USD/CAD whipsaws after BoC holds rates steady, keeping a hawkish tone

- USD/CAD reacted with volatility, hitting a daily high of 1.3676 after the Bank of Canada kept rates unchanged but maintained a hawkish stance on inflation.

- Despite a -0.2% annual contraction in Canada’s Q2 GDP, the BoC expresses concerns about the “persistence of underlying inflationary pressures.”

- Technical outlook suggests further upside if the pair reclaims its daily high; downside support lies at the 200-HSMA at 1.3584 and the week’s low of 1.3575.

The USD/CAD trades volatile earlier in the North American session after the Bank of Canada (BoC) decided to hold rates unchanged at 5%, though it maintained a hawkish tone in its monetary policy statement. At the time of writing, the major trades in a wide 1.3620/70 range.

Bank of Canada holds rates unchanged at 5.00%; USD/CAD remains steady

Given that last week’s Canadian Gross Domestic Product (GDP) shrank annually by -0.2% in Q2, triggering market participants’ expectations, the BoC would keep rates unchanged.

In its statement, the BoC Governing Council said that excess demand is cooling. Still, they kept their options open, as they remain concerned about “the persistence of underlying inflationary pressures,” as mentioned in the monetary policy statement.

The BoC added that measures of core inflation remain high, with major global central banks focused on restoring price stability. BoC policymakers added the economy entered a period of weaker growth, which is needed to alleviate price pressures.

USD/CAD Reaction to the BoC’s decision

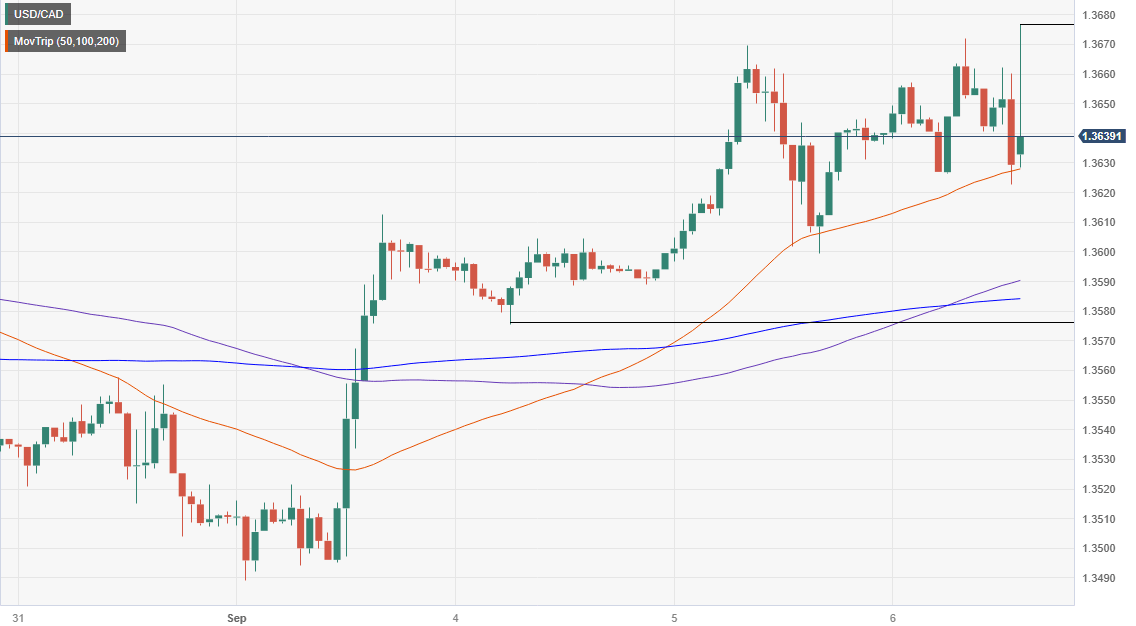

The USD/CAD reacted to the upside, reaching a daily high of around 1.3676 before retreating somewhat towards the 50-hour Simple Moving Average (SMA) at 1.3627. Further upside is seen if the major reclaims the daily high, which could pave the way towards 1.3700. On the flip side, if the USD/CAD dives below the 50-HSMA, the next support emerges at the 200-HSMA at 1.3584 before testing the current week’s low of 1.3575.

USD/CAD Price Action – Hourly chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.