USD/CAD Price Analysis: Eyes previous month’s high at 1.3670 amid solid US Dollar and weak oil

- USD/CAD is eyeing a break above the immediate resistance of 1.3640 amid broader strength in the US Dollar.

- Oil prices tumbled after Russian Novak said he expected no new steps from OPEC+ at its meeting on June 4.

- The US Dollar bulls have got strength after climbing above the downward-sloping trendline plotted from 1.3862.

The USD/CAD pair is gathering strength for a break above the immediate resistance of 1.3640 in the early Asian session. The Loonie asset remained in bullish territory amid strength in the US Dollar Index (DXY) and a weakness in the oil price.

Oil prices tumbled after Russian Deputy Prime Minister Alexander Novak said he expected no new steps from OPEC+ at its meeting on June 4. At the press time, the oil price has shown some recovery, however, the downside bias is still solid. It is worth noting that Canada is the leading exporter of oil to the United States and lower oil prices impact the Canadian Dollar significantly.

The US Dollar Index (DXY) has corrected marginally after a solid upside after the White House Communications Director said we are getting closer to a deal on the debt ceiling. Going forward, US Durable Goods orders data (April) will remain in the spotlight.

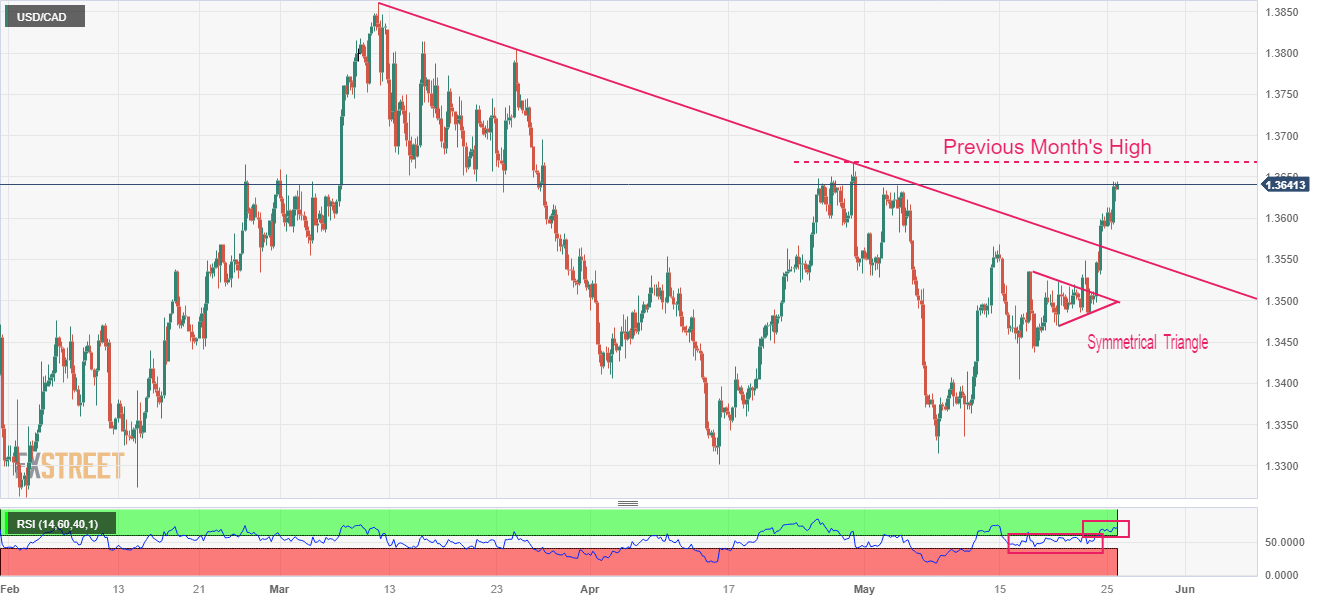

USD/CAD has shown a stellar upside action after a breakout of the Symmetrical Triangle formed on a four-hour scale. The US Dollar bulls have got strength after climbing above the downward-sloping trendline plotted from March 10 high at 1.3862. The Loonie asset is approaching the previous month’s high at 1.3668.

A range shift move by the Relative Strength Index (RSI) (14) into the 60.00-80.00 territory from the 40.00-60.00 zone indicates that the upside momentum has been triggered.

Investors should wait for a marginal correction to near the immediate support of 1.3610 for a fresh buy, which will deliver gains till the previous month’s high at 1.3668 followed by the round-level resistance at 1.3700.

On the flip side, a break below May 23 high at 1.3550 will drag the asset toward the psychological support at 1.3500. A breakdown below the latter will expose the Loonie asset to April 20 low at 1.3448.

USD/CAD four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.