USD/CAD Price Analysis: Bounces off multi-week low, upside potential seems limited

- A combination of factors assisted USD/CAD to reverse the early slide to a three-week low.

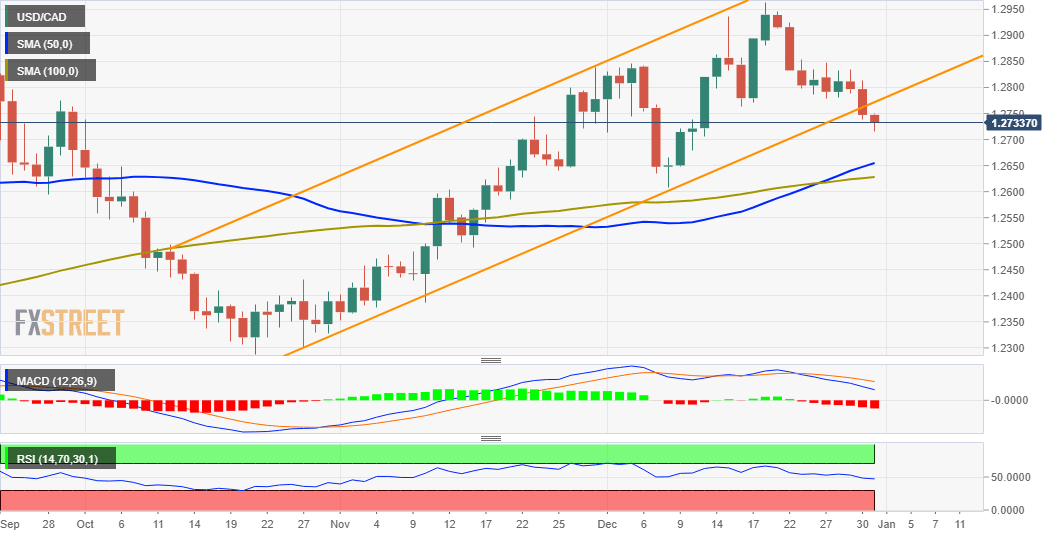

- Ascending channel breakdown supports prospects for an extension of the recent decline.

- Any further recovery move might get sold into and remain capped near the 1.2800 mark.

The USD/CAD pair reversed an intraday dip to a near three-week low and was last seen trading around the 1.2730-35 region, just a few pips below the daily swing high.

A modest pullback in the equity markets benefitted the safe-haven US dollar for the second successive day on Friday. Apart from this, retreating crude oil prices undermined the commodity-linked loonie and assisted the USD/CAD pair to attract some dip-buying near the 1.2715 region.

Looking at the technical picture, the overnight fall and the subsequent decline during the early part of the trading on Friday confirmed a near-term breakdown through an upwards sloping channel. This might have already set the stage for an extension of the recent downfall.

Moreover, technical indicators on the daily chart have just started drifting into the negative territory and add credence to the negative outlook. Hence, any meaningful recovery attempt could be seen as a selling opportunity and runs the risk of fizzling out quickly.

From current levels, any further recovery move is more likely to meet with a fresh supply near the 1.2770-75 horizontal support breakpoint. This, in turn, should cap the upside for the USD/CAD pair near the 1.2800 mark, which should now act as a pivotal point.

That said, a sustained strength beyond might prompt some short-covering move and lift the USD/CAD pair back towards the 1.2835-45 supply zone. Some follow-through buying will negate the negative bias and pave the way for a further near-term appreciating move.

On the flip side, the daily swing low, around the 1.2715 region, now seems to protect the immediate downside ahead of the 1.2700 mark. Failure to defend the mentioned support levels could drag the USD/CAD pair to mid-1.2600s (50-DMA) en-route 100-DMA, around the 1.2625 area.

USD/CAD daily chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.