USD/CAD Price Forecast: Falls back to near 1.3800

- USD/CAD retraces to near 1.3800 as the US Dollar surrenders initial gains.

- US President Trump has signaled a de-escalation in the tariff war with China.

- A sharp decline is expected in the USD/CAD pair if it breaks below the upward-sloping trendline around 1.3800.

The USD/CAD pair retreats from the high of 1.3860 posted earlier in the day to near 1.3800 during European trading hours on Wednesday. The Loonie pair falls back as the US Dollar (USD) gives up initial gains despite United States (US) President Donald Trump expressing confidence on de-escalation in a trade war with China.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, flattens to near 99.00 from the intraday high of 98.86.

US President Trump signaled on Tuesday that Washington can close a deal with China, however, he didn’t provide details of how much tariffs will be charged. However, Beijing has stated that Washington should stop making threats and conduct negotiations fairly and with mutual respect.

Meanwhile, the Canadian Dollar (CAD) performs strongly against its major peers, except antipodeans, on Wednesday as President Trump has signaled that he will soon unveil bilateral deals with his trading partners. Such a scenario will ease the global economic uncertainty, which has been escalated in the face of worse-than-expected tariffs announced by Trump on April 2.

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.19% | 0.25% | 0.23% | 0.05% | -0.66% | -0.31% | 0.54% | |

| EUR | -0.19% | 0.04% | 0.02% | -0.16% | -0.81% | -0.51% | 0.33% | |

| GBP | -0.25% | -0.04% | -0.02% | -0.21% | -0.86% | -0.56% | 0.32% | |

| JPY | -0.23% | -0.02% | 0.02% | -0.20% | -0.78% | -0.57% | 0.33% | |

| CAD | -0.05% | 0.16% | 0.21% | 0.20% | -0.59% | -0.34% | 0.53% | |

| AUD | 0.66% | 0.81% | 0.86% | 0.78% | 0.59% | 0.31% | 1.19% | |

| NZD | 0.31% | 0.51% | 0.56% | 0.57% | 0.34% | -0.31% | 0.88% | |

| CHF | -0.54% | -0.33% | -0.32% | -0.33% | -0.53% | -1.19% | -0.88% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

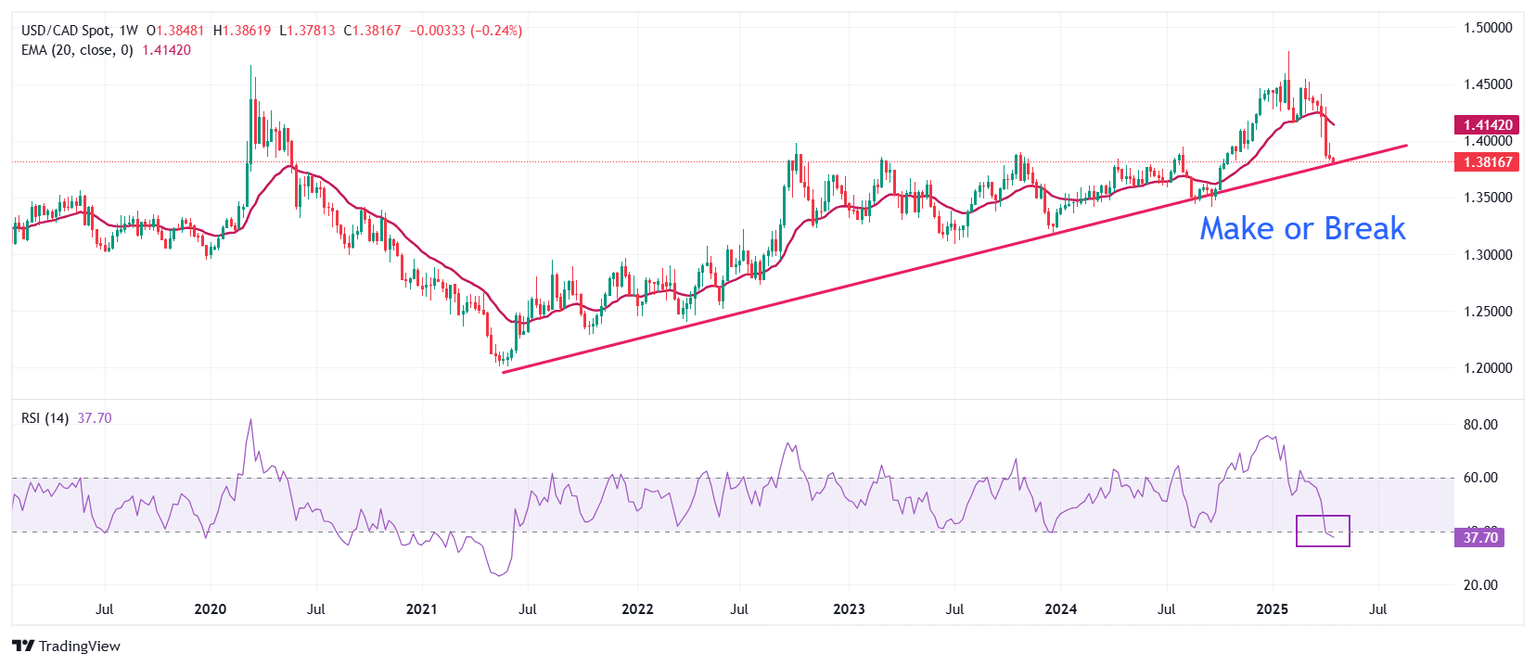

USD/CAD trades at a make-or-break level near the upward-sloping trendline around 1.3800, which is plotted from the May 2021 low of 1.2031 on a weekly timeframe.

The 20-week Exponential Moving Average (EMA) has started declining near 1.4140, suggesting that the trend has become bearish.

The 14-week Relative Strength Index (RSI) falls below 40.00 for the first time in almost four years. A fresh bearish momentum would trigger if it stays below the 40.00 level.

More downside towards the psychological support of 1.3500 and the September 24 low of 1.3430 looks likely if the pair breaks below the round-level figure of 1.3600.

In an alternate scenario, a recovery move by the pair above the psychological level of 1.4000 will support to move further to near the April 9 low of 1.4075, followed by the April 8 low of 1.4272.

USD/CAD weekly chart

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

BRANDED CONTENT

Finding the right broker for your trading strategy is essential, especially when specific features make all the difference. Explore our selection of top brokers, each offering unique advantages to match your needs.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.