USD/CAD Price Analysis: Bears eye a run to 1.3320 as below key H4 structure

- USD/CAD bears stay strong and the bulls are pressured to below a key structure.

- A move to 1.3320 is eyed for the sessions ahead.

USD/CAD is heading lower on the day and is down some 1.17% as we head towards the forex close in New York. The pair has been pressured below 1.3500 to a low of 1.3371 on Friday.

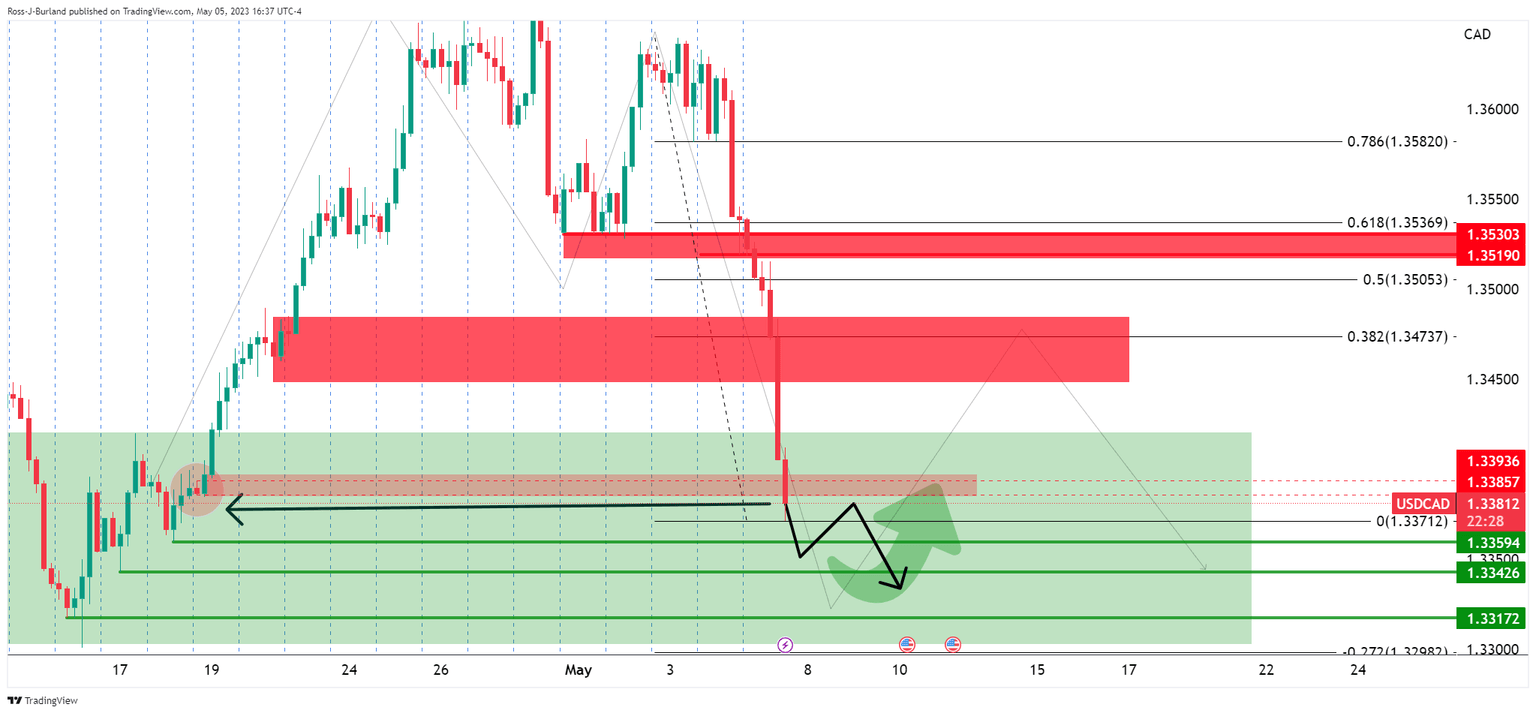

There are eyes on a move back into the supply, however, as the pair has painted an M-formation on the charts as the following daily chart illustrates:

