USD/CAD Price Analysis: Battles at the 20-day EMA, drops toward 1.3530s

- USD/CAD struggles at the 20-day EMA and tumbles towards the 1.3530 area.

- USD/CAD Price Analysis: Oscillators offering mixed signals, but price action stalling at crucial EMAs to keep the pair rangebound.

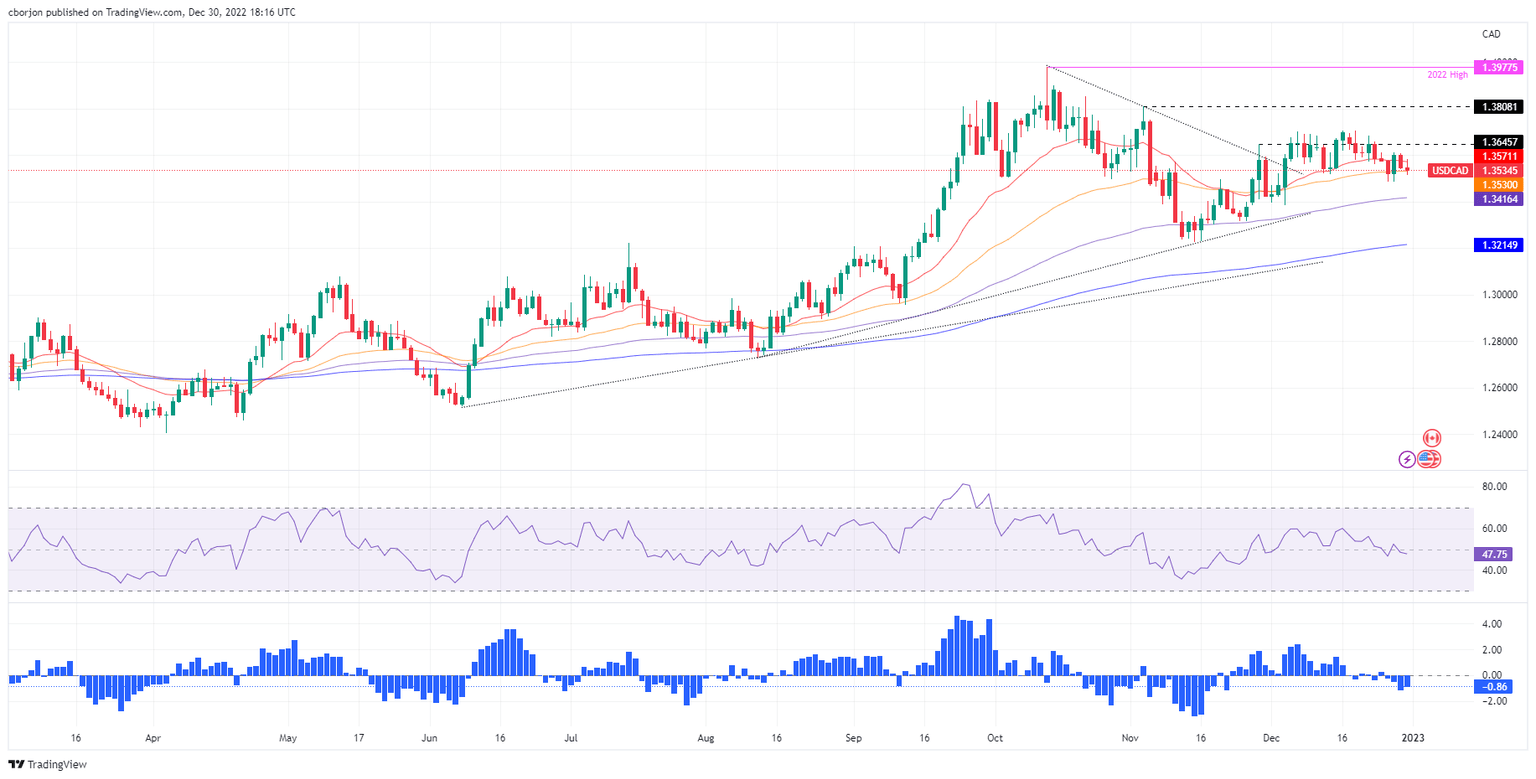

The USD/CAD advance stalled at the 20-day Exponential Moving Average (EMA) at 1.3570 and dropped toward the 50-day EMA as the US Dollar (USD) weakened, while crude oil extended its recovery, a tailwind for the Canadian Dollar (CAD). At the time of writing, the USD/CAD is trading at 1.3530.

USD/CAD Price Analysis: Technical outlook

From a daily chart perspective, the USD/CAD dropped to fresh two-day lows but shy of the weekly low of 1.3484. During the last five trading days, the 20-day Exponential Moving Average (EMA), around 1.3570, capped the USD/CAD recovery towards the 1.3700 figure. And since mid-December, the USD/CAD embarked on successive series of lower highs/lows as the major consolidated ahead of the year’s end.

The Relative Strength Index (RSI), at bearish territory, keeps USD/CAD sellers hopeful for further downside, while the Rate of Change (RoC), suggests selling pressure is waning. Therefore, unless the USD/CAD decisively breaks below 1.3484, that could open the door for further losses. The next support would be the 100-day EMA at 1.3416, ahead of the 1.3400 figure, and the 200-day EMA at 1.3215.

As an alternative scenario, the USD/CAD first resistance would be the 20-day EMA at 1.3570. Once cleared, the next resistance would be 1.3600, followed by the 1.3700 mark.

USD/CAD Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.