USD/CAD struggles at 1.2500 on lower oil prices, stronger US dollar

- The Loonie losses traction for the first time in the week though it keeps trading with gains.

- Russia-Ukraine tussles and Putin’s natural gas decree weighs on market mood.

- The US would tap 1 million barrels per day of their SPR reserves.

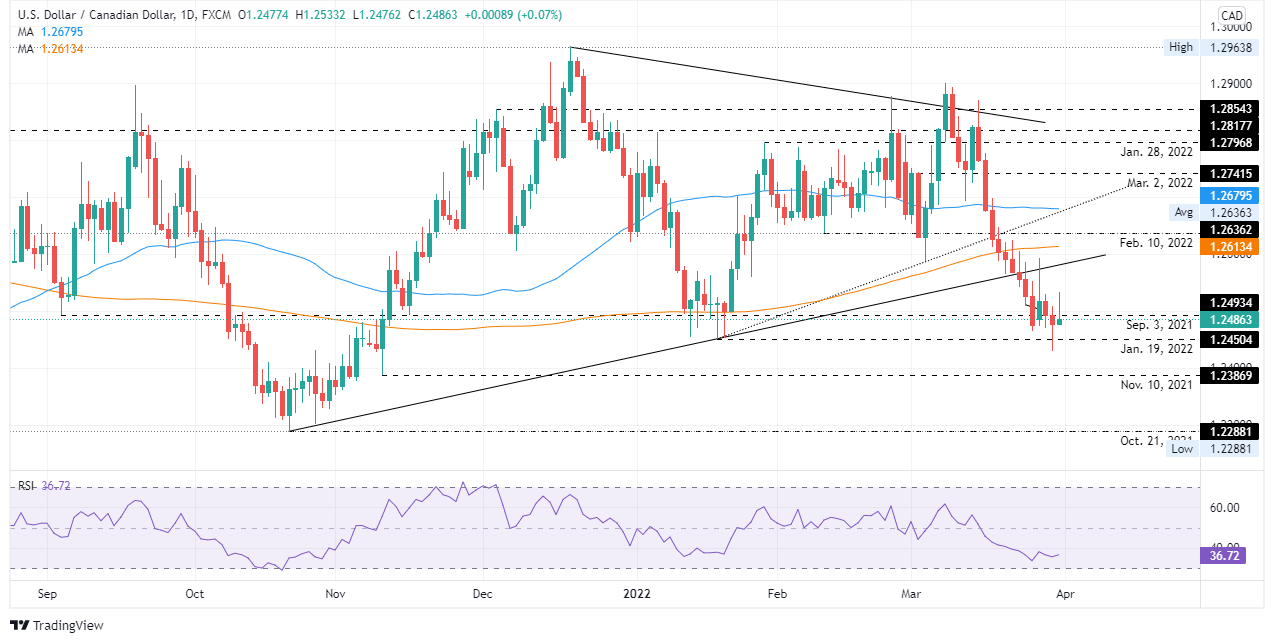

- USD/CAD Price Forecast: Unless the pair trades above 1.2613, where the 200-DMA lies, the trend is downwards.

The USD/CAD snaps two days of losses and recovers some ground amidst a stronger US dollar, continuing hostilities between Russia and Ukraine, and lower oil prices. The Canadian dollar weakens vs. the greenback on the back of those factors but remains flat in the week. At the time of writing, the USD/CAD is trading at 1.2486.

Downbeat market mood and falling oil prices weigh on the USD/CAD

Global equities keep trading in the red for the second straight day as Russia’s President Vladimir Putin signed a decree, which states that natural gas needs to be paid in Roubles beginning on April 1. Furthermore, Putin’s added that proceedings in euros or US dollars could also be blocked while emphasizing that Russia will supply gas at agreed-upon volumes and prices. However, he reiterated that active contracts will be halted if demands are not met.

As a reaction to the headline, market sentiment turned sour, with the S&P heading lower, as market players turned towards the safe-haven US dollar.

The US Dollar Index, a gauge of the greenback’s value vs. a basket of its rivals, advances 0.19%, sitting at 98.021, weighs on the Loonie, also dragged down by falling oil prices.

Western Texas Intermediate (WTI), the US crude oil benchmark, fell from daily highs to the $102 mark on an announcement that the White House would tap its oil reserves and release 1 million BPD over six month period.

Macroeconomic-wise, the Canadian docket featured the GDP for January, which rose by 0.2%, in line with estimations, and higher than December’s 2021 reading. On the US front, the Fed’s favorite gauge of inflation, the Core PCE for February, rose by 5.4% YoY, lower than the 5.5% estimated, while US Initial Jobless Claims for the week ending on March 26 increased by 202K, higher than the 197K expected.

USD/CAD Price Forecast: Technical outlook

The USD/CAD keeps trading downwards, as shown by the daily chart. Thursday’s price action reached a daily high at around 1.2533, but in the North American session, it gave back those gains and meandered around the 1.2480s highs. That said, the downtrend is intact unless the USD/CAD breaks above 1.2613, the 200-day moving average (DMA), and the top of the 1.2450-1.2600 range.

The USD/CAD first support would be March 25 daily low at 1.2465. A breach of the latter would expose January 12 low at 1.2447, followed by November 10, 2021, daily low at 1.2387.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.