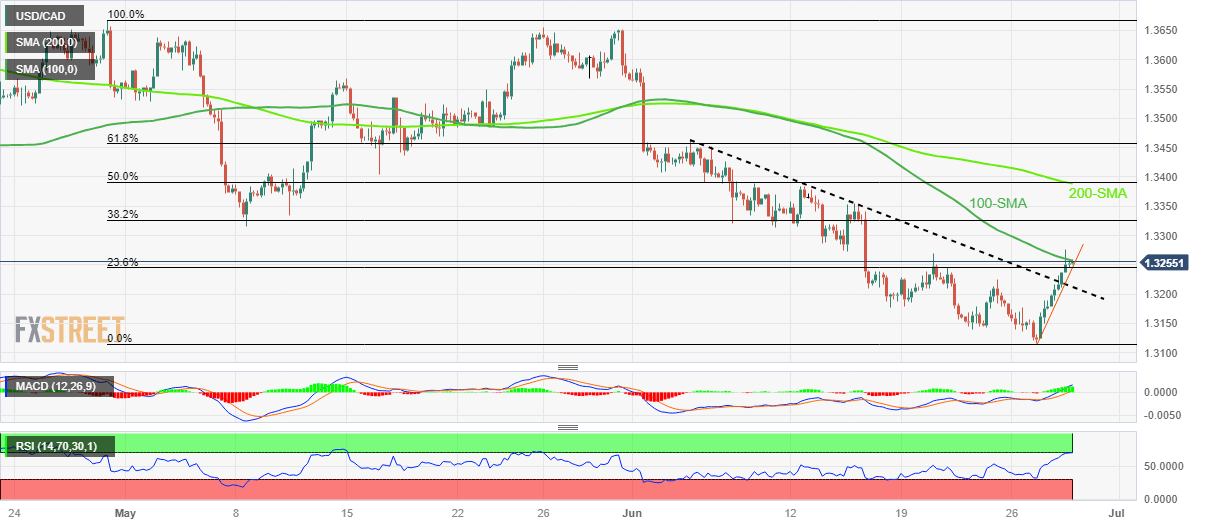

USD/CAD Price Analysis: Loonie pair buyers attack 100-SMA around mid-1.3200s

- USD/CAD grinds near the highest levels in fortnight after rising the most in five weeks.

- Overbought RSI, 100-SMA prods Loonie pair buyers amid sluggish session.

- Bullish MACD signals, upside break of previous resistance and rising support line from Tuesday back upside bias.

USD/CAD remains on the front foot at a two-week high, despite the early Asian session inaction around 1.3250 on Thursday. That said, the Loonie pair jumped the most in five weeks the previous day after crossing a downward-sloping resistance line from June. However, the overbought RSI (14) line and the 100-SMA appear to challenge the buyers of late.

That said, a sustained upside break of the multi-day-old resistance line, now support around 1.3210, joins the bullish MACD signals and the pair’s successful trading beyond the rising support line from Tuesday, close to 1.3240 at the latest, keeps the USD/CAD buyers hopeful.

With this, the Loonie pair is expected to overcome the immediate 100-SMA hurdle surrounding 1.3260 while targeting the early May swing low of around 1.3315.

It should be noted, however, that a convergence of the 200-SMA and 50% Fibonacci retracement of the USD/CAD pair’s April-June downturn, near 1.3390, appears a tough nut to crack for the bulls afterward.

On the contrary, a downside break of the immediate support line and the resistance-turned-support trend line, respectively near 1.3240 and 1.3210, becomes necessary for the USD/CAD bear’s return.

Following that, the yearly low marked earlier in the week around 1.3120 and the 1.3000 psychological magnet will gain the market’s attention.

USD/CAD: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.