USD/CAD Price Forecast: Still too early to say a reversal of the downtrend is unfolding

- USD/CAD is showing bullish signs but lacks upside momentum and remains in a downtrend.

- It would have to rise more strongly and break above some key levels to indicate a reversal of the dominant bear trend.

USD/CAD is showing some bullish reversal insignia but it is still too soon to be confident that bulls are back in the driving seat.

The risks, therefore, continue to be to the downside as the bear trend remains intact. A break below the 1.3440 lows would extend the downtrend, possibly to the next target at 1.3380.

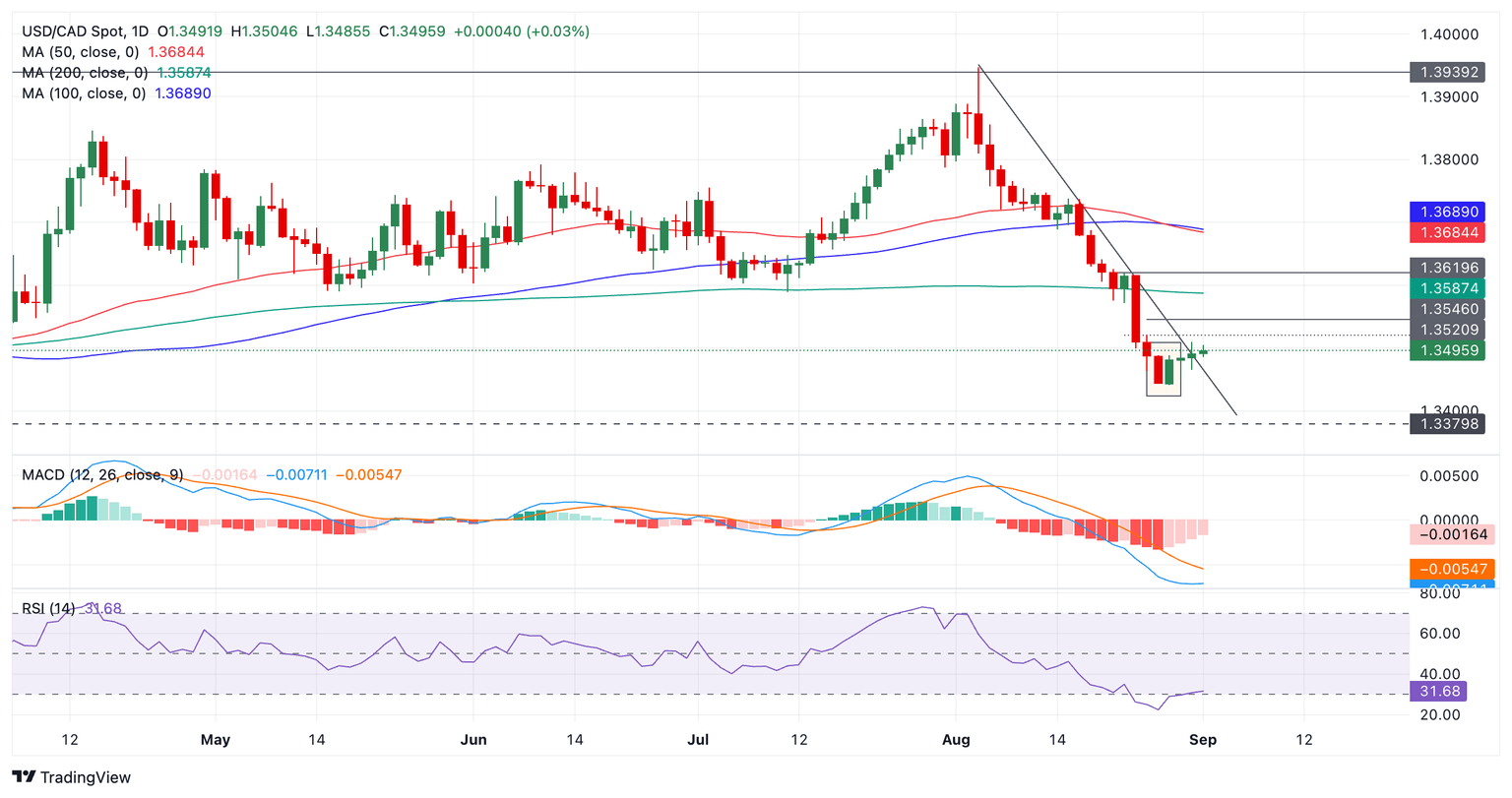

USD/CAD Daily Chart

USD/CAD formed a Two-Bar reversal pattern at the August 27 and 28 lows (rectangle on chart). This pattern indicates a short-term reversal higher. The pattern occurs at the end of a down move when a long red candle is followed by a green candle of a similar shape and size. It was followed by two small up days.

USD/CAD also broke above the trendline for the move down and this was accompanied by the Relative Strength Index (RSI) momentum indicator rising out of its oversold zone, and providing a buy signal. This adds further evidence to the possibility of a reversal evolving.

A close above 1.3520-25 would help confirm a bullish reversal and bring into doubt the validity of the bear trend. Such a break might see the pair move up to 1.3593. A move above the latter would give a surer sign of a reversal of the trend.

The recovery has been sluggish and weak so far, however, and there is every possibility the bear trend could resume. A break back down below the trendline would indicate renewed weakness. The next bearish target is situated at 1.3380 – the swing lows of October 2023 and January 2024. This is followed by the bottom of the range at 1.3222.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.