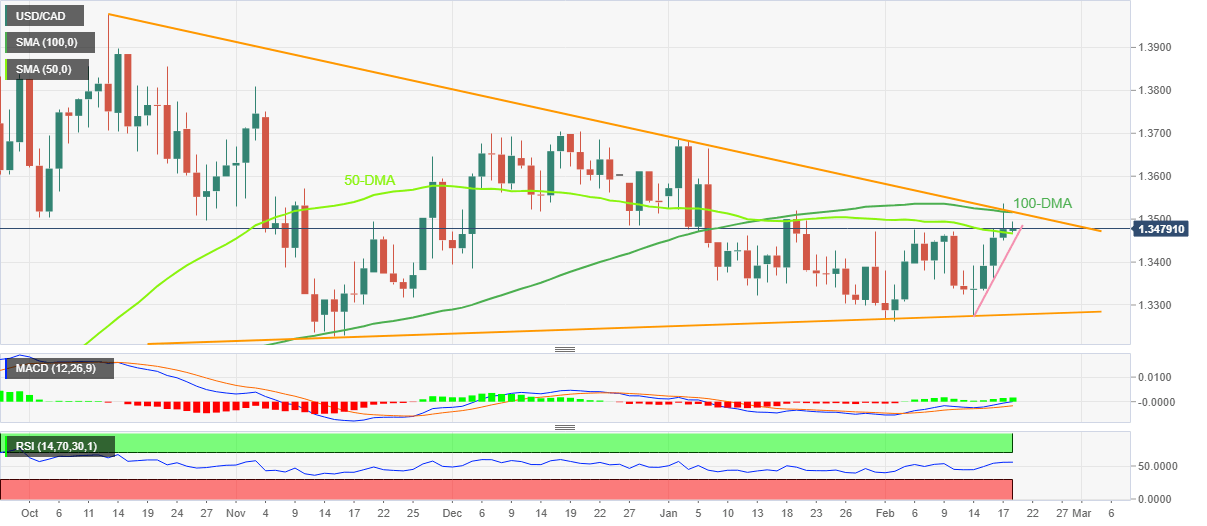

USD/CAD Price Analysis: Stays on the bull’s radar beyond 50-DMA

- USD/CAD remains pressured after retreating from six-week high.

- Upbeat oscillators, sustained trading beyond 50-DMA keep buyers hopeful.

- Convergence of 100-DMA, four-month-old descending resistance line challenge buyers.

USD/CAD bulls take a breather around 1.3480, following the run-up to refresh the monthly high, as the upside momentum failed to cross the key resistance confluence the previous day.

Even so, the Loonie pair remains on the buyer’s radar on early Monday as it defends the previous week’s upside break of the 50-DMA, close to 1.3465 at the latest.

It’s worth mentioning that the 50-DMA breakout joins the bullish MACD signals, as well as the upbeat RSI (14), not overbought, to keep the USD/CAD buyers hopeful.

That said, a one-week-old ascending support line, near 1.3440 by the press time, adds to the short-term downside filters for the USD/CAD pair traders to watch on the break of the 50-DMA.

Following that, a three-month-old ascending support line, around 1.3280 as we write, becomes crucial to follow as it holds the key to the Loonie pair’s slump towards the 1.3000 psychological magnet.

Meanwhile, an upside clearance of the 1.3520 resistance confluence enables the USD/CAD buyers to aim for the previous monthly high of 1.3685.

In case where the quote remains firmer past 1.3685, the last December’s peak of 1.3705 may act as an extra check for the USD/CAD bulls before directing them to the October 2022 high surrounding 1.3980, as well as the 1.4000 round figure.

To sum up, USD/CAD remains on the bull’s radar unless breaking 1.3440 support.

USD/CAD: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.