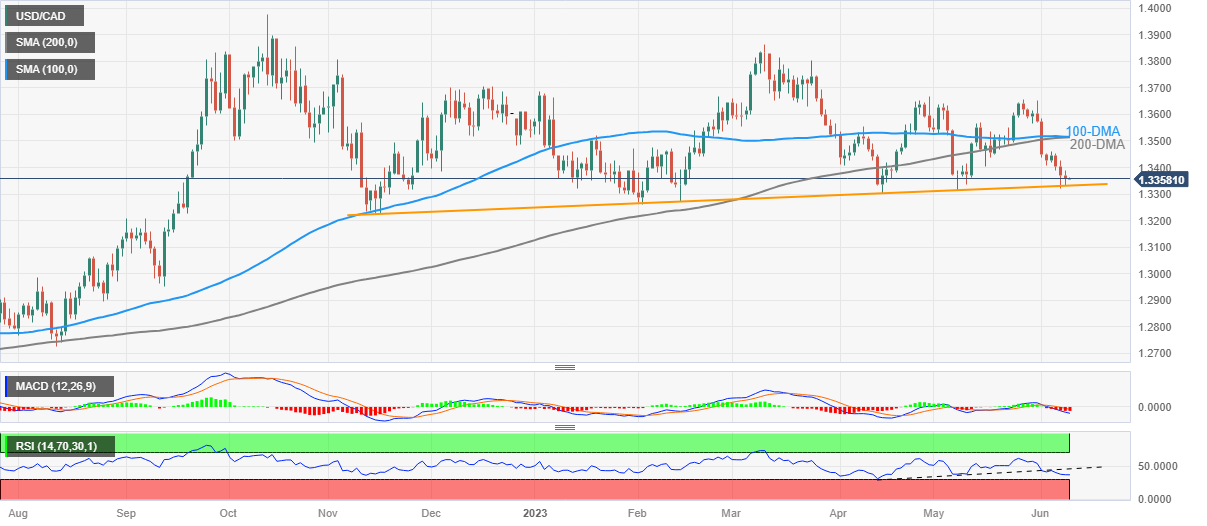

- USD/CAD picks up bids to consolidate the second consecutive weekly loss.

- Seven-month-old ascending trend line, nearly oversold RSI conditions challenge Loonie pair sellers.

- Convergence of 100-DMA, 200-DMA appears a tough nut to crack for the bulls.

USD/CAD licks its wounds around 1.3360, pausing a three-day downtrend near the lowest levels in a year amid the early hours of Friday’s Asian session.

In doing so, the Loonie pair bounces off an upward-sloping support line from November 2022 ahead of the key Canada employment data. It should be noted that the early week’s surprise rate hike from the Bank of Canada (BoC) joins the latest hawkish comments from BoC’s Deputy Governor Paul Beaudry to keep the Loonie pair sellers hopeful.

Also read: Canada Employment Preview: Forecasts from five major banks, tight labour market

In addition to the pre-data anxiety and failure to break the key support line, the Loonie pair’s latest rebound could also be linked to the nearly oversold conditions of the RSI (14) line.

It’s worth noting, however, that the trend line breakdown on the momentum indicator and the USD/CAD pair’s sustained trading below the key moving averages keep the bears hopeful.

Hence, the pair stays on the seller’s radar unless crossing a convergence of the 100-DMA and 200-DMA, around 1.3515 by the press time. Though, the 1.3400 round figure and the weekly high of near 1.3460 can lure short-term buyers.

On the flip side, a daily closing beneath the aforementioned support line, close to 1.3330 at the latest, could make the USD/CAD pair vulnerable to poking the November 2022 bottom surrounding 1.3225.

USD/CAD: Daily chart

Trend: Limited recovery expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays directed toward 1.1000 amid intense US Dollar selling

EUR/USD is consolidating the uptick to near 1.1000 in the European session on Thursday. The pair benefits from US President Trump's tariffs-led intense US Dollar weakness. However, further upside appears capped due to escalating trade war fears, with looming EU retaliatory tariffs.

GBP/USD jumps above 1.3100 ahead of US data

GBP/USD is extending its upbeat momentum above 1.3100 in European trading on Thursday as the US Dollar slumps to a fresh YTD low. Worries about a tariff-driven US economic slowdown lift Fed rate cut bets and weigh on the Greenback. The focus now remains on the US data for further impetus.

Gold price moves further away from all-time peak; downside potential seems limited

Gold price extends its steady intraday pullback from the all-time peak touched this Thursday, though it manages to hold above the $3,100 mark through the early European session. Bullish traders opt to take some profits off the table and lighten their bets around the commodity amid slightly overbought conditions.

Bitcoin price reacts as Gold sets fresh record highs after Trump’s reciprocal tariffs announcement

Bitcoin price plunges towards $82,000 as Gold soars past $3,150 after US President Donald Trump imposed new tariffs on Israel and UK, triggering global markets turbulence.

Trump’s “Liberation Day” tariffs on the way

United States (US) President Donald Trump’s self-styled “Liberation Day” has finally arrived. After four straight failures to kick off Donald Trump’s “day one” tariffs that were supposed to be implemented when President Trump assumed office 72 days ago, Trump’s team is slated to finally unveil a sweeping, lopsided package of “reciprocal” tariffs.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.