USD/CAD Price Analysis: Gauges cushion around 1.3700 as USD Index eyes more gains

- USD/CAD is gauging an intermediate cushion near 1.3700 as USD Index looks firm.

- A recovery in retail demand could force the BoC to resume hiking rates again.

- The upside bias for the loonie asset is still solid as it is holding auction above the downward-sloping trendline from 1.3862.

The USD/CAD pair is looking for an intermediate cushion around 1.3700 in the early Tokyo session. The Loonie asset is juggling in a narrow range below 1.3740 following the footprints of the US Dollar index (DXY). The major slipped firmly on late Friday after the release of a jump in the Canadian Retail Sales data.

Monthly Canadian Retail Sales (Feb) jumped to 1.4%, higher than the consensus of 0.7%, and a flat performance was observed earlier. A recovery in retail demand could force the Bank of Canada (BoC) to resume hiking rates again.

The US Dollar Index (DXY) extended its recovery above 103.00 after S&P Global reported upbeat preliminary PMI (March) data. Manufacturing and Services PMI recovered to 49.3 and 53.8 respectively. Although a figure below 50.0 is still considered as a contraction for an economic indicator.

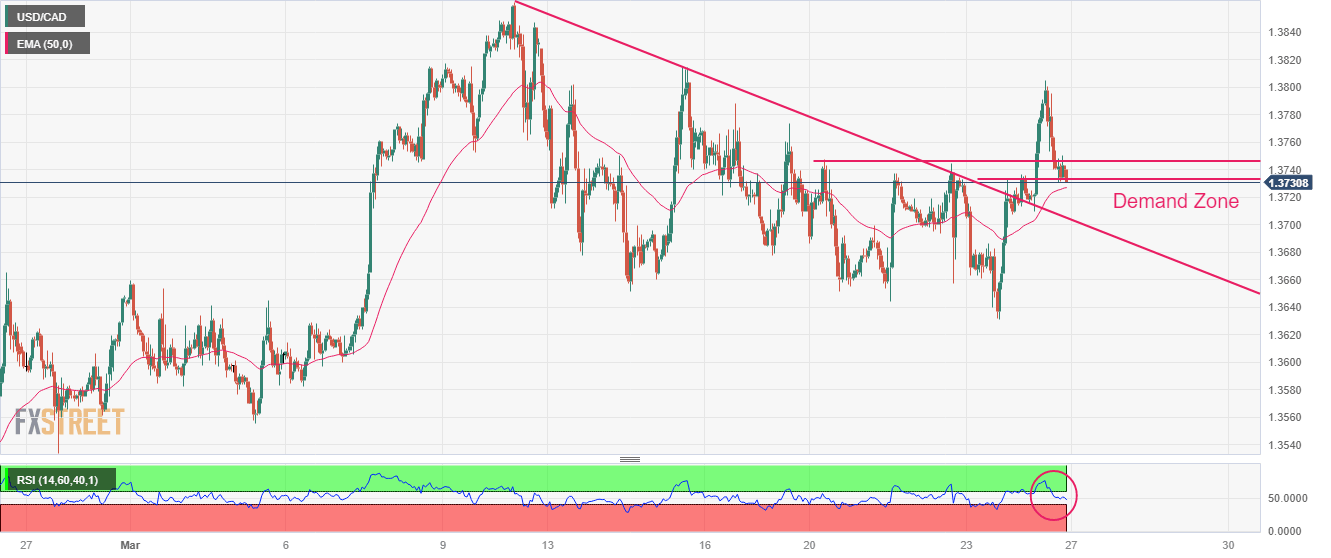

On an hourly scale, USD/CAD has corrected to near the demand zone placed in a narrow range of 1.3737-1.3746. The upside bias for the loonie asset is still solid as it is holding auction above the downward-sloping trendline plotted from March 10 high at 1.3862.

Also, the major is still above the 50-period Exponential Moving Average (EMA) at 1.3727, which indicates that the short-term upside bias has not faded yet.

The Relative Strength Index (RSI) (14) has slipped below 60.00 but is likely to find support around 40.00 initially.

A confident recovery above March 14 high at 1.3773 would drive the major toward March 09 high at 1.3835 and the round-level resistance at 1.3900.

In an alternate scenario, a decisive breakdown of March 14 low at 1.3652 would drag the loonie asset toward March 07 low at 1.3600, followed by March 03 low at 1.3555.

USD/CAD hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.