USD/CAD surges above 1.2700 on safe-haven flows and a firm US dollar

- The USD/CAD is gaining in the week by some 0.39%.

- A dismal market sentiment, courtesy of China’s Covid-19 outbreak, weighed on oil prices and the CAD.

- Bank of Canada Governor Tiff Macklem said Canada needs higher interest rates, because inflation is too high.

- USD/CAD Price Forecast: Tilted to the upside, once broken the 200-DMA around 1.2624.

The USD/CAD rallies in the middle of a flight to safe-haven peers in the FX space, using the US dollar, the JPY, and the CHF as safety vehicles in a risk-off market mood. Also, falling oil prices and increasing bets that the Federal Reserve would hike rates 0.50% in the May 4-5 meeting boost the prospects of the greenback. At the time of writing, the USD/CAD is trading at 1.2755 at fresh monthly highs at the time of writing.

The Covid-19 outbreak in China weighed on market sentiment

Global equities are recording losses. The abovementioned factors and China’s Covid-19 lockdown in Shanghai threaten to slow down economic recovery. China’s situation is expanding towards Beijing, as reported by Reuters.

“In Shanghai, authorities have erected fences outside residential buildings, sparking fresh public outcry. In Beijing, many people have begun stockpiling food, fearing a similar lockdown after the emergence of a few cases of COVID-19.”

Consequently, commodity prices are down, led by the US crude oil benchmark, Western Texas Intermediate (WTI), down close to 5%, exchanging hands at $96.70 per barrel, weighing on the commodity-linked Loonie. Production and delivery of oil products in Canada contributed just under 10% of the Gross Domestic Product (GDP).

An absent Monday’s US economic docket left USD/CAD traders adrift to the Bank of Canada (BoC) Governor Tiff Macklem, and Senior Deputy Governor Rogers are scheduled to testify before the House of Commons Standing Committee on Finance at 11:00 ET on Monday.

On Monday, the BoC Governor Tiff Macklem said that inflation is too high and would remain “elevated” more than previously thought. He reiterated that inflation is broadening, and it worries the bank. Macklem added that Canada requires higher interest rates, and he would not rule out hiking rates more than 50 bps.

Also read: BoC's Macklem: Reiterates Canada needs higher interest rates, inflation is too high

USD/CAD Price Forecast: Technical outlook

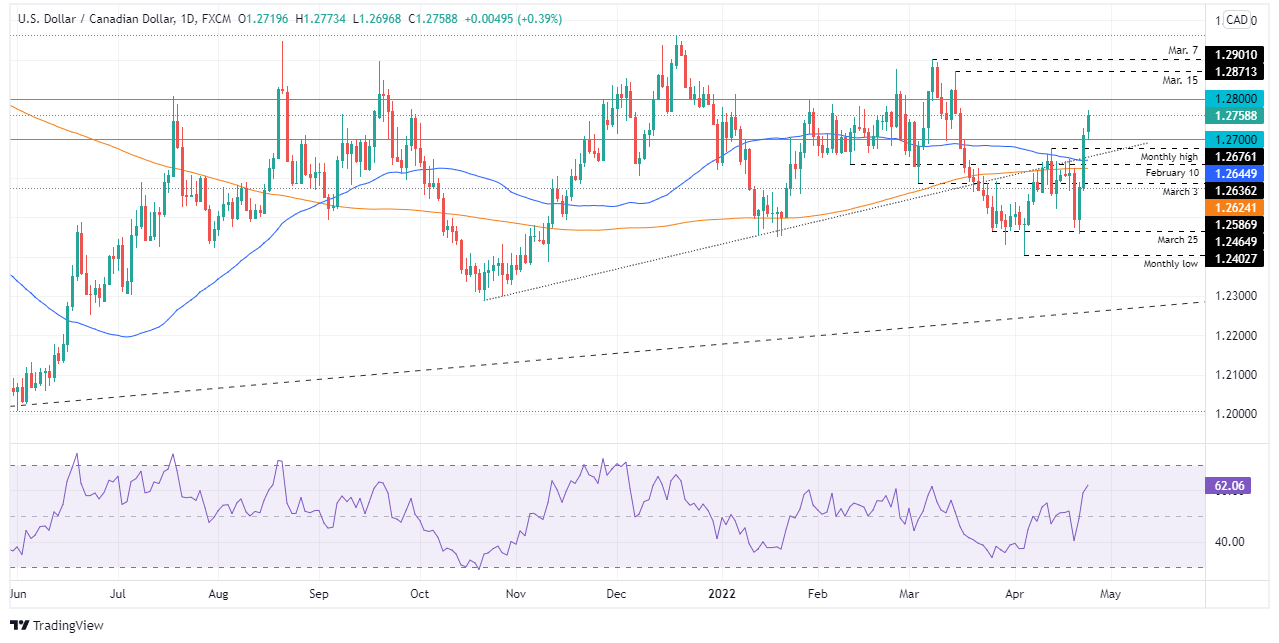

The USD/CAD broke April’s 13 previous monthly high at 1.2676 and gave fresh legs to the pair, as it broke above the 1.2700 figure quickly. It extended its gains and is accelerating the uptrend towards 1.2800. However, the Relative Strength Index (RSI) at 62.19, with its steeper slope, has enough space before reaching overbought conditions.

Given the previously-mentioned, the USD/CAD first resistance would be 1.2800. Break above would expose a solid supply zone around March’s 13 daily high at 1.2871, followed by March’s 7 daily high at 1.2901.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.