USD/CAD Price Forecast: The first upside barrier emerges above 1.4400

- USD/CAD rebounds to around 1.4355 in Thursday’s early European session.

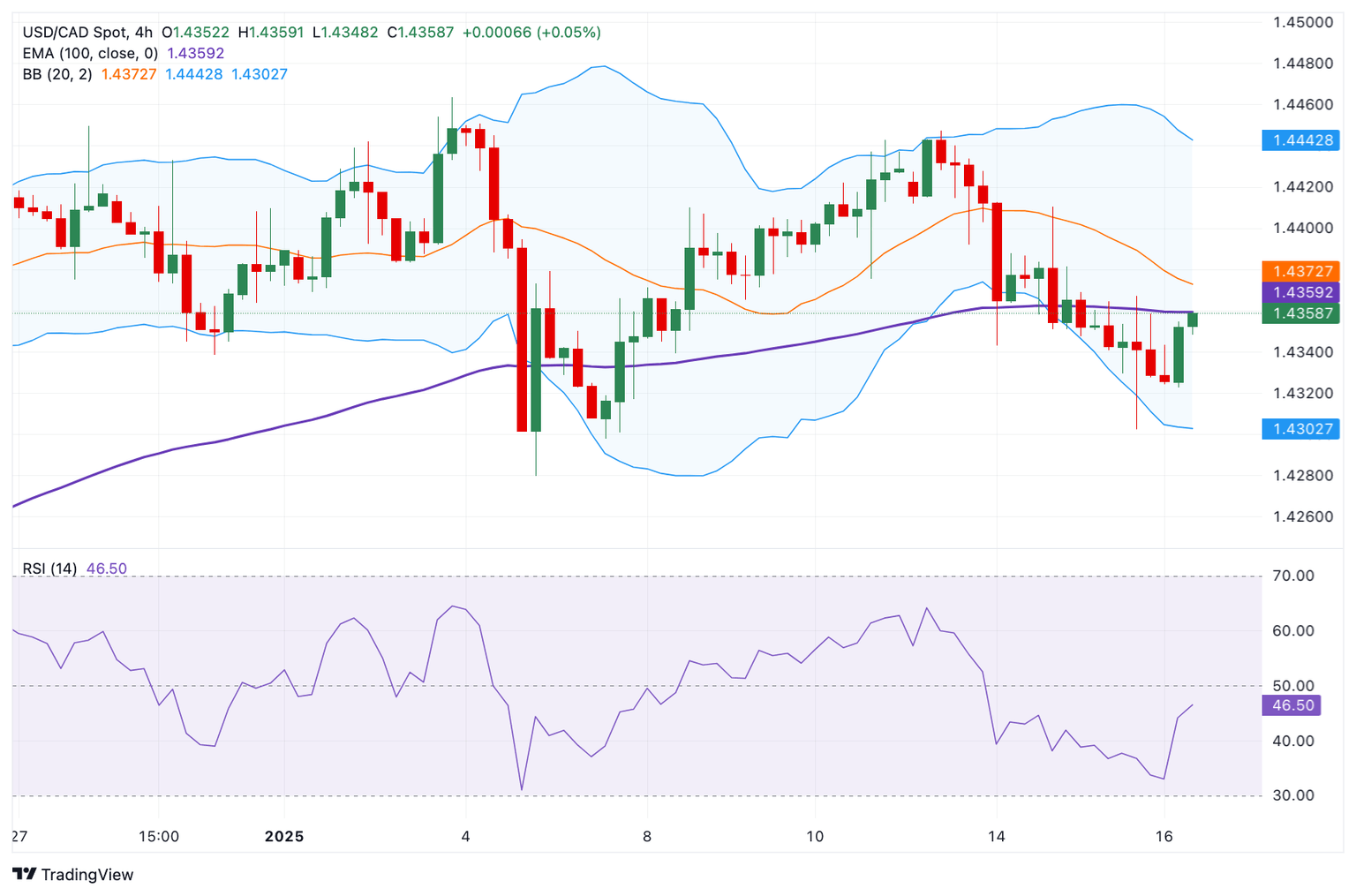

- The negative outlook prevails below the 100-period EMA with the bearish RSI indicator.

- The initial support level is located at 1.4322; the first upside barrier emerges at the 1.4400-1.4410 region.

The USD/CAD pair recovers to 1.4355, snapping the three-day losing streak during the early European session on Thursday. The renewed US Dollar (USD) demand provides some support to the pair. However, a rise in crude oil prices might boost the commodity-linked Loonie and cap the upside for the pair.

According to the 4-hour chart, the bearish outlook of USD/CAD remains intact as the pair is below the key 100-period Exponential Moving Average (EMA). If the pair decisively crosses above this level, it could resume its upside. However, the Relative Strength Index (RSI) stands below the midline near 45.80, suggesting that further downside cannot be ruled out in the near term.

The initial support level for USD/CAD is located at 1.4322, the low of January 16. Extended losses could expose 1.4300, representing the lower limit of the Bollinger Band and psychological level. The additional downside filter to watch is 1.4279, the low of January 6.

On the other hand, sustained trading above the key 100-period EMA could see a rally to the 1.4400-1.4410 zone, the round mark and the high of January 14. Further north, the next hurdle to watch is 1.4442, the upper boundary of the Bollinger Band.

USD/CAD 4-hour chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.