USD/CAD Price Analysis: Bulls looking to build on the recovery beyond 1.2800 mark

- USD/CAD staged a modest recovery from a near two-month-old ascending channel support.

- Bullish crude oil prices might underpin the loonie and cap any meaningful gains for the pair.

- A convincing break below the 1.2770-65 area will set the stage for a further near-term slide.

The USD/CAD pair staged a goodish bounce from a one-and-half-week low touched earlier this Tuesday and climbed to the 1.2800 mark during the first half of the European session.

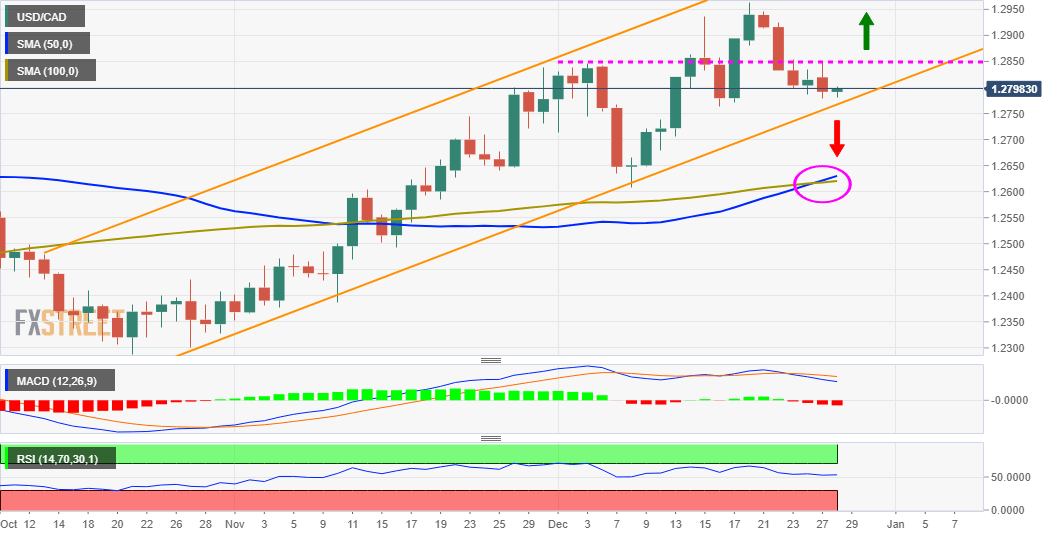

From a technical perspective, the recent corrective slide from the YTD low found a decent support near the lower boundary of an upward sloping channel extending from late October. The mentioned support is currently pegged near the 1.2770-65 region, which should now act as a pivotal point for short-term traders.

Meanwhile, technical indicators on the daily chart – though have been retreating from higher levels – are still holding in the positive territory. This, in turn, supports prospects for additional gains. That said, bullish crude oil prices might continue to underpin the commodity-linked loonie and cap the USD/CAD pair.

Hence, any subsequent positive move is more likely to confront stiff resistance near the 1.2845-50 supply zone. A sustained strength beyond will reinforce the constructive set-up and prompt some near-term short-covering rally. The USD/CAD pair could then aim back to reclaim the 1.2900 round-figure mark.

The momentum could get extended towards the recent daily closing high, near the 1.2935-40 area, en-route the YTD high, around the 1.2965 region. Some follow-through buying will be seen as a fresh trigger for bullish traders and has the potential to lift the USD/CAD pair towards the key 1.3000 psychological mark.

On the flip side, a convincing break below the trend-channel support, around the 1.2770-65 region, could prompt aggressive technical selling and accelerate the slide towards the 1.2710-1.2700 zone. The corrective fall could further get extended towards the 50/100-day SMAs confluence, currently around the 1.2625-15 region.

USD/CAD daily chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.