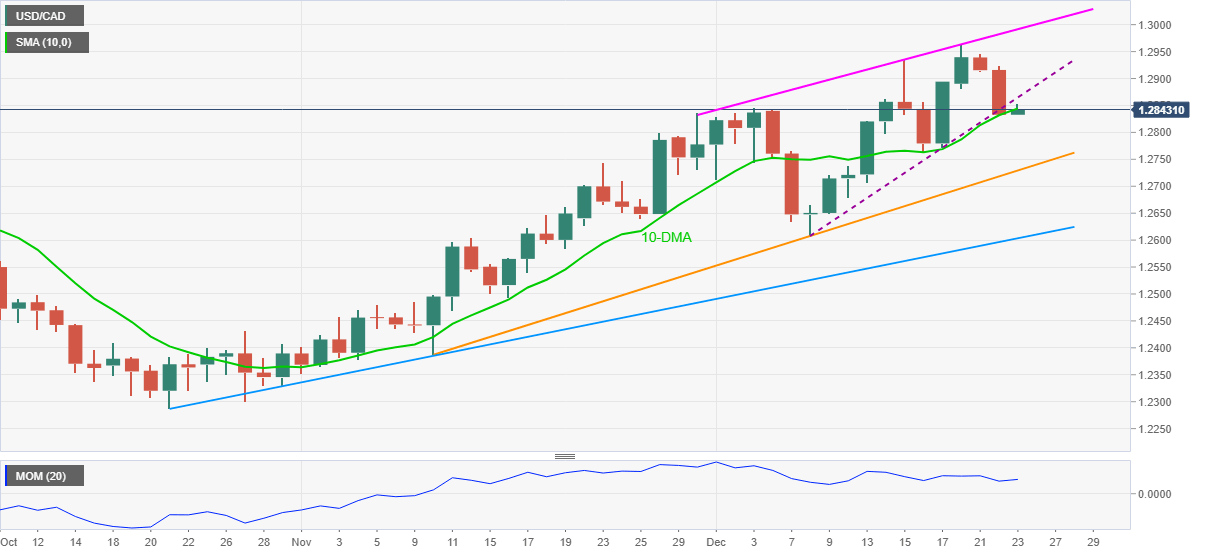

USD/CAD Price Analysis: Bulls remain unconvinced below 1.2865

- USD/CAD struggles to defend the bounce from weekly low around 10-DMA.

- Steady Momentum line, clear break of two-week-old rising trend line favor sellers.

- Bulls may aim for monthly resistance line beyond 1.2865.

USD/CAD snaps a two-day pullback from the yearly top, up 0.09% intraday despite recently easing to 1.2840 ahead of Thursday’s European session.

Although 10-DMA challenges the Loonie pair’s immediate downside, a sustained break of the ascending trend line from December 08 keeps the USD/CAD sellers hopeful amid a steady Momentum line.

Even if the quote rises past the nearby support-turned-resistance line close to 1.2865, the 1.2900 threshold and the latest peak of 1.2965 may lure the bulls ahead of an ascending resistance line from November 30, near the 1.3000 psychological magnet.

Alternatively, the quote’s fresh weakness will aim for November 23 swing high near 1.2745 before targeting the six-week-old support line near 1.2730.

In a case where USD/CAD bears keep reins past 1.2730, a two-month-long support line, close to 1.2600 will be crucial to watch.

USD/CAD: Daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.