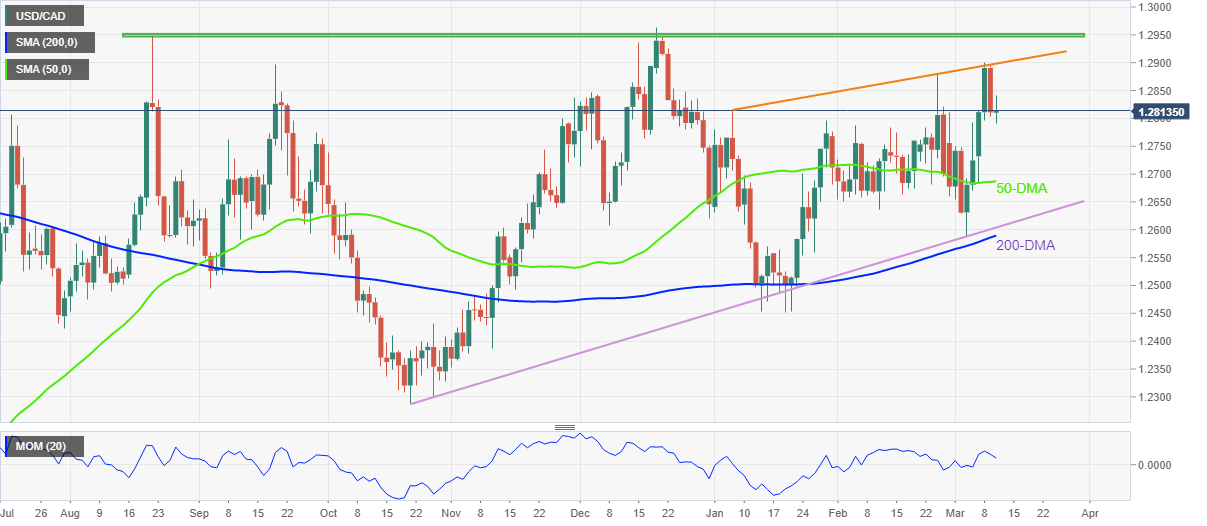

USD/CAD Price Analysis: Pullback from two-month-old resistance battles 1.2800

- USD/CAD fades bounce off intraday low, keeps pullback from 11-week low.

- Retreat of Momentum line, failures to cross key hurdle hint at further weakness.

- Horizontal area from August 2021 appears tough nut to crack for bulls.

USD/CAD retreats from intraday high while revisiting 1.2810 levels during Thursday’s Asian session.

The Loonie pair portrayed a U-turn from an upward sloping trend line stretched from early January. In doing so, the quote also reversed from the highest levels since late December 2021. The pullback moves weigh on the Momentum line to hint at the further weakness.

That said, the quote presently eyes the 50-DMA level surrounding 1.2685, a break of which will direct USD/CAD bears to a five-month-long support line near 1.2600.

However, the 200-DMA level of 1.2589 will challenge the pair’s further downside.

Alternatively, recovery moves need to cross the aforementioned resistance line, close to 1.2900 by the press time, to recall the USD/CAD bulls.

Even so, a horizontal area comprising tops marked during the August and December months of 2021, around 1.2950, will challenge the quote’s further advances.

To sum up, USD/CAD is likely to extend the latest pullback but the bears have a bumpy road ahead.

USD/CAD: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.