USD/CAD Price Analysis: Recovery remains elusive below 1.3790 hurdle

- USD/CAD clings to mild gains after bouncing off short-term key technical supports.

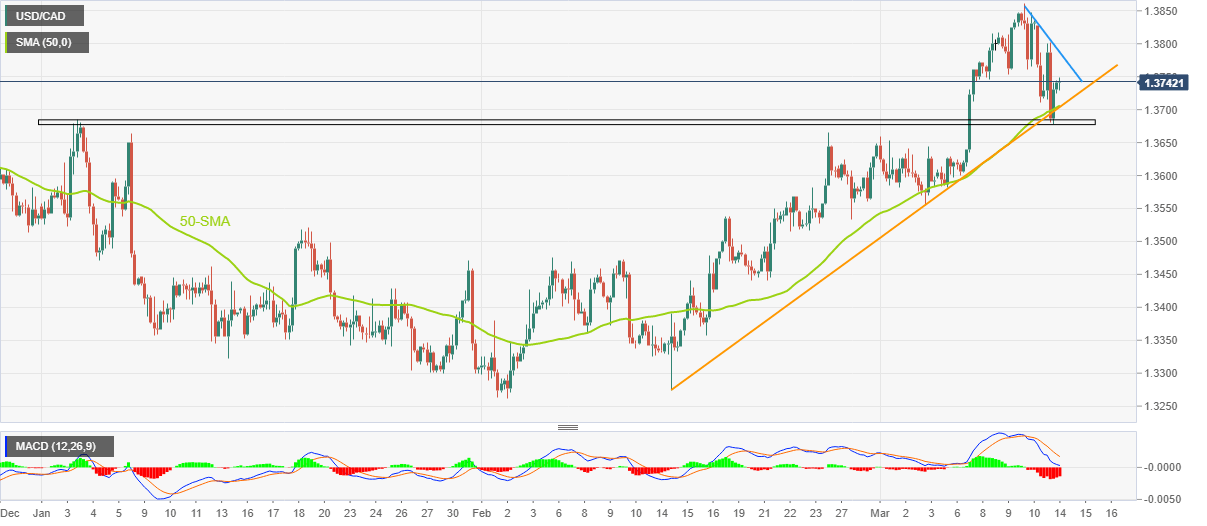

- Convergence of 50-SMA, one-month-old ascending trend line restricts immediate downside.

- Horizontal area comprising early January lows adds to the downside filters.

- Descending resistance line from Friday, bearish MACD signals challenge Loonie pair buyers.

USD/CAD bulls struggle to keep the latest rebound from a one-week low around 1.3750 during early Tuesday. Even so, the Loonie pair sellers have a tough road on the south before retaking control as the quote consolidates the biggest daily slump in a month.

That said, the pair bounced off early January tops the previous day, as well as portrayed a sustained recovery from the one-month-old ascending support line and the 50-SMA.

However, the bearish MACD signals and the Loonie pair’s inaction raises doubts on the quote’s further upside.

Also challenging the USD/CAD bulls is a downward-sloping resistance line from Friday, close to 1.3790 at the latest.

Even if the quote manages to remain firmer past 1.3790, it needs to remain firmer past the 1.3800 round figure ahead of challenging the monthly high surrounding 1.3860.

On the flip side, a convergence of the 50-SMA and aforementioned support line from the mid-February, around 1.3700 at the latest, appears the short-term key support for the USD/CAD sellers to watch during the quote’s pullback.

Should the quote drops below 1.3700 mark, the horizontal area comprising levels marked since early January, close to 1.3685-80, may gain the USD/CAD bear’s attention as a break of which won’t hesitate to challenge the monthly low marked in the last week around 1.3555.

USD/CAD: Four-hour chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.