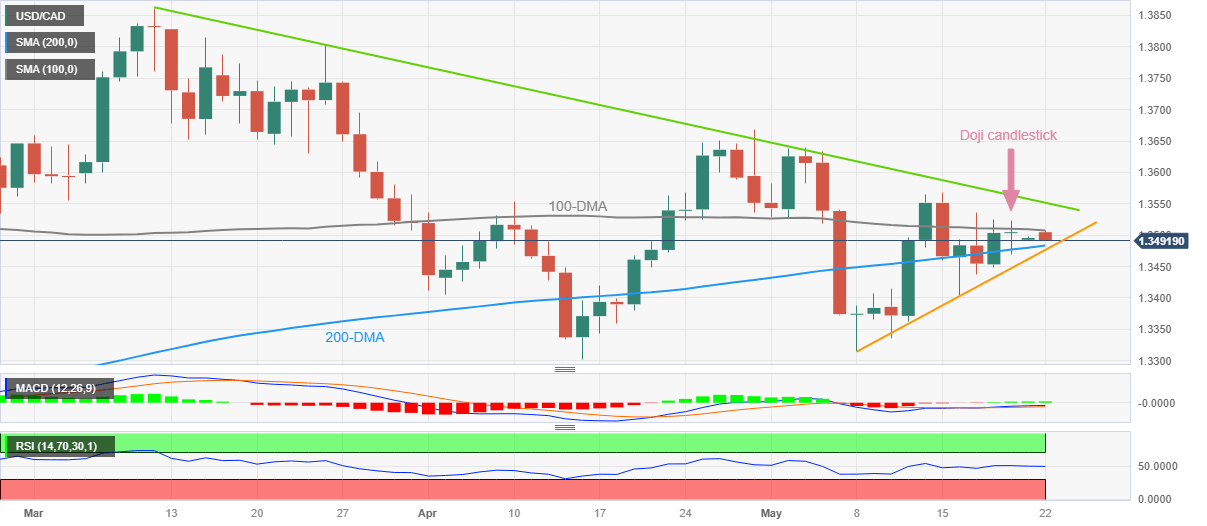

USD/CAD Price Analysis: Justifies Friday’s Doji to drop towards 200-DMA below 1.3500

- USD/CAD takes offers to refresh intraday low, defends the previous week’s downbeat performance.

- Loonie pair remains pressured between 100-DMA and 200-DMA.

- Bearish candlestick formation, unimpressive oscillators suggest further grinding of USD/CAD price.

- Descending resistance line from early March, two-week-old rising support line act as additional downside filters.

USD/CAD renews its intraday low near 1.3490 during early Monday morning in Europe. In doing so, The Loonie pair justifies Friday’s Doji candlestick, as well as a steady RSI (14) line and bullish MACD signals.

With this, the USD/CAD pair is likely to remain sidelined between the 100-DMA and 200-DMA, respectively near 1.3510 and 1.3480.

It’s worth noting that the Loonie pair’s downside break of 1.3480 allows it to take a chance about further bearish bias over the USD/CAD pair as it needs to cross a two-week-old upward-sloping support line, close to 1.3475 by the press time.

Following that, the USD/CAD fall towards the 1.3400 round figure and then to the yearly low of around 1.3300 can’t be ruled out.

On the flip side, a daily closing beyond the 100-DMA hurdle of around 1.3510 isn’t an open welcome to the USD/CAD bulls as a downward-sloping resistance line from March, close to 1.3550, appears a tough nut to crack for the pair buyers.

In a case where the USD/CAD manages to stay firmer beyond 1.3550, a gradual run-up toward the previous monthly low of around 1.3665 can’t be ruled out.

Overall, USD/CAD is likely to remain sidelined but the bears have upper hand of late.

USD/CAD: Daily chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.