USD/CAD Price Forecast: Holds above 1.4300 ahead of US PCE Inflation, Canadian GDP data

- USD/CAD stays above 1.4300 ahead of the US PCE Inflation data for February and the Canadian monthly GDP data for January.

- US President Trump is set to announce reciprocal tariffs on April 2.

- On Wednesday, Trump imposed a 25% blanket tariff on all cars imported into the US.

The USD/CAD pair rises to near 1.4330 during European trading hours on Friday. The Loonie pair trades higher ahead of the United States (US) Personal Consumption Expenditure Price Index (PCE) data for February and Canadian monthly Gross Domestic Product (GDP) data for January, which will be published at 12:30 GMT.

The US PCE inflation data will influence market expectations for the Federal Reserve (Fed) monetary policy outlook. Economists expect the US core PCE inflation, which is the Fed’s preferred inflation gauge, to have grown at a faster pace of 2.7% year-on-year, compared to the 2.6% increase seen in January.

Meanwhile, the Canadian economy is expected to have expanded at a faster pace of 0.3% against 0.2% growth seen in December.

The impact of the US and Canadian data is expected to be limited on the pair as its fate is tied to impending tariffs to be announced by US President Donald Trump on April 2. Trump is poised to unveil his reciprocal tariff plan on Wednesday, which is expected to force market experts to revise their global economic forecasts.

On Wednesday, Trump imposed 25% tariffs on foreign cars, which has impacted the Canadian Dollar (CAD), being one of the leading auto exporters to the US.

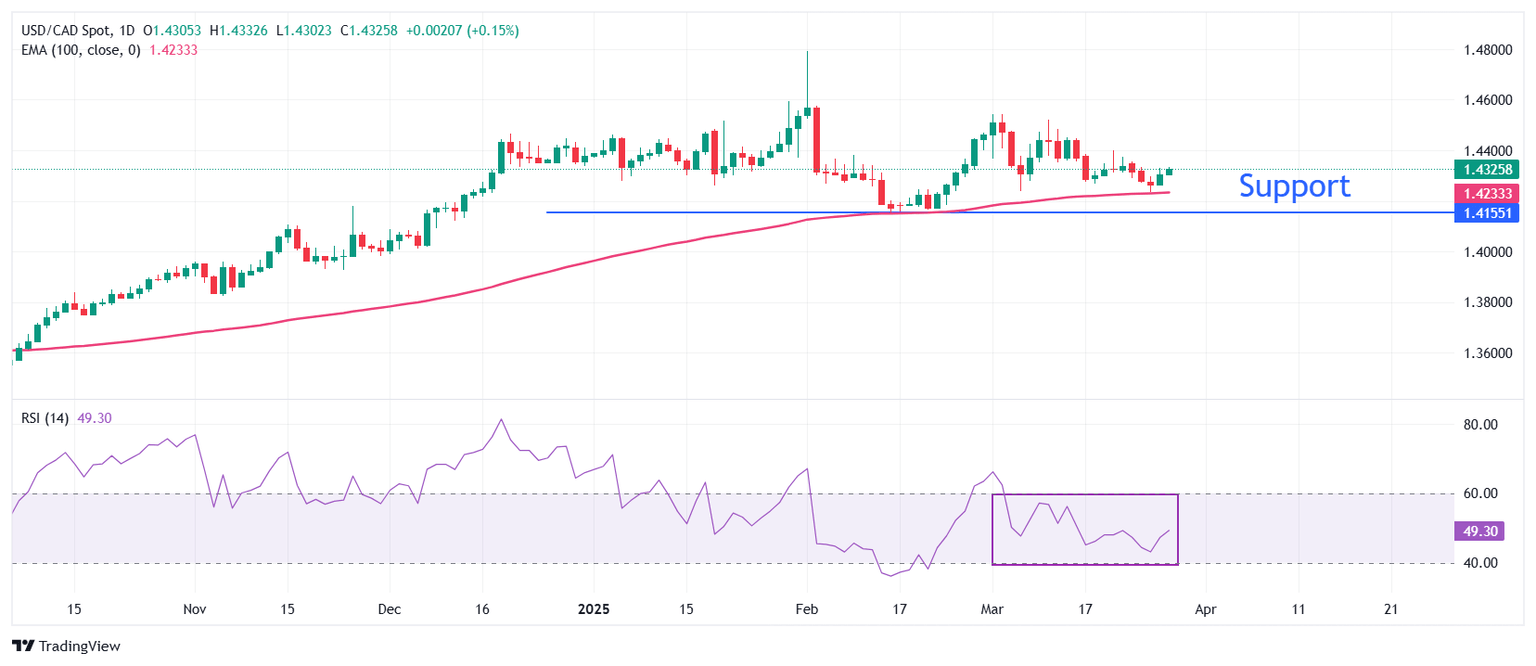

USD/CAD holds above the 100-period Exponential Moving Average (EMA), which is around 1.4233, suggesting that the overall trend is bullish.

The 14-period Relative Strength Index (RSI) oscillates in the 40.00-60.00 range, indicating a sideways trend.

Going forward, an upside move would emerge above the March 10 high of 1.4470, which will open the door toward the psychological resistance of 1.4500 and the January 30 high of 1.4595.

On the contrary, a breakdown below the February 14 low of 1.4151 by the pair would expose it to the December 9 low of 1.4094, followed by the December 6 low of 1.4020.

USD/CAD daily chart

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.