USD/CAD Price Analysis: Bulls take on critical resistance

- USD/CAD bulls have moved back in, but bears could be about to make another move.

- The price is testing key resistance areas on the time frames.

As per the prior analysis, USD/CAD Price Analysis: Bears on the prowl at key resistance, the price indeed moved lower, but this was only a temporary outcome and the bulls have since taken back over. The following illustrates the prior analysis and outcome and gives an update on the current market structure and possible scenarios.

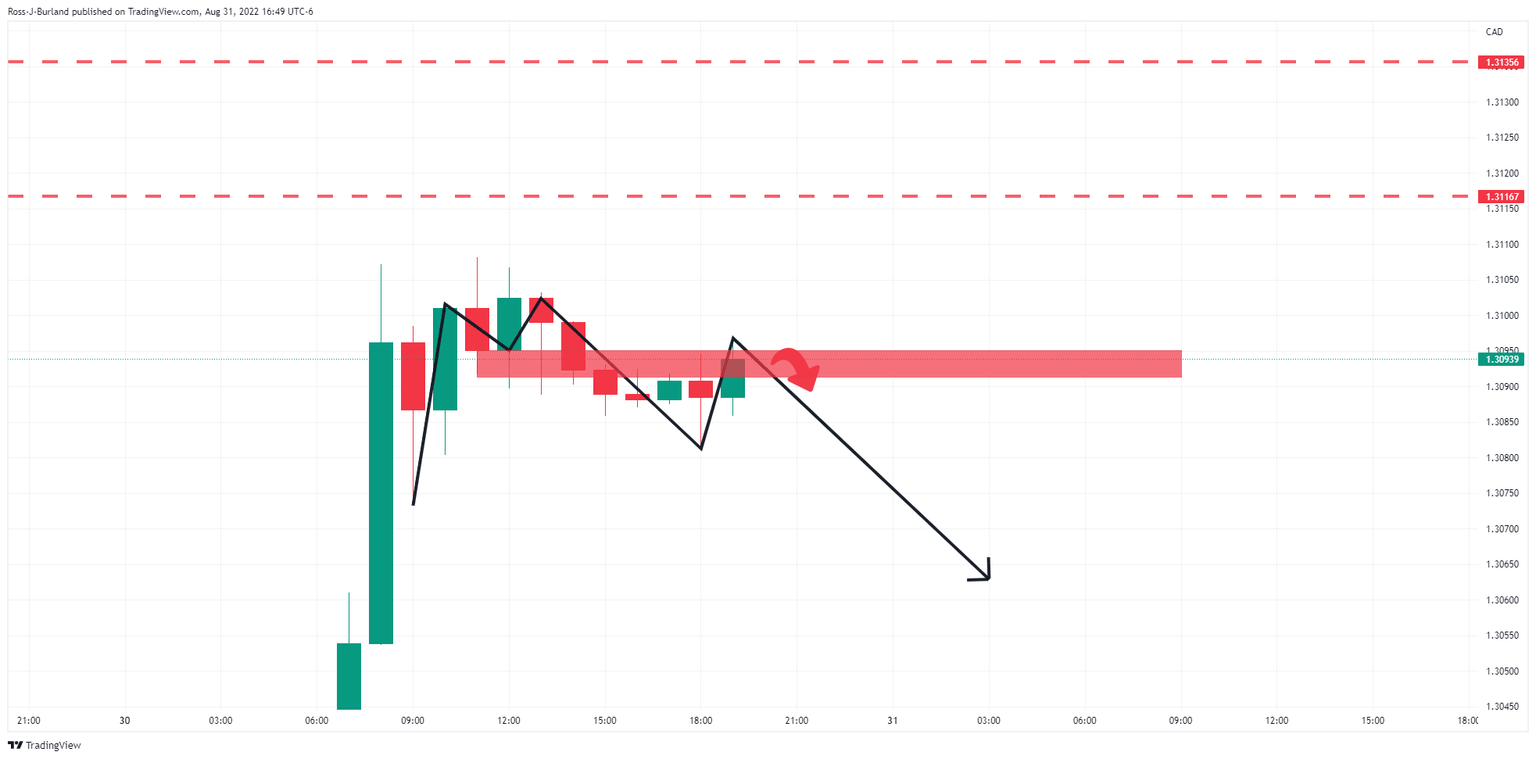

USD/CAD H1 chart, prior analysis

