- USD/CAD oscillated in a narrow trading range through the mid-European session.

- A breakout through a falling wedge pattern supports prospects for additional gains.

- Bulls might aim for a move beyond the 1.2700 mark and test the 1.2745 supply zone.

The USD/CAD pair lacked any firm directional bias and seesawed between tepid gains/minor losses through the first half of the European session. The pair was last seen trading just above mid-1.2600s, nearly unchanged for the day.

Strong follow-through US dollar buying was seen as a key factor that assisted the USD/CAD pair to attract some dip-buying near the 1.2630 region. Apart from this, a modest pullback in crude oil prices undermined the commodity-linked loonie and remained supportive. That said, investors preferred to wait for Fed Chair Jerome Powell's scheduled speech later during the North American session. This, along with nervousness ahead of the OPEC+ decision on production quotas, further held traders from placing directional bets.

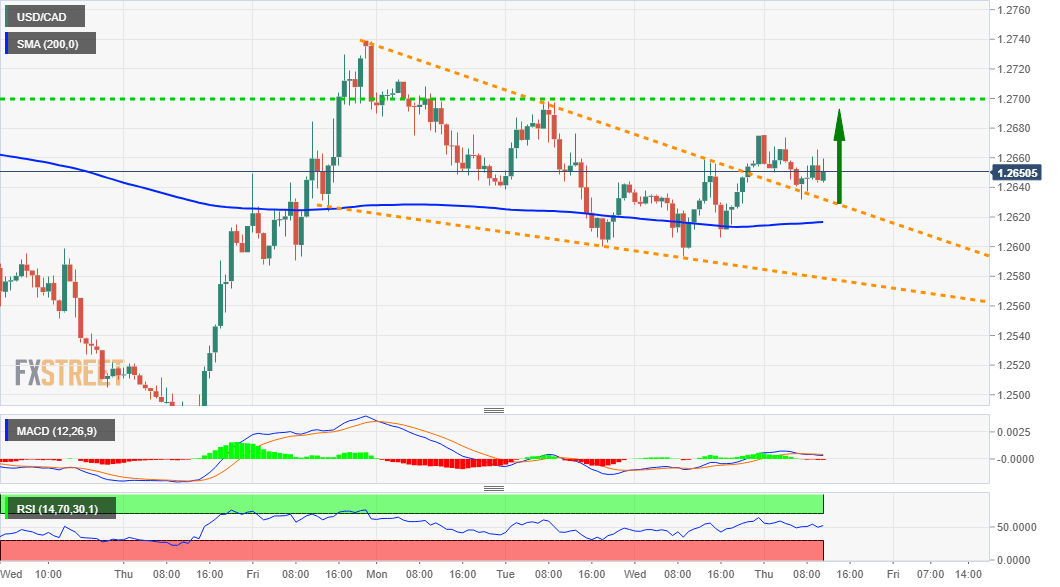

From a technical perspective, the intraday downtick managed to find decent support near a four-day-old descending trend-line resistance breakpoint. The mentioned resistance-turned-support constituted the formation of a bullish falling wedge on short-term charts. Given that the USD/CAD pair, so far, has managed to find acceptance above the pattern resistance, the intraday bias seems tilted in favour of bullish traders. Hence, a move back towards weekly tops, around the 1.2700 mark, looks a distinct possibility.

Meanwhile, technical indicators on the daily chart have recovered from the negative territory and maintained their bullish bias on hourly charts. This, in turn, further supports prospects for an extension of the recent goodish bounce from multi-year lows. A sustained strength beyond the 1.2700 mark will reaffirm the constructive outlook and push the USD/CAD pair back towards the 1.2745 supply zone. Some follow-through buying should pave the way for a move towards reclaiming the 1.2800 round-figure mark.

On the flip side, the 1.2630 region might continue to protect the immediate downside. This is followed by the lower boundary of the wedge, around the 1.2600-1.2590 region, which if broken decisively will negate any near-term bullish bias. The USD/CAD pair might then turn vulnerable and accelerate the fall further towards challenging the key 1.2500 psychological mark.

USD/CAD 1-hourly chart

Technical levels to watch

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays weak below 1.0500 due to risk-off mood

EUR/USD remains depressed below 1.0500 in Tuesday's European morning as US President-elect Trump’s tariff plans dampen the market sentiment and keep the US Dollar broadly bid. The Euro struggles due to growing Euro area economic concerns and increased dovish ECB bets.

GBP/USD consolidates losses near 1.2550 ahead of BoE's Pill, Fed Minutes

GBP/USD struggles near 1.2550 in European trading on Tuesday, following a slump to the 1.2500 area. The US Dollar holds on to modest gains amid Trump's tariffs threat-driven cautious mood, keeping the pair undermined ahead of BoE Pill's speech and Fed Minutes.

Gold price seems vulnerable amid bullish USD; $2,600 mark holds the key

Gold price struggles to capitalize on its modest intraday bounce from the $2,600 neighborhood, or over a one-week low and retains a negative bias for the second straight day on Tuesday. Trump's tariff threat drove some haven flows and offered some support to the safe-haven precious metal.

Trump shakes up markets again with “day one” tariff threats against CA, MX, CN

Pres-elect Trump reprised the ability from his first term to change the course of markets with a single post – this time from his Truth Social network; Threatening 25% tariffs "on Day One" against Mexico and Canada, and an additional 10% against China.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.