USD/CAD Price Analysis: Range restricts to 40-pips as investors await US/Canada Employment data

- USD/CAD has locked in a tight range ahead of the US/Canada labor market data.

- The tight US labor market is cooling down as firms have eased their recruitment process.

- Canada’s Employment Change is seen at 12K and the Unemployment Rate might escalate to 5.1%.

The USD/CAD pair corrected below 1.3450 in the early Asian session as the US Dollar Index (DXY) showed a loss in the upside momentum after reaching to the critical resistance of 102.00. The Loonie asset is expected to deliver a power-pack action as investors are awaiting the release of the United States/Canada Employment data.

The tight US labor market is cooling down as firms have eased their recruitment process observed after a slowdown in Job Openings and weak additions of fresh jobs through Automatic Data Processing (ADP). This has triggered expectations of steady interest rates by the Federal Reserve (Fed) for its May policy meeting.

Meanwhile, S&P500 futures have resumed their downside journey, conveying a risk-off market mood.

The Canadian Dollar will be impacted by the Employment data. As per the consensus, Net Change in Employment is seen at 12K, lower than the former release of 21.8K. The Unemployment Rate is seen higher at 5.1% vs. the former release of 5.0%.

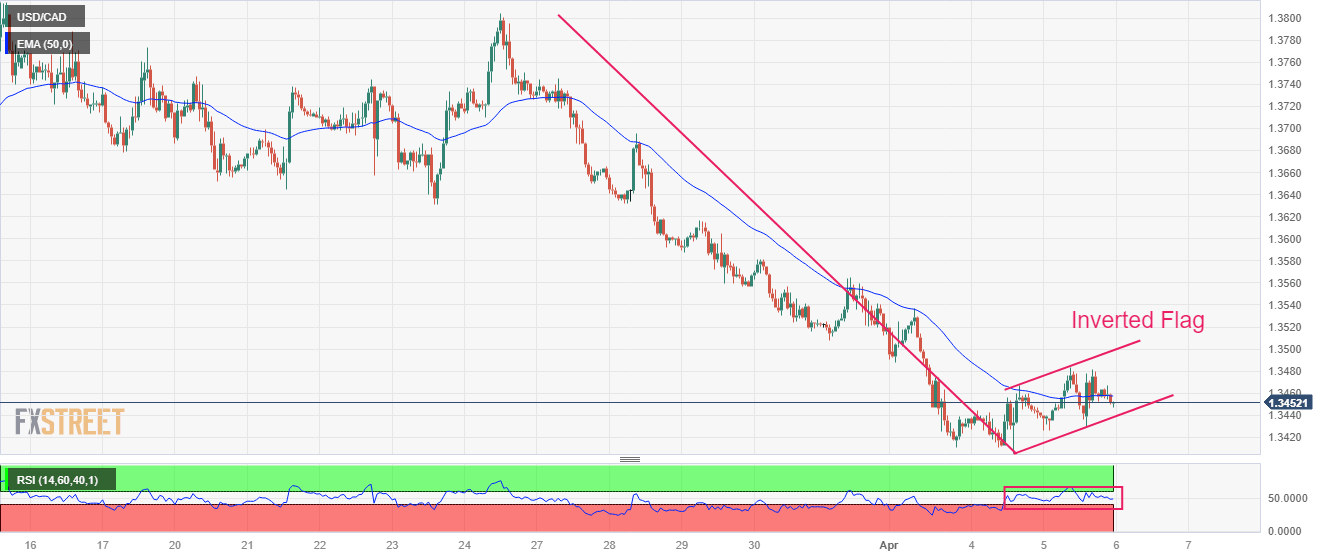

USD/CAD is auctioning in an Inverted Flag chart pattern on an hourly scale. An Inverted Flag is a trend-following pattern that displays a long consolidation that is followed by a breakdown. Usually, the consolidation phase of the chart pattern serves as an inventory adjustment in which those participants initiate shorts, which prefer to enter an auction after the establishment of a bearish bias and current sellers add more positions.

The Loonie asset has failed to sustain above the 50-period Exponential Moving Average (EMA) at 1.3458, which indicates more weakness ahead.

Meanwhile, the upside in the Relative Strength Index (RSI) (14) is capped around 60.00. A slippage into the bearish range of 20.00-40.00 will activate the downside momentum.

A downside break below April 04 low at 1.3406 will expose the asset to a fresh six-week low near 1.3350, which is February 6 low followed by the round-level support at 1.3300.

In an alternate scenario, an upside move above the psychological resistance of 1.3500 will shift traction in the favor of US Dollar bulls, which will drive the asset toward March 31 high and March 29 high at 1.3559 and 1.3619 respectively.

USD/CAD hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.