Progress

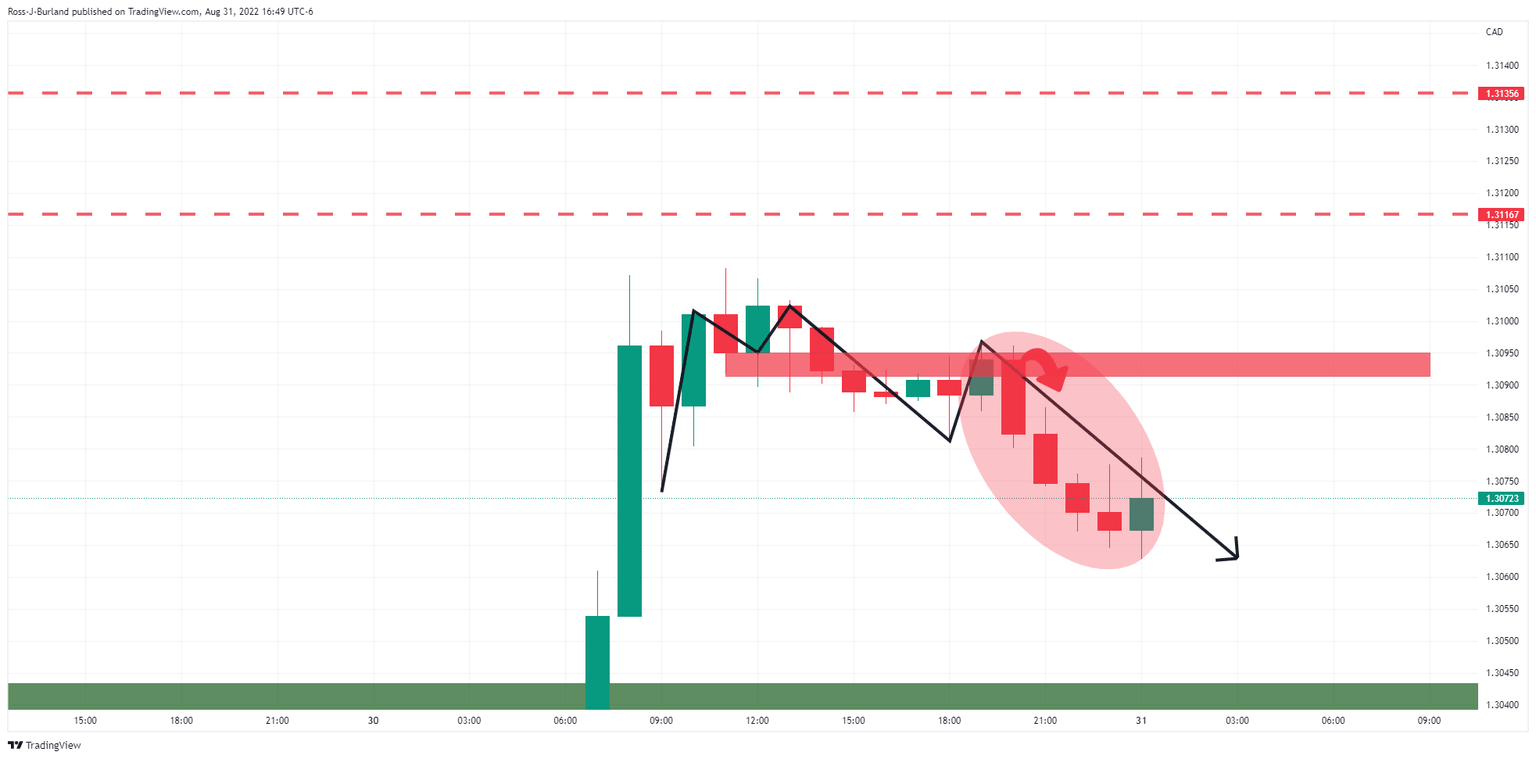

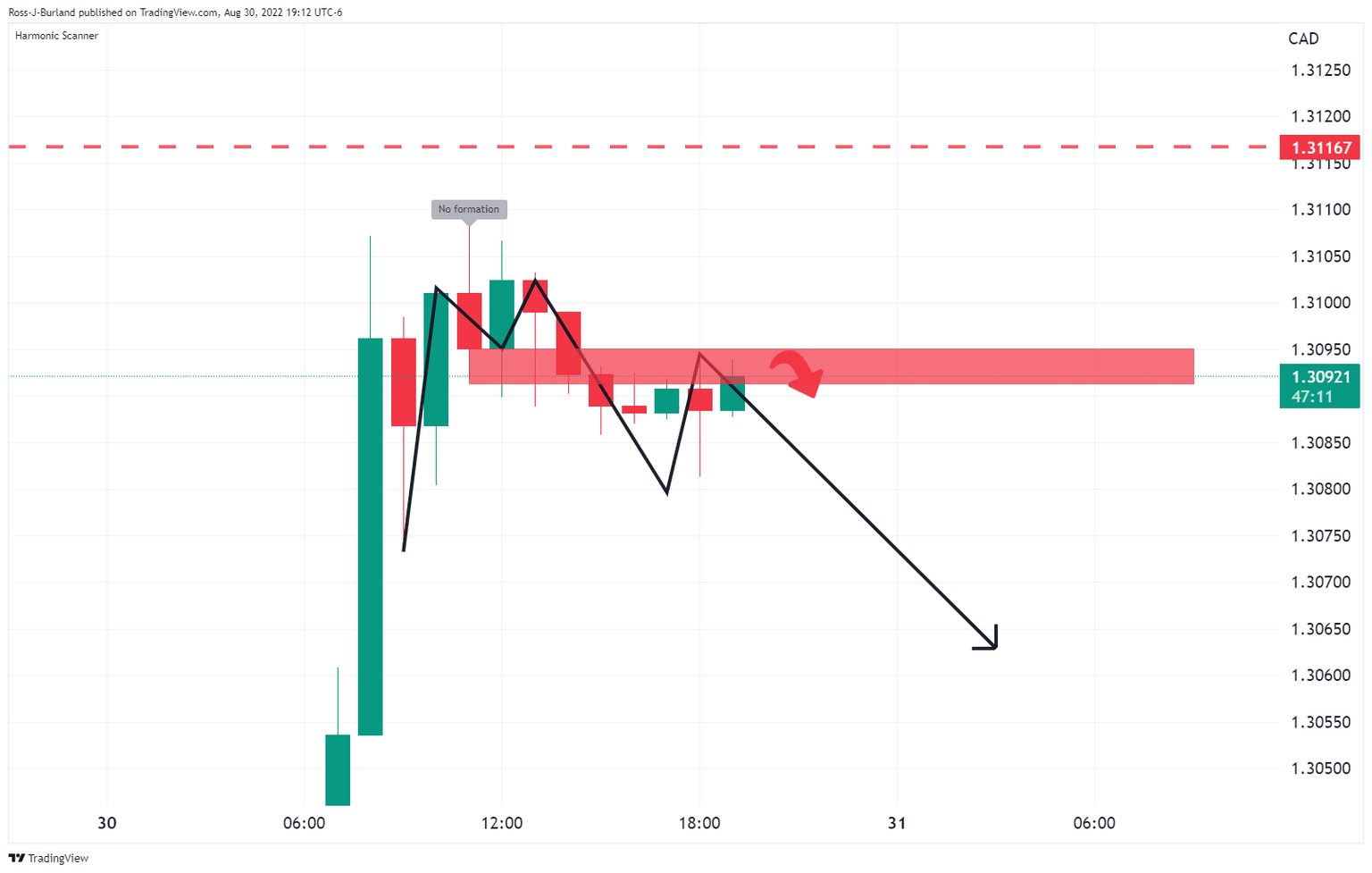

USD/CAD live update

The price is testing a key resistance area now and should the bears commit, then the downside would be the favourable outlook for the session ahead. A break of trendline support could be in order.

