- USD/CAD is gathering strength for a fresh upside move above 1.3360 as the focus shifts to US CPI and Fed policy.

- The US Dollar Index (DXY) has deliberating reached to near 103.70 as investors are divided about Fed’s policy decision.

- USD/CAD has witnessed decent buying interest after testing the demand zone plotted in a narrow range of 1.3300-1.3315.

The USD/CAD pair is gathering strength for a fresh rally around 1.3350 ahead of the release of the United States Consumer Price Index (CPI) and the interest rate decision by the Federal Reserve (Fed). The Loonie asset is expected to remain in the bullish trajectory as anxiety among investors is deepening due to critical economic events.

S&P500 futures have posted decent gains in the Asian session. US equities remained choppy on Friday but managed to settle on a positive note. The overall market sentiment is risk-on, however, mild caution cannot be ruled out.

The US Dollar Index (DXY) has deliberating reached to near 103.70 as investors are divided about Fed’s policy decision. No doubt, United States labor market conditions are easing, the current inflation rate is more than twice the desired rate.

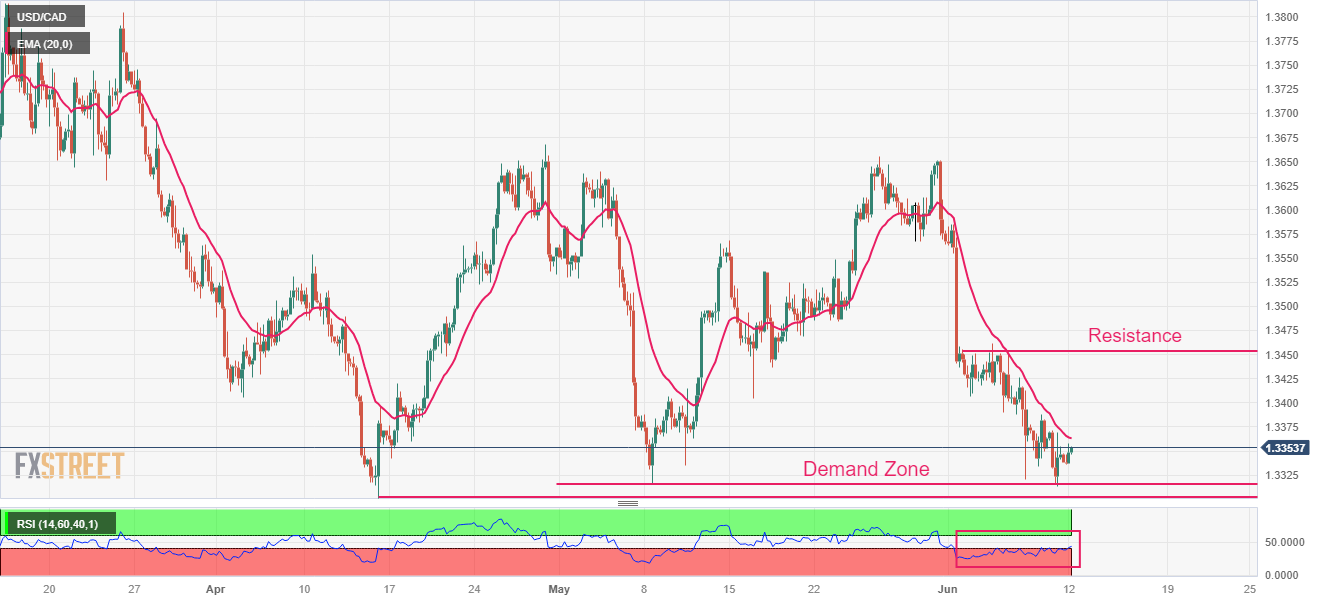

USD/CAD has witnessed decent buying interest after testing the demand zone plotted in a narrow range of 1.3300-1.3315 on a four-hour scale. The 20-period Exponential Moving Average (EMA) at 1.3363 is still acting as a barricade for the US Dollar bulls. Horizontal resistance is plotted around June 05 high at 1.3462.

The Relative Strength Index (RSI) (14) has tried to ditch the bearish range of 20.00-40.00 and enter into the 40.00-60.00 range, indicating an attempt of a bullish reversal.

Should the asset break above June 08 high at 1.3388, US Dollar bulls will drive the asset toward June 05 high at 1.3462 and the psychological resistance at 1.3500.

On the flip side, a breakdown below the round-levels support of 1.3300 will expose the Loonie asset to a fresh four-month low around 1.3274 followed by 15 November 2022 low at 1.3226.

USD/CAD four-hour chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD consolidates its recent substantial gains to over one-week high

AUD/USD holds steady above the 0.6300 mark during the Asian session on Tuesday and remains close to a one-and-half-week top touched the previous day. The USD finds some support following the recent sell-off and caps the pair near the 100-day SMA amid the escalating US-China trade war.

USD/JPY trades with positive bias above 143.00; upside potential seems limited

USD/JPY gains some positive traction on Tuesday and now seems to have snapped a three day losing streak to a multi-month low touched last week. The upbeat market mood undermines the safe-haven JPY and lends support amid a modest USD uptick.

Gold price holds steady above $3,200; remains close to all-time peak

Gold price trades above the $3,200 mark following the previous day's modest pullback from a fresh record high as the escalating US-China trade war continues to underpin the safe-haven bullion. Moreover, the Fed rate cut bets lend support to the XAU/USD.

Solana ETF to debut in Canada after approval from regulators

Solana ETF will go live in Canada this week after the Ontario Securities Commission greenlighted applications from Purpose, Evolve, CI and 3iQ. The products will allow staking, enabling investors to earn yield on their holdings.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.