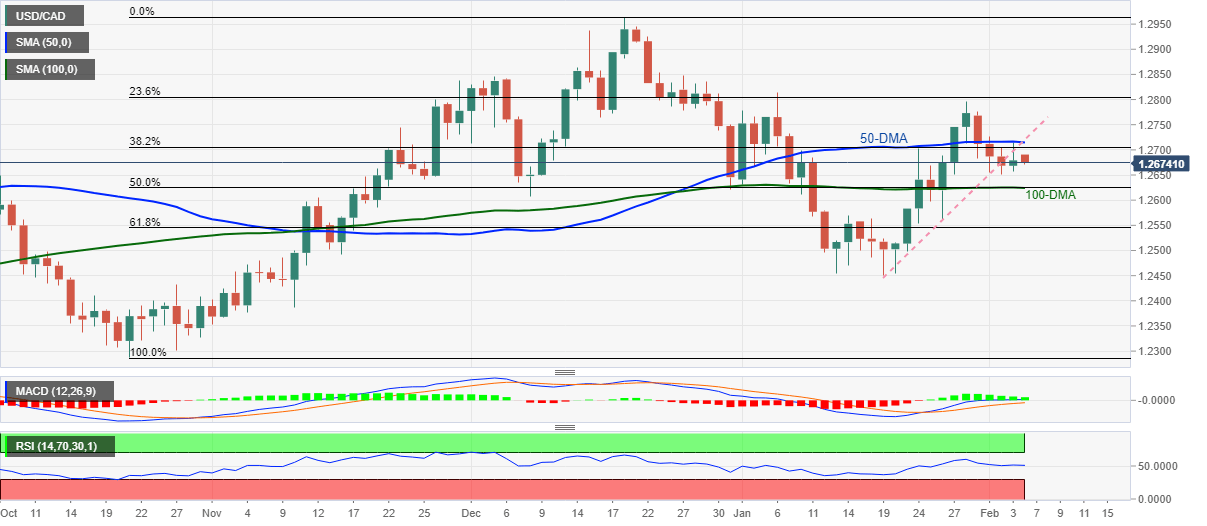

USD/CAD Price Analysis: Keeps pullback from 50-DMA above 1.2620 key support

- USD/CAD fades the previous day’s bounce from weekly low.

- A confluence of 100-DMA, 50% Fibonacci retracement restrict short-term downside.

- Steady RSI, bullish MACD signals keep buyers hopeful.

- Previous support line, 50-DMA guards nearby advances ahead of January’s top.

USD/CAD remains pressured around 1.2680 during Friday’s Asian session, following the previous day’s U-turn from 50-DMA.

Thursday’s pullback also marked the quote’s inability to cross the previous support line from January 19, around 1.2715.

However, a convergence of the 100-DMA and 50% Fibonacci retracement (Fibo.) of October-December 2021 upside, near 1.2620, becomes the key support to watch during the quote’s further weakness. That said, firmer RSI and MACD signals are in favor of buyers.

Hence, USD/CAD prices are likely to have a limited horizon to move during the key jobs report, between 1.2715 and 1.2620.

Should the quote drops below 1.2620, the mid-January peak near 1.2570 may entertain USD/CAD bears before directing them to the yearly low of 1.2450.

On the contrary, an upside clearance of 1.2715 resistance will direct the quote towards January’s peak of 1.2813.

USD/CAD: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.