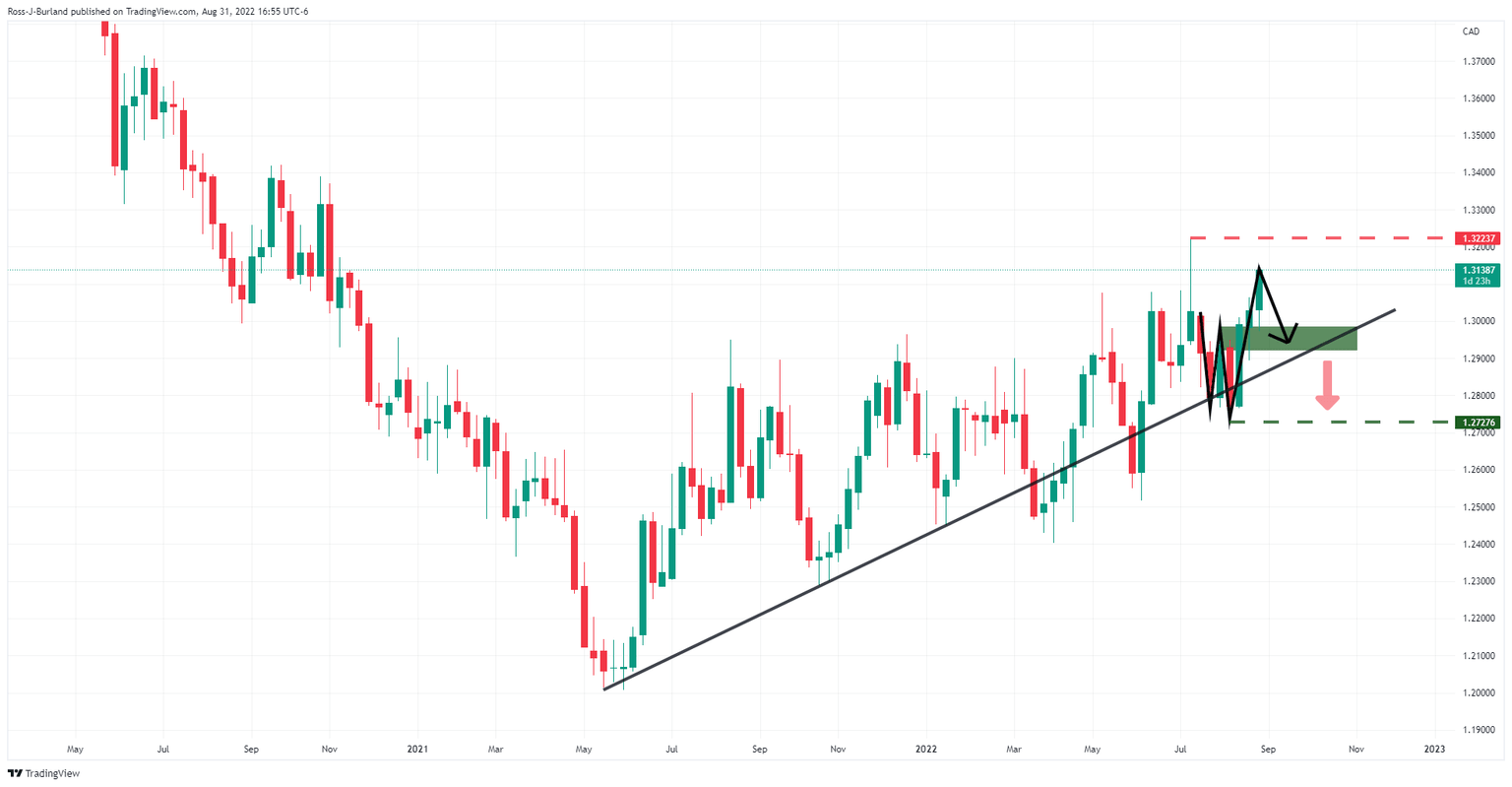

The weekly W-formation is compelling. This is a reversion pattern that would be expected to lure in the price towards the neckline in the coming days. But that is not to say that the bulls are done yet as they have the 1.3220s in their sights.

