USD/CAD reverses back below 1.2700 as oil prices advance and forecasters becoming more bearish

- USD/CAD has reversed back lower from earlier highs above 1.2700 as oil prices have advanced.

- Thursday’s US data dump didn’t have much FX market impact as focus shifts to Friday’s US and Canadian jobs reports.

- Forecasters have been growing more bearish on USD/CAD as of late, according to the latest Reuters poll.

USD/CAD has traded in a relatively directionless fashion on Thursday, initially strengthening towards above 1.2700 as the Canadian dollar weakened in tandem with an earnings-driven downturn in global equities, but more recently dropping back to the 1.2675 area on rising oil prices. At current levels, the pair is back to trading broadly flat on the day, with the latest US data dump having an only limited impact on FX markets with focus more on European central bank meetings.

For reference, the latest US ISM Services PMI survey for January was broadly in line with consensus, weakening to its lowest since March 2021 to reflect the spread of Omicron, but remaining at robust levels. Meanwhile, the latest US jobless claims report showed initial claims heading back lower again in an early sign that the pandemic impact on the US labour market began to ease in late January. Perhaps most importantly, Q4 Unit Labour Cost data came in substantially weaker than expected, dovetailing with last week’s alternative Q4 Employment Cost Index figures.

Traders will be looking to Friday’s US labour market report for further evidence of easing US wage pressures, which the Fed has recently flagged as a notable upside risk to inflation. If Average Hourly Earnings on Friday also disappoint, that could exacerbate recent USD weakness that has seen USD/CAD pull back from the upper 1.2700s. Note that there will also be plenty of focus on Friday’s Canadian labour market report, which is out at the same time as the US data.

Forecasts becoming more bullish

In other notable news, Reuters released a survey on Thursday that showed market participants have grown more bearish on USD/CAD amid expectations for further crude oil upside and amid bets the BoC will outpace the Fed regarding monetary tightening. The median three-month forecast according to the latest poll was for USD/CAD to drop to 1.2500 versus last month’s three-month forecast for USD/CAD to slip to 1.2600. The median 12-month forecast fell to 1.22 from 1.2350 one month ago.

Technical Outlook

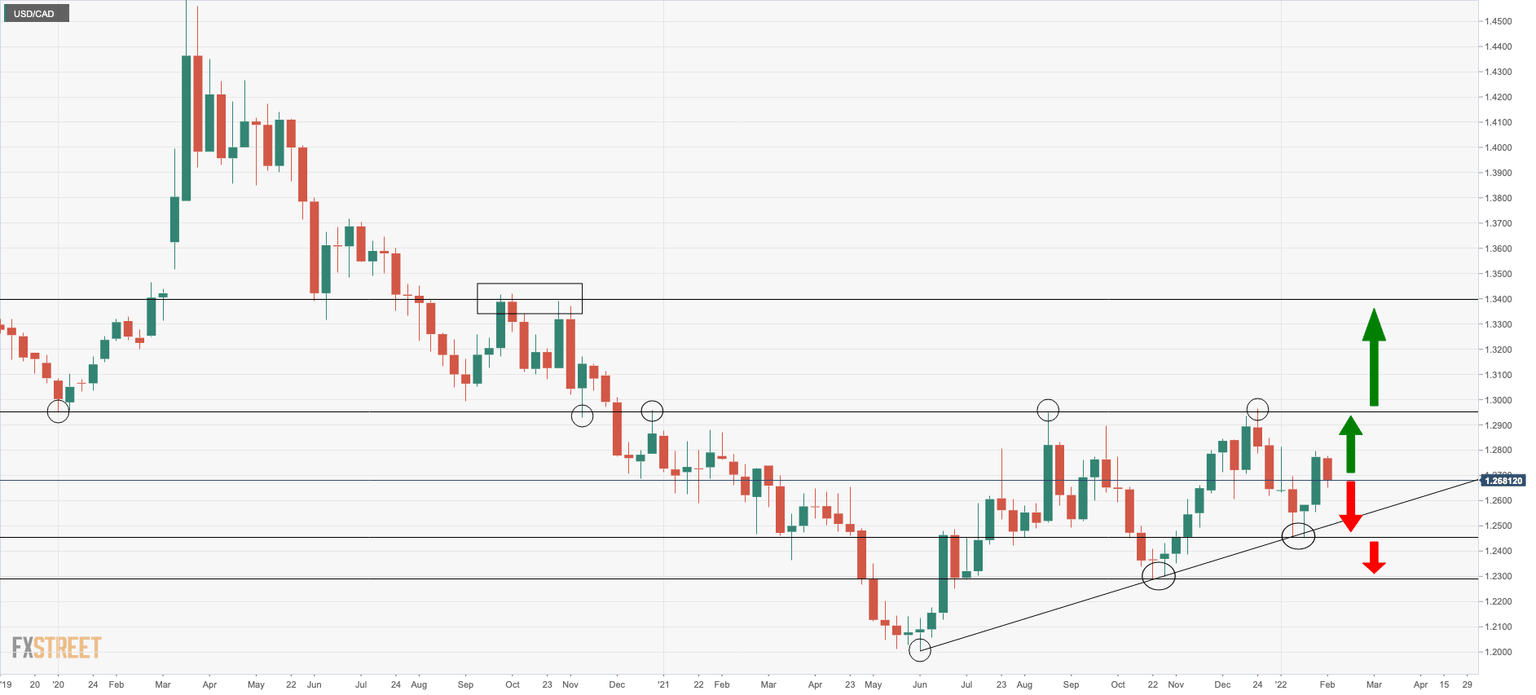

Looking at USD/CAD over a longer time horizon and from a technical perspective, if the above forecasts prove correct, that implies USD/CAD will break to the south of a long-term uptrend that has been supporting the pair since last June in the next three-months. Again, assuming the forecasts are correct, USD/CAD would then break below its January lows in the mid-1.2400s and then plough below its Q4 2021 lows at 1.2300 over the course of the rest of the year. If the long-term uptrend is broken, such a move does seem likely from a technical standpoint.

Conversely, should the forecasts prove wrong and USD/CAD reverse higher, traders should keep an eye on the critical 1.2950 resistance zone that has capped the price action since late December 2020 and prior to that offered support going all the way back to late-2019. With USD/CAD having formed a long-term ascending triangle, a break above this resistance zone would be highly meaningful from a technical standpoint and would imply a push higher towards the next big resistance zone in the mid-1.30s.

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset