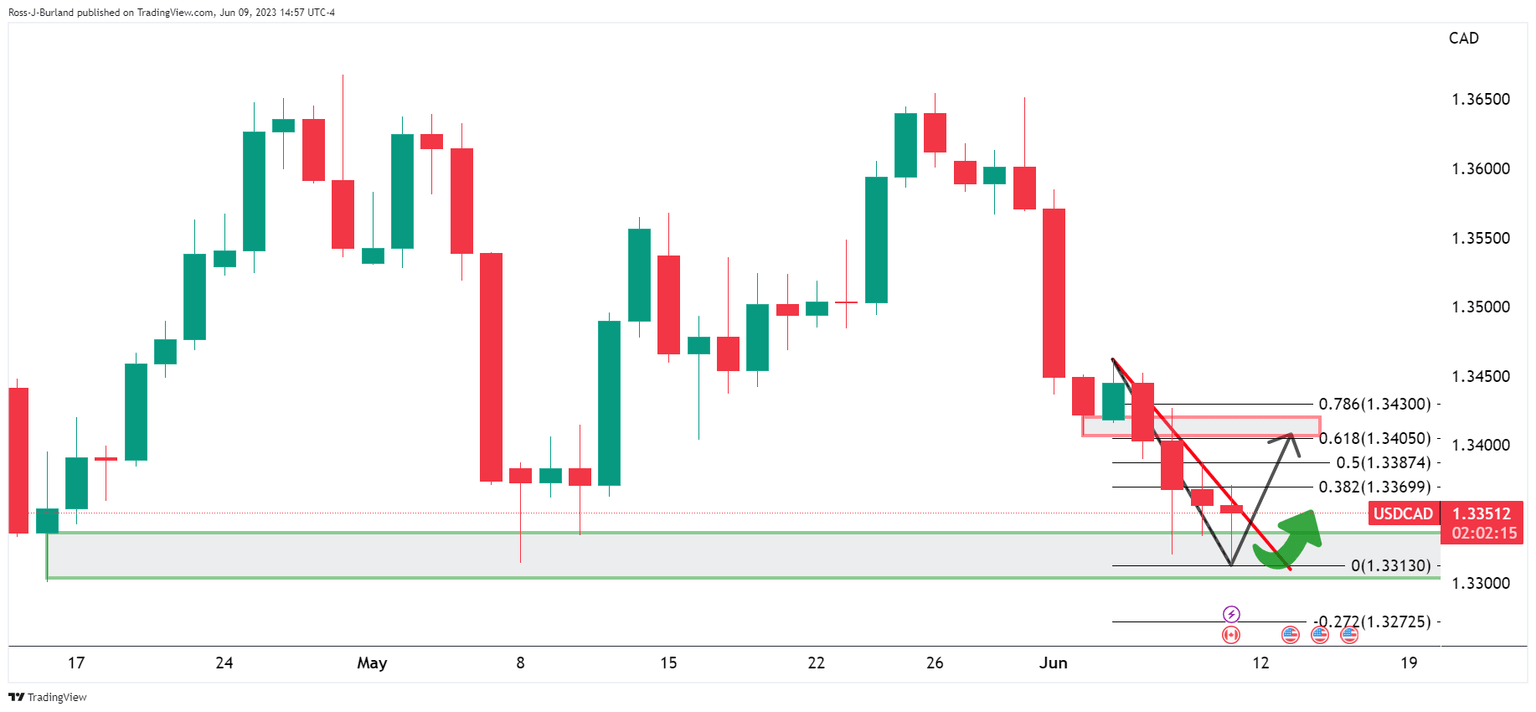

USD/CAD Price Analysis: Bulls move in at key demand area

- USD/CAD bulls eye a break of the 1.3370 resistance.

- Bears need a break of 1.3300 and the solid demand area.

USD/CAD has been firmer on the day, adding to its weekly gain. However, on Wednesday, the BoC hiked its benchmark rate by 25 basis points to a 22-year high of 4.75%, on increasing concerns that inflation could get stuck significantly above its 2% target. This leaves the technical outlook in contrast with the fundamentals considering the prospects of a phase of accumulation as per the following analysis:

USD/CAD daily charts

The bulls are moving in although the price remains on the front side of the bearish trendline.

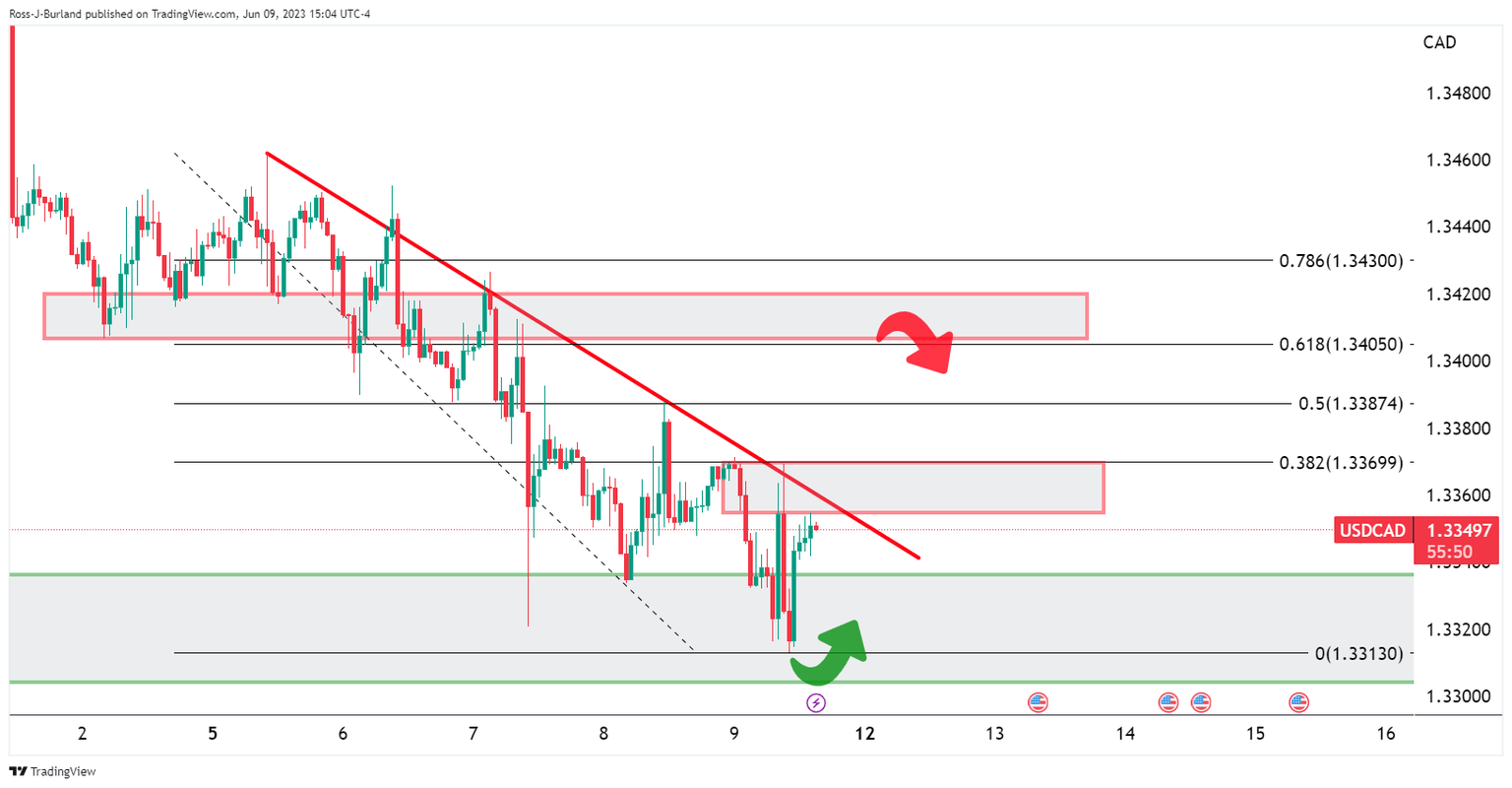

USD/CAD H1 chart

A break of the resistance, both horizontal and dynamic, will open risks of a move beyond 1.3370 and toward prior support around 1.34 the figure. However, there is work to do for the bulls and failures below the resistance leave 1.3300 vulnerable for next week.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.