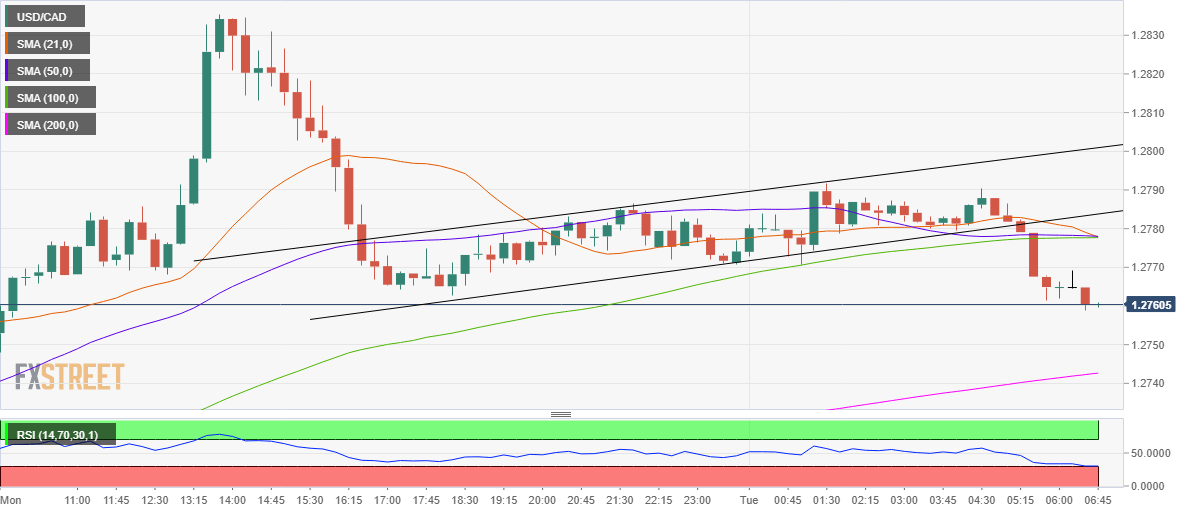

- USD/CAD accelerating downside towards 200-HMA.

- A rising channel breakdown spotted on 15-minutes chart.

- 1.2778 is likely to keep the recovery attempts limited.

USD/CAD is feeling the pull of the gravity in early European trading, tracking the retreat in the US dollar alongside the Treasury yields.

Additionally, renewed strength seen in WTI prices seems to be boding well for the resource-linked loonie, as the major flirts with daily lows above the midpoint of the 1.2700 level.

The dollar’s pullback also collaborates with the rising channel breakdown on the 15-minutes chart, which is likely to exacerbate the pain in USD/CAD.

The bears now target the 200-simple moving average (SMA) support at 1.2742, with the Relative Strength Index (RSI) probing the oversold territory, at the time of writing.

The decline gathered steam after the price cut through the critical support at 1.2778, which the convergence of the 50 and 100-SMAs.

Any pullbacks will be likely restricted by the latter. The path of least resistance appears to the downside, as the 21-SMA is on the verge of crossing the 50 and 100-SMAs from above, confirming a bearish crossover.

USD/CAD: Hourly chart

USD/CAD: Additional levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD drops to 1.0450 ahead of German IFO

EUR/USD edges lower to near 1.0450 in the early European session on Monday. The US Dollar extends recovery amid risk aversion, weighing on the pair. ECB rate cut expectations also continue to undermine the Euro, adding to the pair's downside ahead of Germany's IFO survey.

GBP/USD slips below 1.2450 as risk-off mood lifts US Dollar

GBP/USD remains under selling pressure and gives up 1.2450 in the early European session on Monday. The pair is undermined by the resurgent haven demand for the US Dollar amid Trump's tariff risks and global tech stocls sell-off.

Gold price remains depressed amid USD strength; downside seems limited

Gold price kicks off the new week on a weaker note amid a modest USD recovery. Fed rate cut bets and sliding US bond yields might cap any further USD move up. Renewed trade war fears could help limit losses for the safe-haven XAU/USD pair.

Pepe Price Forecast: PEPE eyes for 20% crash

Pepe continues its decline, trading around $0.000012 and dipping nearly 10% at the time of writing on Monday after correcting more than 12% the previous week. PEPE’s long-to-short ratio trades below one, indicating more traders are betting on the frog-based meme coin to fall.

ECB and US Fed not yet at finish line

Capital market participants are expecting a series of interest rate cuts this year in both the Eurozone and the US, with two interest rate cuts of 25 basis points each by the US Federal Reserve and four by the European Central Bank (ECB).

Trusted Broker Reviews for Smarter Trading

VERIFIED Discover in-depth reviews of reliable brokers. Compare features like spreads, leverage, and platforms. Find the perfect fit for your trading style, from CFDs to Forex pairs like EUR/USD and Gold.