USD/CAD Price Forecast: Hitting resistance zone at top of multi-year range

- USD/CAD rallies up to a zone of resistance from historic highs at the top of a long-term range.

- The pair’s strong rally could begin to wane in the face of the firm resistance.

- There are no signs yet of a reversal lower, however, and the short and medium-term trends remain “up”.

USD/CAD reaches the top of a multi-year range and it is probable the pair will meet stiff technical resistance at these levels.

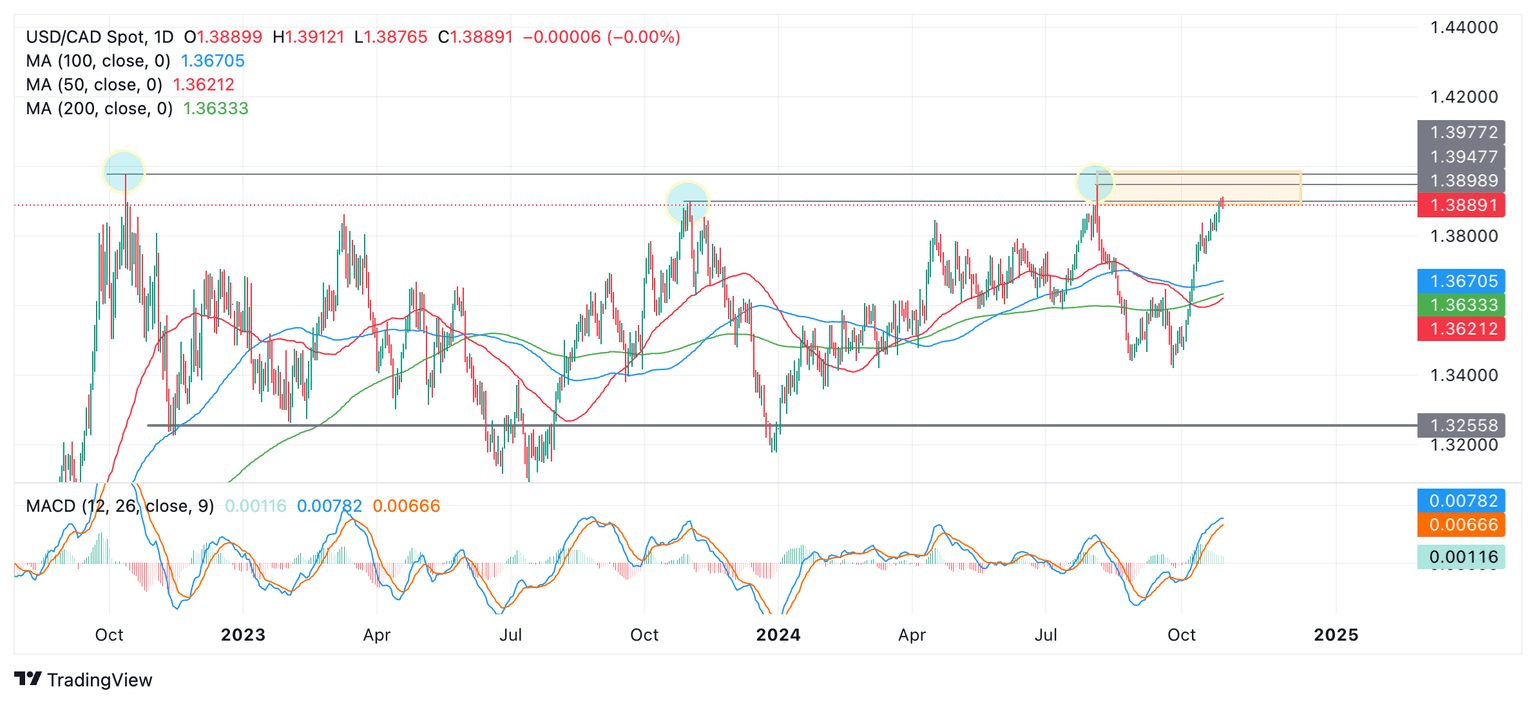

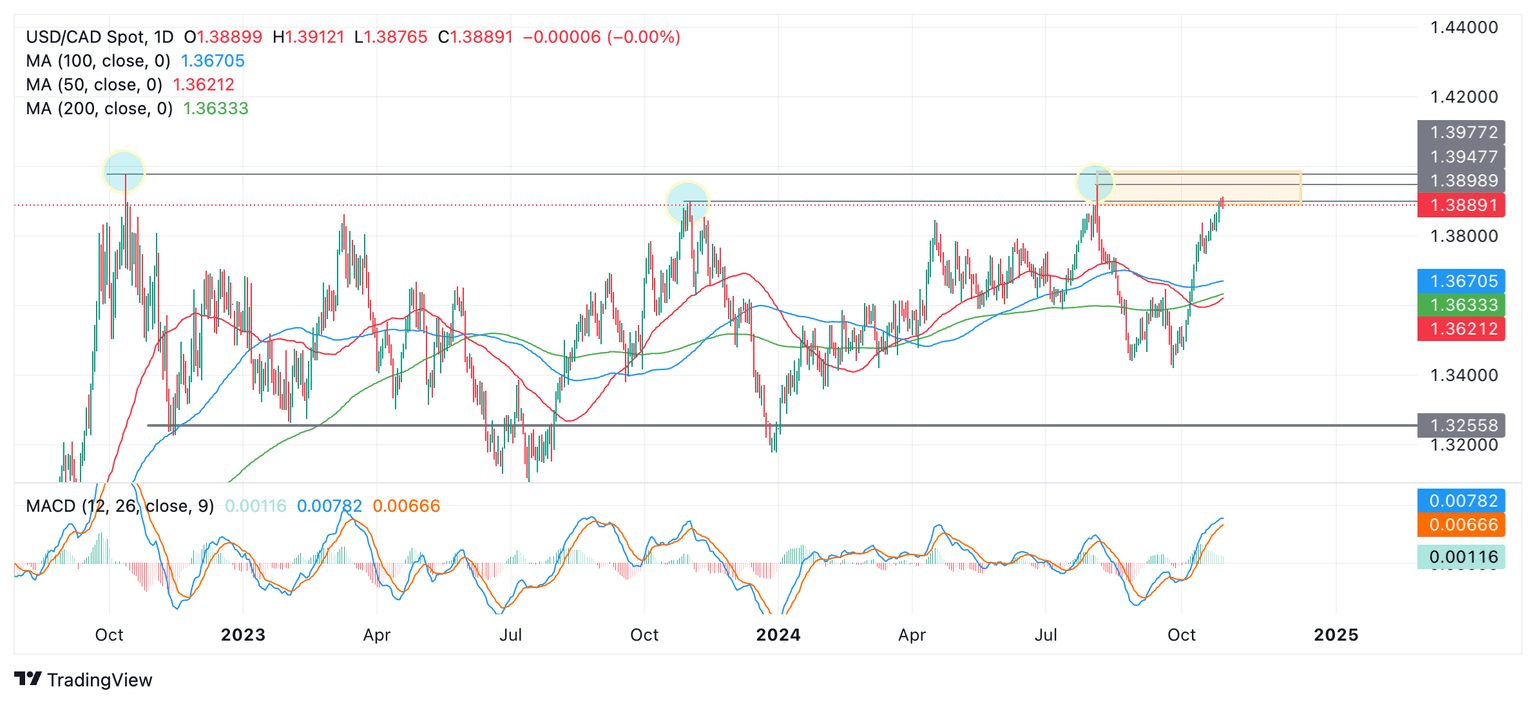

USD/CAD Daily Chart

USD/CAD has reached a zone (orange shaded rectangle) in the 1.3800s and 1.3900s composed of resistance from historic highs. These include the August 2024 high, the November 2023 high and the October 2022 high. The peaks have been highlighted with blue circles in the chart above. They comprise the top of the pair’s long-term sideways range.

It is possible this may mark a turning point for USD/CAD and price will roll over and begin a leg down within its range, however, there are no signs yet from price confirming this. Although the pair has formed two Doji Star Japanese candlesticks in a row over the last two days (so far), it would require a long bearish candle to confirm that these formed part of a reversal pattern. Such a down day has not yet materialized.

The short and medium-term trends remain bullish and given the principle that “the trend is your friend” the odds are tilted in favor of more upside. As such, USD/CAD could still go higher to the very top of the range at 1.3977.

The Moving Average Convergence Divergence (MACD) momentum indicator is at relatively high levels and is bending over. It looks like it might cross below the red signal line giving a sell signal – but that has not happened yet. If it does, it will be further evidence of a bearish reversal.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.