USD/CAD Price Forecast: Seems poised to surpass 61.8% Fibo. hurdle near mid-1.4500s

- USD/CAD enters a bullish consolidation phase near one-month high set on Monday.

- Bearish Oil prices undermine the Loonie amid worries about a US-Canada trade war.

- A modest USD uptick lends additional support to the major and favors bullish traders.

The USD/CAD pair holds steady around the 1.4500 psychological mark during the Asian session on Tuesday and remains close to a one-month top touched the previous day. The US Dollar (USD) ticks higher amid worries that US President Donald Trump's tariffs could reignite inflation and force the Federal Reserve (Fed) to keep interest rates higher for longer. Moreover, bearish Crude Oil prices undermine the commodity-linked Loonie amid concerns about the US-Canada trade war and act as a tailwind for the currency pair.

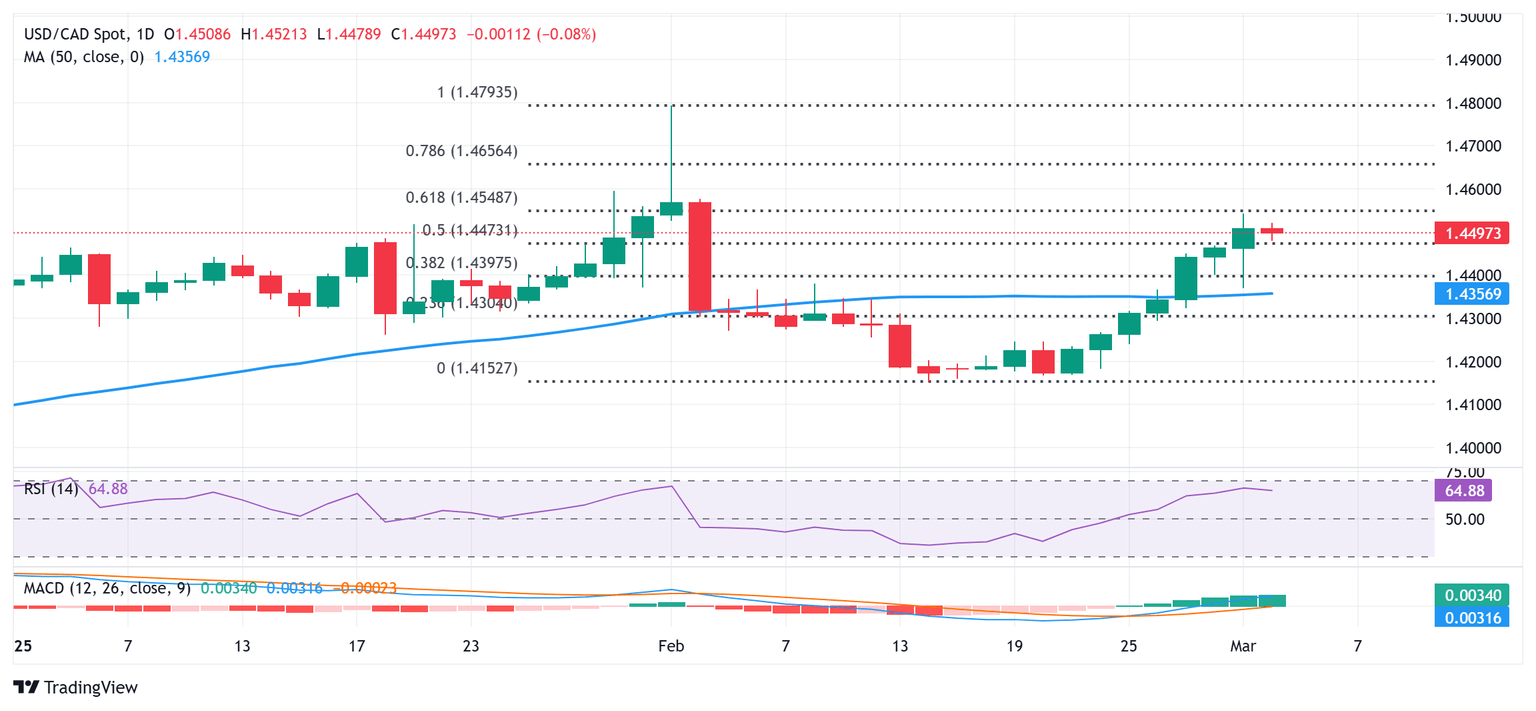

From a technical perspective, the overnight goodish bounce from the vicinity of the 50-day Simple Moving Average (SMA) and a subsequent move beyond the 50% Fibonacci retracement level of the downfall from a multi-year peak touched in February favor bullish traders. Moreover, oscillators on the daily chart are holding comfortably in positive territory and are still away from being in the overbought zone. This suggests that the path of least resistance for the USD/CAD pair remains to the upside and supports prospects for further gains.

Hence, some follow-through strength back towards retesting the 1.4545 area, or the one-month peak, which coincides with the 61.8% Fibo. level, looks like a distinct possibility. Some follow-through buying would set the stage for an extension of a nearly two-week-old uptrend and allow the USD/CAD pair to reclaim the 1.4600 round figure. The momentum could extend further towards the 1.4665-1.4670 intermediate hurdle en route to the 1.4700 neighborhood, or the highest level since April 2003 touched on February 3.

On the flip side, weakness below the 50% Fibo. level, around the 1.4470 area, might continue to attract some dip-buyers near the 1.4400 mark or 38.2% Fibo. level. This should help limit the downside near the 1.4360-1.4350 region or the 50-day SMA. That said, some follow-through selling could shift the bias in favor of bearish traders and drag the USD/CAD pair to the 1.4300 mark (23.6% Fibo. level) en route to the next relevant support near the 1.4240-1.4235 zone. Spot prices could slide further towards the 1.4200 mark before eventually dropping to the mid-1.4100s, or the year-to-date low touched last month.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.