USD/CAD Price Analysis: Bears about to make a move at courageous bullish recovery

- USD/CAD bulls come up to meet resistance on the correction of the BoC induced sell-off.

- USD/CAD bears eye a downside extension on a break of 15-minute support area between 1.3370 and 1.3360.

The Canadian Dollar popped to a four-week high vs. the Greenback on Wednesday after the Bank of Canada said it would continue to raise interest rates next month after it tightened for the first time since January. The BoC showed its hand to the market as it warned that inflation could get stuck significantly above its 2% target amid persistently strong economic growth.

This has flipped the script technically ahead of US Consumer Price Index and the Federal Reserve events next week, putting the bears in control again as the following technical analysis will illustrate:

USD/CAD daily chart

The bears are targeting the lows and we could see further selling coming in following this meanwhile correction. However, traders would be aware of the CPI and Fed events at the start of next week and thus we could see some derisking into the events that would likely see a deceleration of the bearish impulse as drawn above.

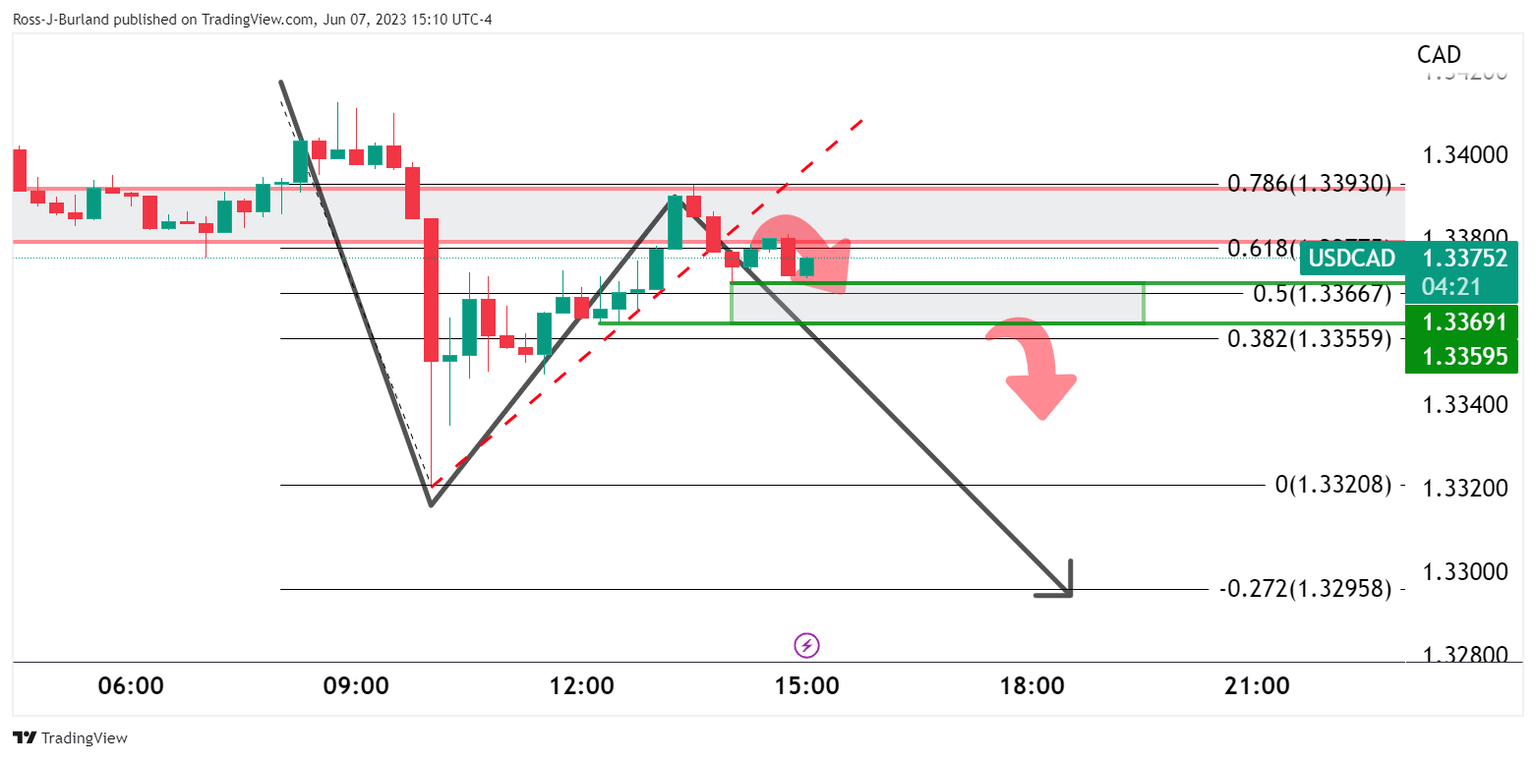

USD/CAD H1 and M15 charts

For the time being, however, it appears that the correction is decelerating at resistance and this could lead to further selling pressure in the sessions and days ahead before the week is out. A downside extension could be on the cards if the 15-minute support area between 1.3370 and 1.3360 gives way with sellers potentially encouraged to add below 1.3350.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.