- USD/CAD attracts some dip-buying and edges higher to 1.3305, gaining 0.19% for the day.

- The next barrier for USD/CAD is located at 1.3350; 1.3285 acts as an initial support level.

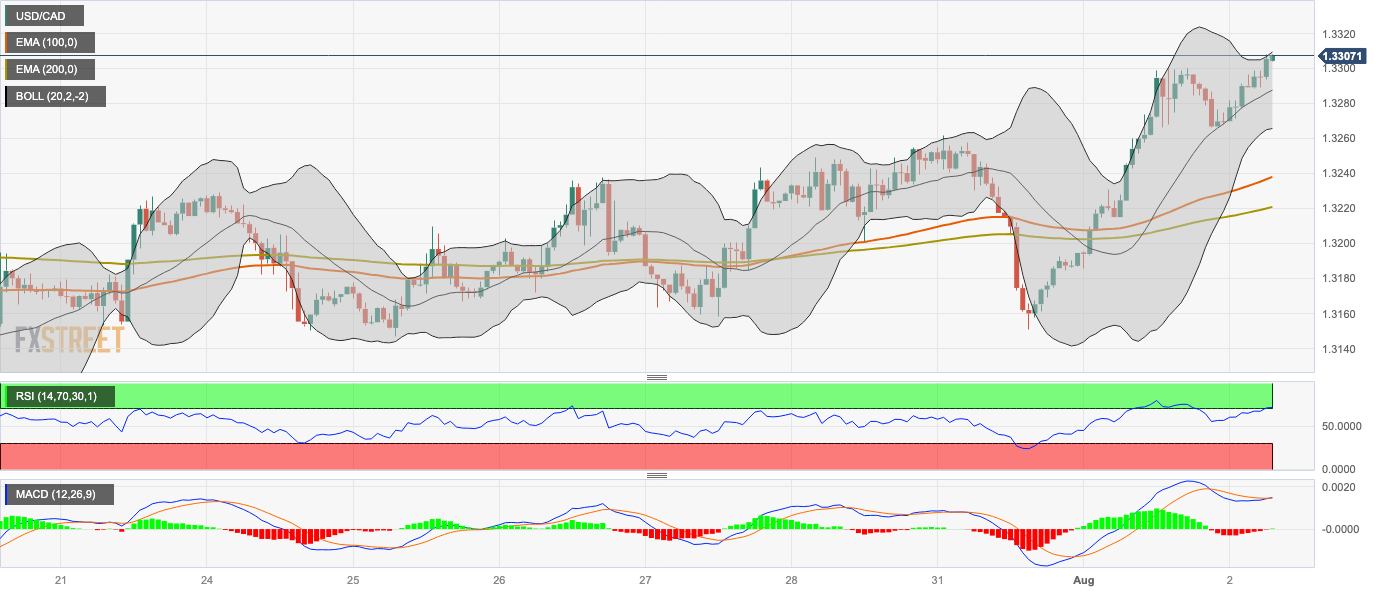

- The Relative Strength Index (RSI) stands above 50.

The USD/CAD pair gains momentum and surges above the 1.3300 barrier heading into the early European session on Wednesday. The major pair is on track for its sixth weekly close above 1.3200.

Fitch downgraded the US government's credit rating from AAA to AA+, but expectations for an additional 25 basis point (bps) rate hike by the Federal Reserve (Fed) support the US Dollar (USD) and help USD/CAD attract some dip-buying on Wednesday. However, an increase in oil prices would benefit the Canadian Dollar, since Canada is the largest oil exporter to the United States. Market players await the US ADP employment data later in the American session.

According to the four-hour chart, any meaningful follow-through buying above the 1.3300 area will see a rally to the next barrier at 1.3350 (High of June 15). Following that, the July 7 high of 1.3385 will be the next hurdle, followed by 1.3450 (High of June 6).

Looking at the downside, any extended weakness below 1.3285 (the midline of the Bollinger Band) will challenge the next downside filter at 1.3265 (the lower limit of the Bollinger Band) en route to 1.3235 (100-hour EMA) and 1.3220 (the 200-hour EMA). A decisive break below the latter would drive the pair towards 1.3200 (a psychological round mark).

However, the further upside appears favorable as the Relative Strength Index (RSI) stands above 50, activating the bullish momentum for the USD/CAD pair for the time being.

USD/CAD four-hour chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold gives away some gains, slips back to $2,980

Gold retraced from its earlier all-time highs above the key $3,000 mark on Friday, finding a footing around $2,980 per troy ounce. Profit-taking, rising US yields, and a shift to a risk-on environment seem to be putting the brakes on further gains for the metal.

EUR/USD remains firm and near the 1.0900 barrier

EUR/USD is finding its footing and trading comfortably in positive territory as the week wraps up, shaking off two consecutive daily pullbacks and setting its sights back on the pivotal 1.0900 mark—and beyond.

GBP/USD remains depressed, treads water in the low-1.2900s

GBP/USD is holding steady in consolidation territory after Friday’s opening bell on Wall Street, hovering in the low-1.2900 range. This resilience comes despite disappointing UK data and persistent selling pressure on the USD.

Crypto Today: BNB, OKB, BGB tokens rally as BTC, Shiba Inu and Chainlink lead market rebound

Cryptocurrencies sector rose by 0.13% in early European trading on Friday, adding $352 million in aggregate valuation. With BNB, OKB and BGB attracting demand amid intense market volatility, the exchange-based native tokens sector added $1.9 billion.

Week ahead – Central banks in focus amid trade war turmoil

Fed decides on policy amid recession fears. Yen traders lock gaze on BoJ for hike signals. SNB seen cutting interest rates by another 25bps. BoE to stand pat after February’s dovish cut.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.