USD/CAD daily chart

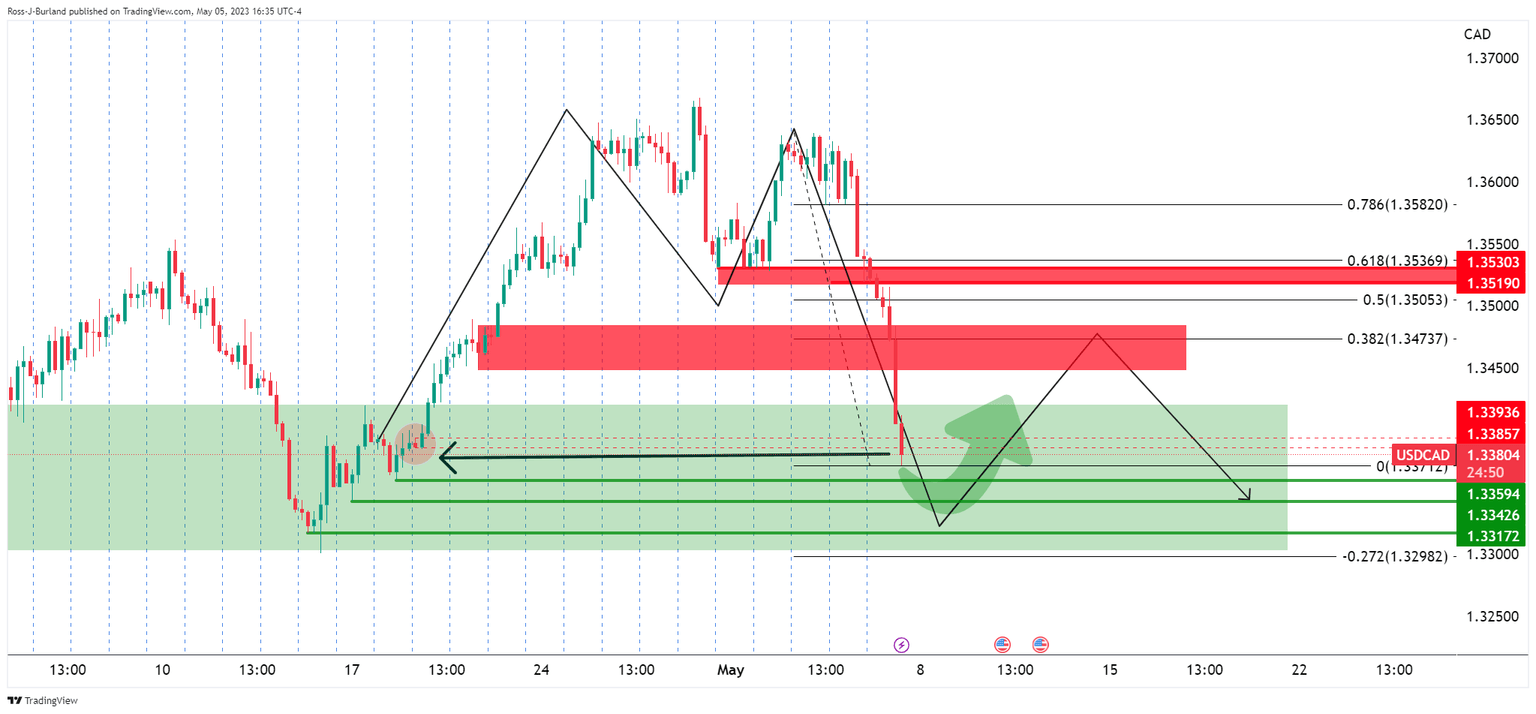

The price, however, has taken out a key structure and for that, we can zoom down to the lower time frames:

