USD/CAD Price Analysis: Bulls brace for 1.2660 key hurdle

- USD/CAD grinds higher following the run-up to refresh seven-week top.

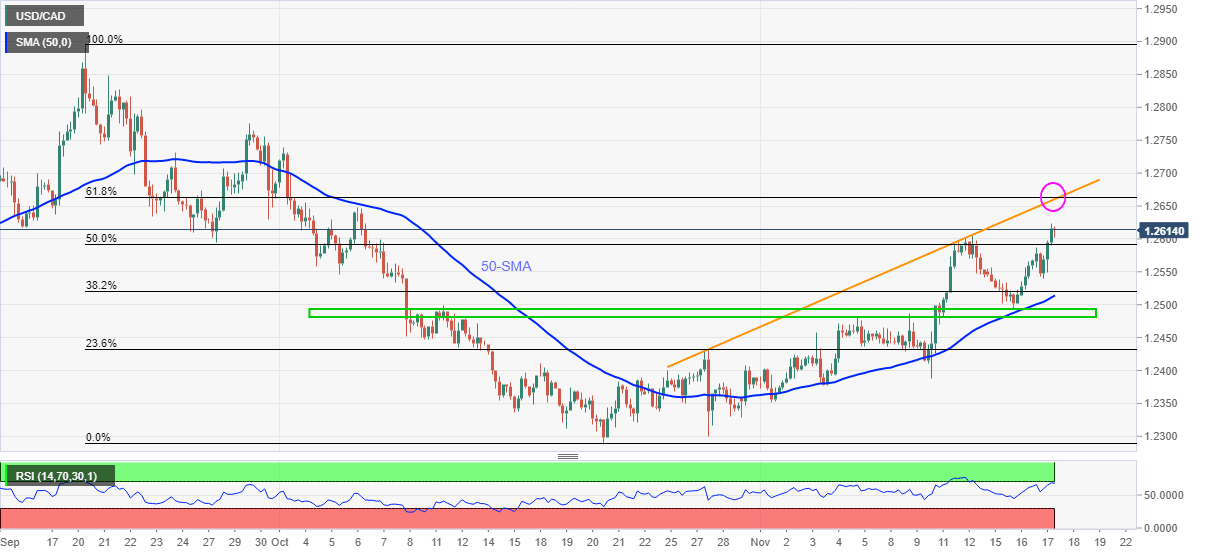

- Short-term ascending trend line, 61.8% Fibonacci retracement tests immediate upside, overbought RSI conditions.

- 50-SMA restricts immediate downside, late September peak lures bulls past 1.2660.

USD/CAD picks up bids in a 20-pip trading range above 1.2600 after rising to the highest levels since early October the previous day. That said, the quote rises to 1.2613 amid the initial Asian session on Thursday.

Sustained trading beyond the 50-SMA and a six-week-old horizontal area keeps USD/CAD buyers hopeful. However, a convergence of an ascending trend line from October 27 and 61.8% Fibonacci retracement (Fibo.) of September-October fall, challenge the bulls around 1.2660 amid the overbought RSI conditions.

Hence, the pair buyers should wait for a clear upside break of 1.2660 for fresh entry. Following that, the 1.2700 threshold and late September high near 1.2775 will be in focus.

Even if the USD/CAD upside remains intact past 1.2775, September’s top around the 1.2900 threshold should attract the sellers.

Alternatively, pullback moves may aim for the 50% retracement level of 1.2592 before targeting the 50-SMA, around 1.2515 at the latest.

However, USD/CAD should watch for entry if the quote breaks a horizontal region comprising multiple levels since October 8, around 1.2480-95.

USD/CAD: Four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.