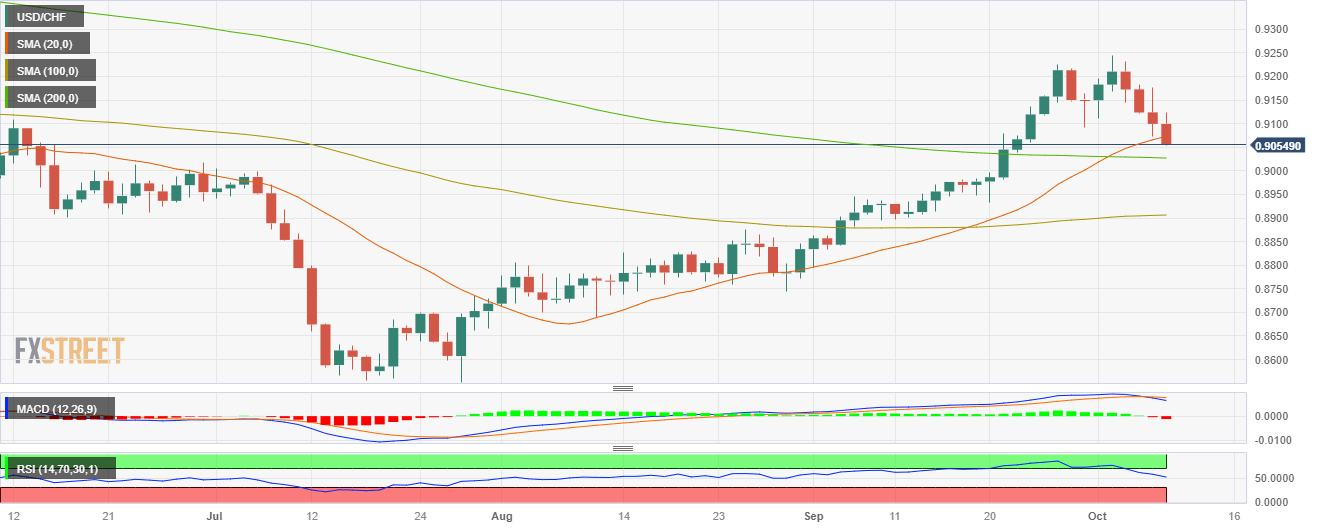

Based on the daily chart, the USD/CHF exhibits a bearish outlook for the short term. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) remain in negative territory. Additionally, the pair is above the 100 and 200-day Simple Moving Average (SMA), indicating that despite bears gaining momentum in the shorter time frames, the buyers command the broader perspective.

Support levels: 0.9050, 0.9030, 0.9000.

Resistance levels: 0.9073 (20-day SMA), 0.9150, 0.9170.

USD/CHF Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.