USD/CAD Price Analysis: Tumbles below 1.3400 with bears targeting the 200-DMA

- USD/CAD surrendered 1.3400, as buyers could not break the confluence of the 20 and 100-day EMAs.

- USD/CAD Price Analysis: Upward biased, but once it falls below 1.3225, a move towards 1.3000 is on the cards

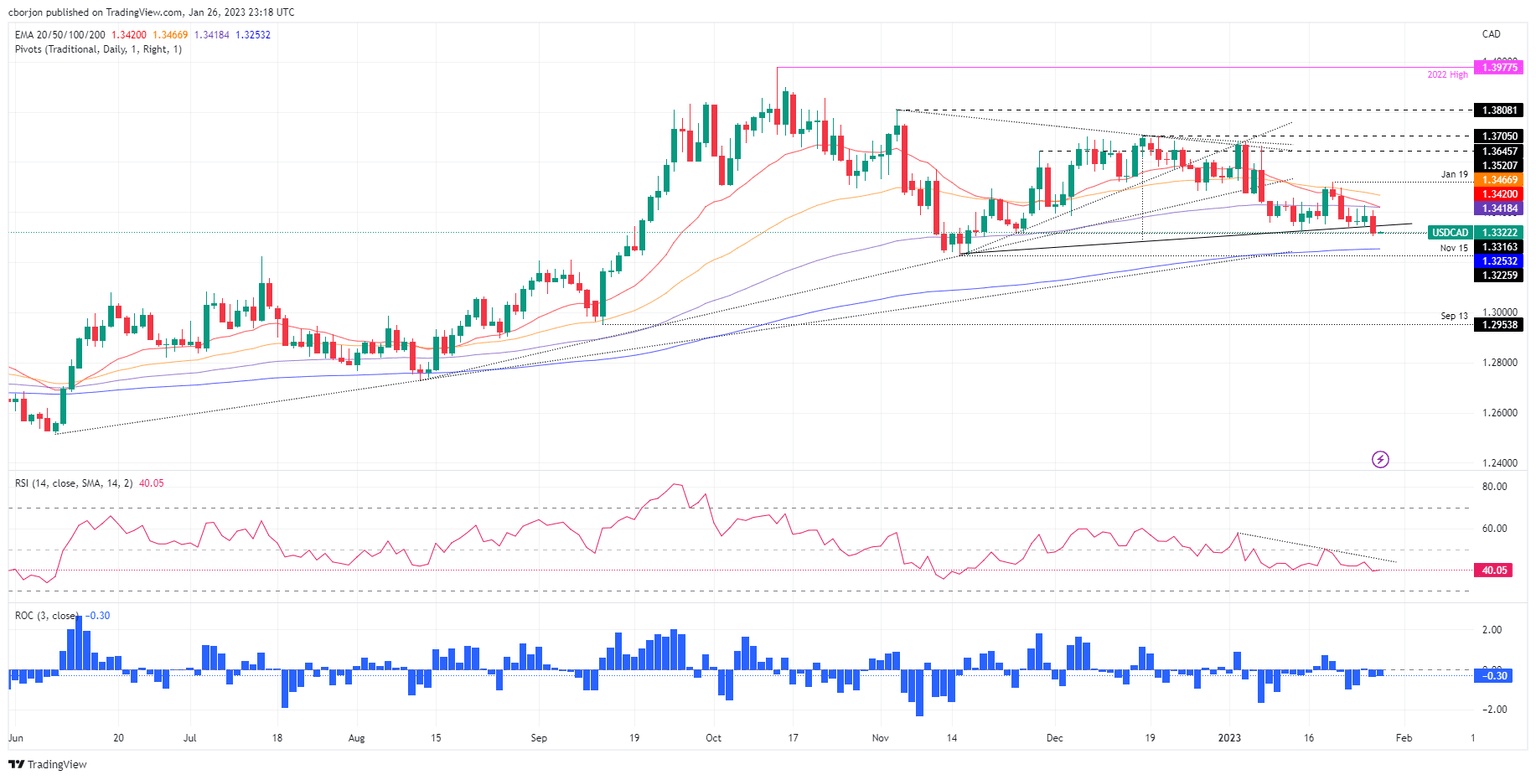

The USD/CAD extended its losses on Thursday after hitting a daily high of 1.3407, though as the Asian session begins, it’s almost unchanged. Additionally, the 20-day Exponential Moving Average (EMA) is crossing below the 100-day EMA, a bearish signal, suggesting further downside pressure lies ahead. At the time of writing, the USD/CAD is trading at 1.3323.

USD/CAD Price Analysis: Technical outlook

From a daily chart perspective, the Loonie (CAD) had continued to strengthen against the US Dollar (USD), as the USD/CAD failed to clear solid resistance in the form of the 100-day EMA at 1.3418 and the 20-day EMA at 1.3420. Nevertheless, the USD/CAD bias is bullish as long as the exchange rates hold above the 200-day EMA, which is meandering around 1.3253.

USD/CAD traders should be aware of a break of a support trendline drawn from the lows of November, which could pave the way for further losses. Oscillators-wise, the Relative Strength Index (RSI) continued its bearish path, while the Rate of Change (RoC) indicates consolidation lying ahead as volatility remains low.

The USD/CAD key support levels would be the 1.3300 figure. A break below, and the USD/CAD could test the 200-day EMA at 1.3253. Once cleared, the pair’s next demand area will be the November 15 low at 1.3225, followed by 1.3200.

As an alternate scenario, if the USD/CAD edges up, its first supply area would be the upslope support trendline broken on Thursday at around 1.3330/40. Once reclaimed, the confluence of the 20/100-day EMAs around 1.3418/20 would be next, and then the January 19 high at 1.3520.

USD/CAD Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.