USD/CAD Price Analysis: Bears take a breather on their way to 1.3470 support

- USD/CAD pares intraday losses at the lowest levels in six weeks.

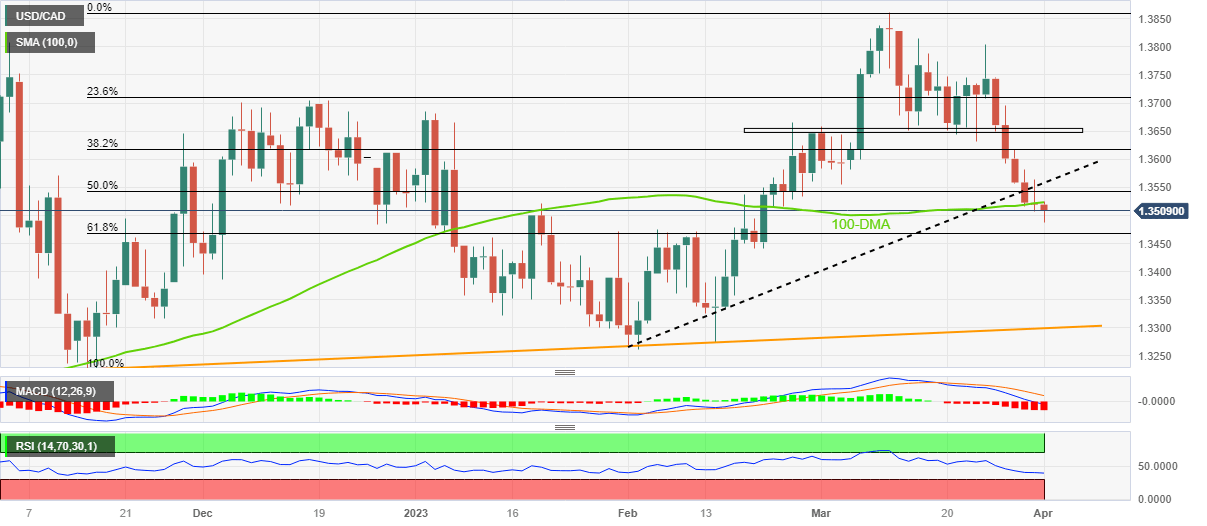

- Clear downside break of two-month-old ascending trend line, 100-DMA favor sellers.

- 61.8% Fibonacci retracement level lures sellers amid bearish MACD signals.

- Loonie pair buyers should remain cautious below 1.3650-55.

USD/CAD licks its wounds around 1.3500 after refreshing the 1.5-month low early Monday.

In doing so, the Loonie pair sellers take a breather after breaking the short-term key support line, now resistance, as well as the 100-DMA. Not only the DMA and support line break but the bearish MACD signals also keep the USD/CAD pair sellers hopeful.

That said, the quote is on the way to testing the 61.8% Fibonacci retracement level of its November 2022 to March 2023 upside, near 1.3470. However, the RSI (14) slides below the 50 level and suggest dip-buying at lower levels, which in turn can test the USD/CAD bears afterward.

Should the quote remains bearish past 1.3470, multiple levels around 1.3390 and 1.3320 can test the USD/CAD sellers before highlighting an upward-sloping support line from November 15, 2022, close to 1.3300 by the press time.

Meanwhile, the 100-DMA and the previous support line restrict short-term USD/CAD rebound near 1.3525 and 1.3565 in that order.

However, a horizontal area comprising multiple levels marked since late February 2023, near 1.3650-55, appears a tough nut to crack for the USD/CAD, a break of which could push back the bearish hopes, at least for a while

USD/CAD: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.