USD/CAD remains under 1.3500 after upbeat Canadian jobs report

- US Initial Jobless Claims rise to 228,000, above the 200,000 of market consensus.

- Canadian economy adds 34,700 jobs in March, more than 12,000 expected.

- USD/CAD remains in the previous range, below 1.3500.

The USD/CAD is hovering around 1.3470/80 after the release of employment numbers from the US and Canada. The pair dropped to 1.3457 and then bounced to 1.3480 after the economic figures, staying sideways, in a familiar range.

Employment numbers from US and Canada

In Canada, the economy added 34,700 jobs in March, surpassing expectations. The Unemployment rate stayed unchanged at 5%. The Loonie strengthened against it main rivals, hitting fresh daily highs, expected versus the US Dollar.

The weekly US Jobless Claims report came in below expectations. Initial Jobless Claims rose to 228,000, above the 200,000 of market consensus. The Labor Department made a sharp revision to the upside in the previous weeks, reflecting a change in the methodology. Friday is Nonfarm Payrolls Day.

The US Dollar rose despite signs of labor conditions softening. US stocks react negatively, probably reflecting fears about the global economic outlook. US yield dropped but quickly rebound.

Technical outlook

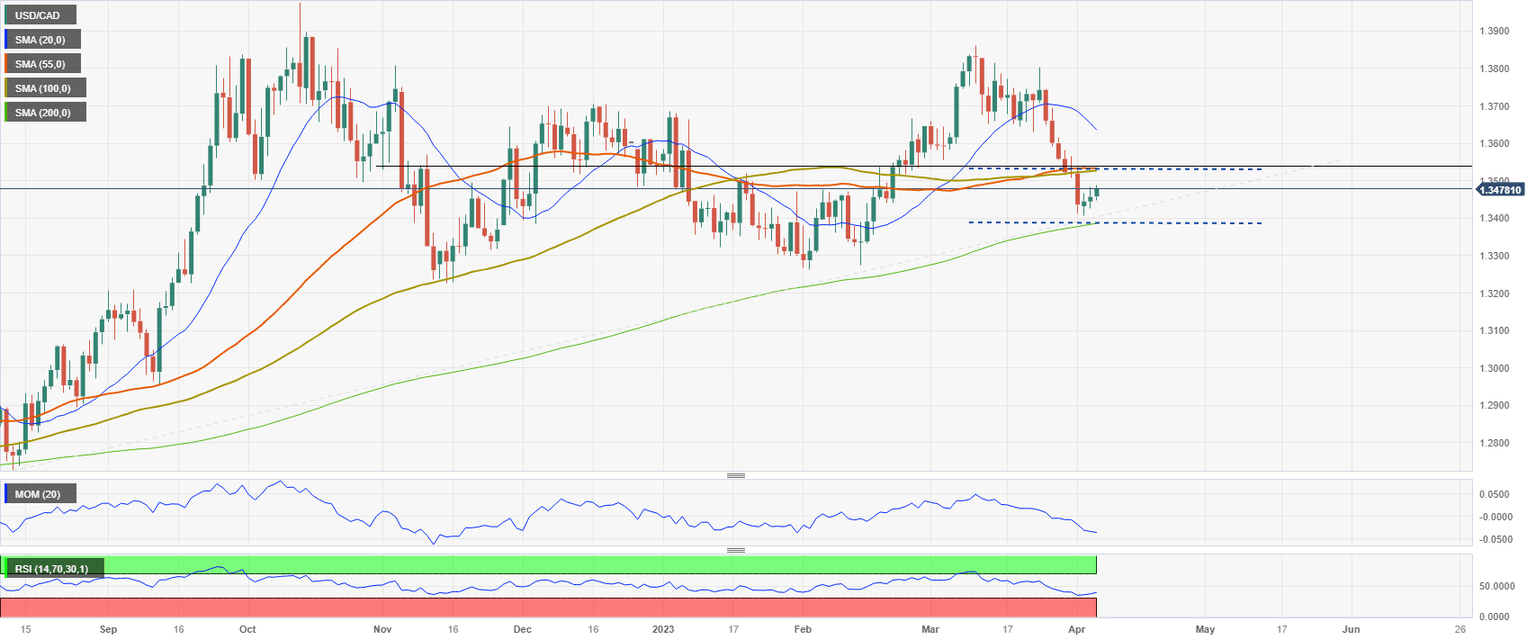

The USD/CAD is moving between two key moving averages in the daily chart: the 200-day offers support at 1.3380 while the 55 and 100-day are near 1.3525.

The bias is skewed to the downside, however technical indicators favor some consolidation after the recent rally of the Loonie that send USD/CAD from 1.3740 to the 1.3400 area.

USD/CAD Daily Chart

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.