USD/CAD daily chart

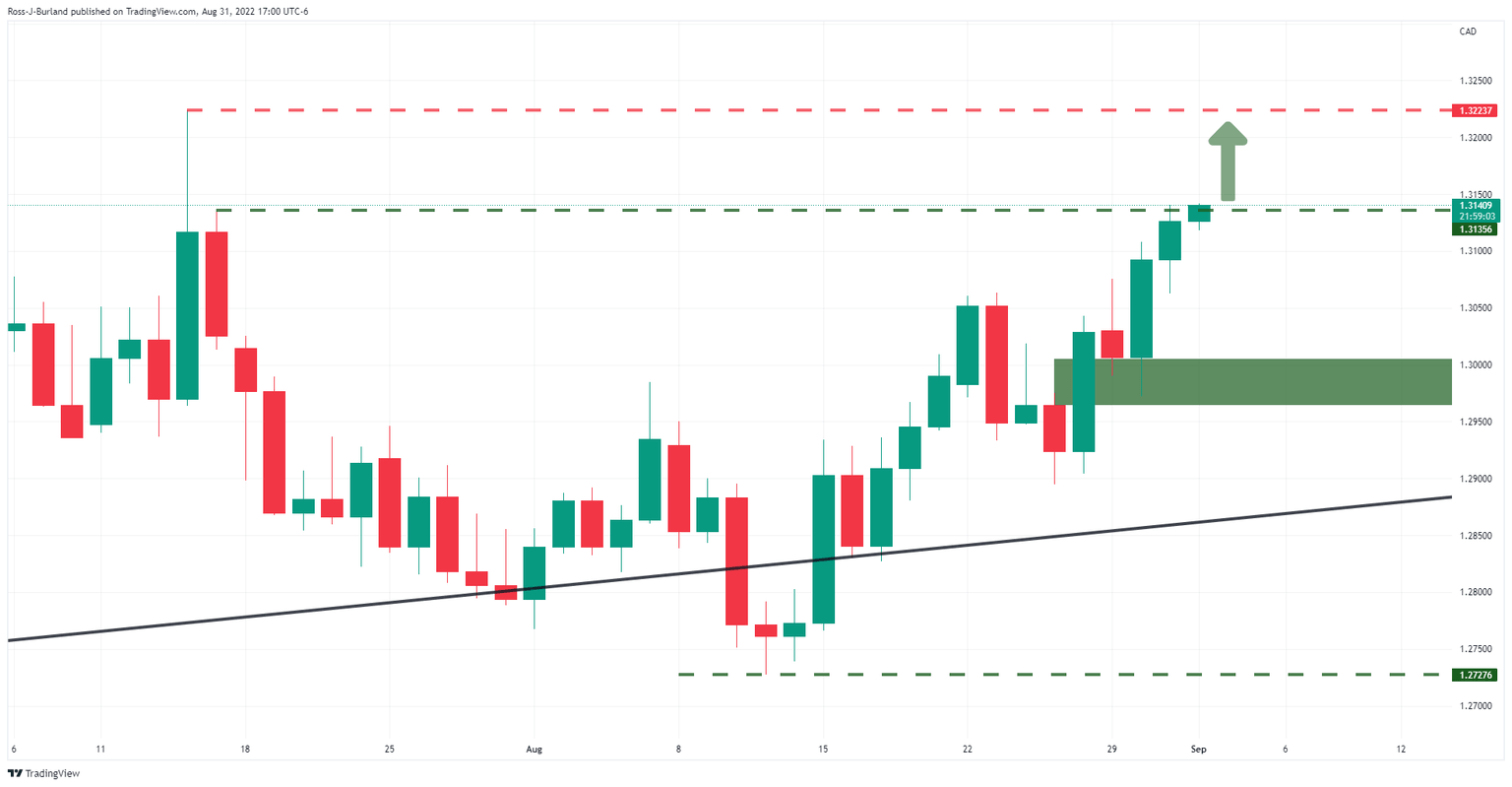

However, from the daily time-frame perspective, there is still room to go until prior highs have been met and the break of the last highs of 1.3135 leaves the bulls with the baton.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.