As we can see, the market is below 1.3393 and 1.3385 4-hour structure. This was a 4-hour bar where the price rallied from previously. Therefore, this is regarded as a key area so it will be interesting to see if the bears can stay below it for longer:

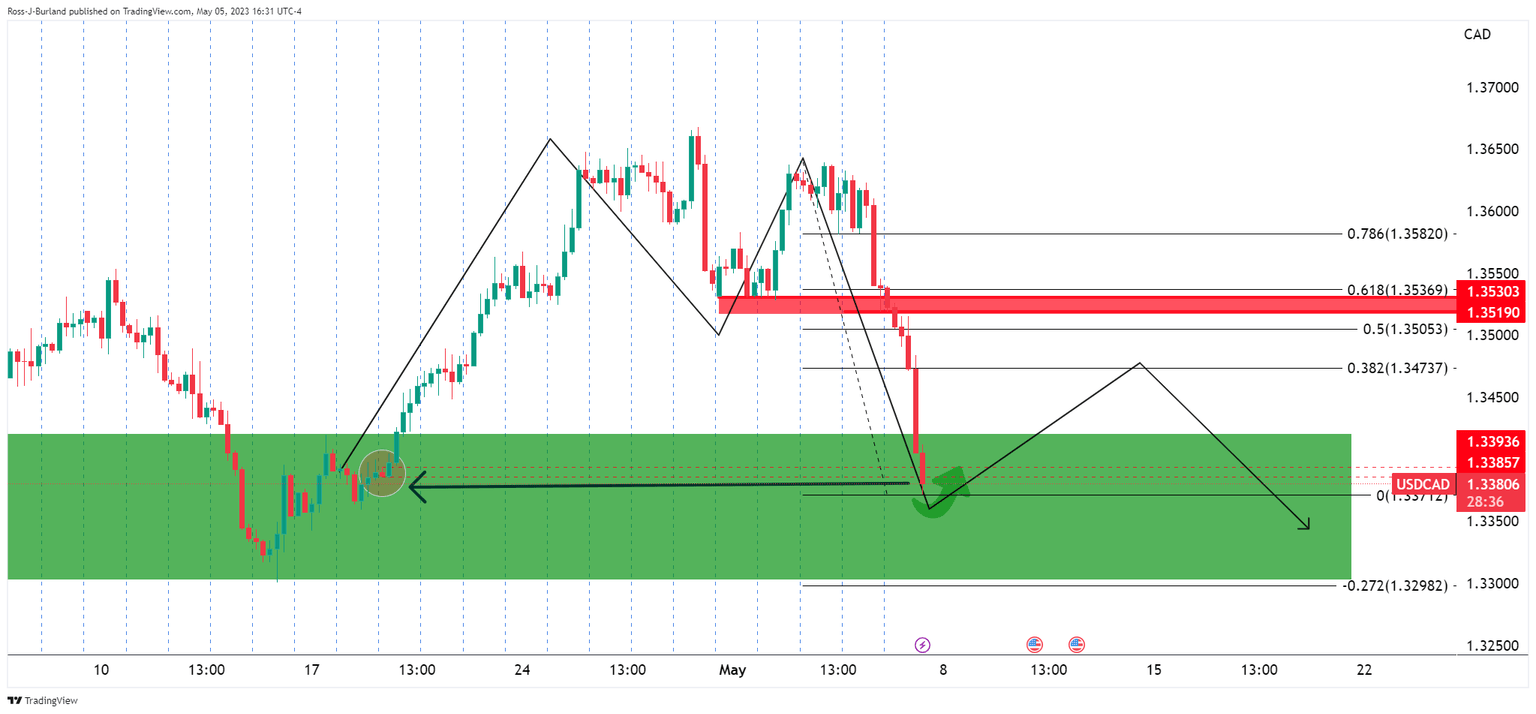

If the bears managed to do so, then the 1.3350s and 1.3320 levels will be eyed:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.