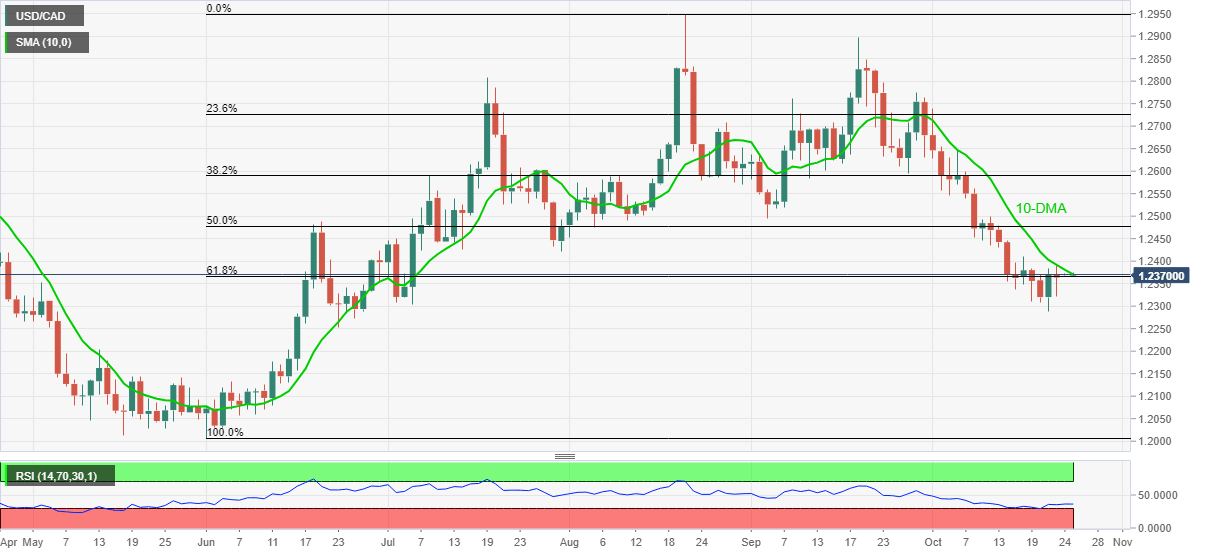

USD/CAD Price Analysis: Teases key Fibonacci retracement level below 1.2500

- USD/CAD struggles to defend rebound from four-month low.

- 10-DMA guards immediate upside amid downbeat RSI conditions.

- Late June’s swing low challenges bears, bulls need validation from July 30 bottom.

USD/CAD remains sidelined around 1.2370, flirting with the 61.8 Fibonacci retracement (Fibo.) of June-August upside during Monday’s Asian session.

The pair bounced off a four-month low the last week but failed to cross 10-DMA. The rebound, however, seems to the momentum strength per RSI line and hence keeps the bears hopeful.

It's worth noting that the latest bottom close to 1.2290 precedes the June 23 low of 1.2252 in restricting the short-term USD/CAD declines.

However, any further weakness won’t hesitate in challenging the 1.2200 round figure, a break of which will direct the quote towards the yearly low marked in June around the 1.2000 threshold.

Meanwhile, an upside clearance of the 10-DMA level surrounding 1.2370 will need validation from late July’s low near 1.2425 before directing USD/CAD bulls toward the 50% Fibo. level near 1.2480.

Also acting as an upside filter is the September’s low near 1.2495 and the 1.2500 psychological magnet.

USD/CAD: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.